Hapag-Lloyd taps Blume Global for managing global drayage

The fifth-largest ocean carrier picks the leading provider of container management technology to handle its inland container haulage worldwide.

The fifth-largest ocean carrier by capacity said it will use a platform from Blume Global “to support its entire global network of motor carrier partners.” Hapag-Lloyd will begin its rollout of the Blume Global platform starting in North America in January.

The company’s logistics platform, which was launched last year and uses application programming interface (API) connectivity and transport management system (TMS) integration, will connect Hapag-Lloyd’s motor carriers to provide “settlement workflow,” Blume said. This includes dispatching, managing drayage rates, appointment scheduling, accessorial charges, live tracking, proof of delivery, invoicing and other reporting capabilities.

Hapag-Lloyd’s North American president Uffe Ostergaard said the agreement with Blume stems from customer demand for better tracking and reporting of container movements once off the ship.

“Our North American customers are asking for enhanced end-to-end shipment visibility to better manage their supply chains and by implementing this integrated cloud-based solution we will be able to offer that value-added service,” Ostergaard said.

Blume Global, formerly known as Rez-1, provides the technology for tracking and managing containers, as well as automating payments, for intermodal carriers and railroads. The Pleasanton, California-based company is a portfolio company of Apollo Global Management.

In July, Fenix Marine Services, the second-largest marine terminal in the Port of Los Angeles, said it would tap Blume’s software to help manage its container volumes.

“Blume Logistics helps companies successfully manage logistics execution across the supply chain network, and around the world, with first- and last-mile shipment visibility and control over transportation spending. It also improves customer service quality and enhanced vendor relations,” said Pervinder Johar, chief executive officer of Blume Global.

ONE making ocean freight slots visible on digital exchange

Ocean Network Express (ONE) said it will start offering container slots on a digital exchange as it seeks to “further enhance customer experience.”

The joint venture of Japan’s three largest shipping companies, ONE will tap the New York Shipping Exchange (NYSHEX) to offer trans-Pacific eastbound container space. January sailing slots will be available on the platform from mid-December onward, it said.

NYSHEX’s platform offers shippers a guaranteed space and rate for booking ocean freight with steamship lines. The mutually enforceable contract requires that the liner operator not roll the cargo to another sailing and the shipper actually have the cargo at the dock in time for the sailing.

“Having our customer’s commitment to show up with their cargo as contracted allows us to optimize our network and more accurately plan our vessels, which in turn provides cost-effective and reliable services,” said Sundeep Sibal, senior vice president at ONE.

ONE did not say how much space it will be offering on the platform. NYSHEX said that ONE’s offers on the platform will be dynamic, meaning they can adjust the price and the allocation in real time.

ONE has 14 services running between China and the U.S. on the trans-Pacific lane. Through October, ONE had average monthly container liftings of 230,000 twenty-foot equivalent units (TEUs) on its trans-Pacific eastbound services, with utilization averaging 90%.

“We are thrilled to welcome ONE as a carrier member of the exchange,” said Gordon Downes, chief executive of NYSHEX. “The ONE approach to container shipping today is refreshing and relevant. We look forward to the continued collaboration and innovation.”

ONE joins NYSHEX’s other carrier members, which include Maersk, Hapag Lloyd, CMA CGM, OOCL, COSCO and Hyundai Merchant Marine.

Since its August 2017 launch, NYSHEX’s platform has handled over 75,000 TEU in bookings. It said it will enhance its platform in 2020 to support more customizable terms for carriers and shippers, including multiple origins and destinations and longer valid dates for a contract.

Maersk launches new logistics centre in Vietnam

The new logistics centre took place in Bac Ninh Province of Vietnam. Constructed by Mapletree Logistics Park Bac Ninh Phase 3, the 11,000 square-meter warehouse is strategically located inside the VSIP Industrial Park in Bac Ninh Province, within 25km to Hanoi centre and 120km to Hai Phong port.

The fully Maersk-operated footprint is equipped with the latest technology to enable automation and provide best-in-class Ware-housing and Distribution solutions. Approximately 40% of the new warehouse is occupied by Turkish home appliances company Vietbeko, while the remaining capacity is filled by customers from various segments including automotive and FMCG.

The Bac Ninh logistics centre will enable Maersk to offer end-to-end solutions to North Vietnam customers and thus better meet their specific requirements. “Maersk has a longstanding commitment to Vietnam and we are continuously reviewing our value proposition to ensure we offer competitive end-to-end solutions to fuel our Vietnamese customers’ business ambitions,” said Marco Civardi, Maersk Vietnam Managing Director.

“With our investment in this new logistics centre, we are proud to provide agile capacity and thus help facilitate the continuous trade growth and development of North Vietnam.” Marco added.

Speaking at the ceremony, Vietbeko Head of Supply Chain Mr. Quang Le said: “The opening of Maersk’s new logistics centre today demonstrates your company’s continuous innovation and development to support our business growth in the Vietnam market. It not only marks an important milestone in our collaboration going forward but the investment is also a crucial step for North Vietnam to become a viable and globally competitive trade hub.”

Over the past five years, Vietnam has been in the fastest growing range compared to other Asian countries. In 2018, the country was ranked the 8th biggest export/import country in Asia, and based on this growth rate, Vietnam is expected to be ranked the 4th biggest export/import country by 2023. North Vietnam is seeing continuous growth in electronics, automotive and retail segments.

Maersk is an integrated container logistics company working to connect and simplify its customers’ supply chains. As the global leader in shipping services, the company operates in 130 countries and employ roughly 76,000 people with a mission is to enable and facilitate global supply chains and provide opportunities for its customers to trade globally.

MSC Defends Itself Against Report Claiming EU’s Biggest Polluter Status

MSC Mediterranean Shipping Company is defending itself against a report claiming the Swiss-based ocean carrier is one of the top carbon emitters in the EU.

The report, published this week by the non-governmental organization Transport & Environment, claims that in 2018 MSC was responsible for about 11 million metric tons of CO2 emissions, which would rank it the 8th biggest emitter in the EU.

MSC reports on CO2 emissions through the EU Monitoring, Reporting and Verification (MRV) system, which T&E used as the basis for its analysis. The MRV takes into account ship consumption and CO2 emission data for voyages starting and terminating in EU ports, including voyages between EU ports.

MSC, however, argues that the report offers an incomplete analysis of the data and therefore does not provide an accurate picture of emissions from the shipping sector.

“In particular, the T&E analysis fails to take a number of operational aspects of MSC’s services fully into account, and thus does not offer a complete assessment of our role and impact in terms of emissions,” MSC hit back in a statement.

According to MSC’s own analysis of its operational records, the company argues that only 40-45% of the 11 million tons of emissions reported in the MRV actually took place in the EU.

“As an example, a ship carrying fruits from the Caribbean to Northern Europe and back needs to report emissions for the whole distance of the trip, even though only part of it takes place in the EU,” MSC explains. “As a result, the actual emissions in the EU for this particular ship may be up to 65% less than is recorded in the MRV. This is particularly relevant for a global company such as MSC, which operates in all the world’s major shipping lanes.”

MSC is also using the opportunity to reaffirm its strong commitment to reducing C02 emissions and longer-term goals of fully decarbonizing the shipping industry.

“While continuously increasing its TEU capacity to meet the growing demand, MSC operates a modern, green fleet and is investing heavily in low-carbon technologies and extensive new-build and retrofit programs to boost performance and minimize our environmental impact,” MSC stated.

“MSC remains fully supportive of decarbonizing the shipping industry. At the same time, it recognizes that some major breakthroughs, especially in fuel and propulsion technologies, are needed to shift the industry towards a zero-carbon future,” the company added.

Vietnam will connect ASEAN Single Window with Laos and Myanmar in December

VCN- If successfully connecting the ASEAN Single Window with Laos and Myanmar, by the end of 2019, the number of countries that Vietnam connects to this system will increase to eight.

National Single Window interface. |

According to the General Department of Vietnam Customs at the 31stSCA-ROO meeting (the Sub-Committee on ATIGA Rules of Origin) and report of the ASEAN Secretariat, Laos and Myanmar have completed the pilot phase and are ready for official connection to the ASEAN Single Window to exchange ATIGA C/O form D.

Accordingly, the two countries will connect to ASW in December.

To connect C/O form D, the General Department of Vietnam Customs (the Standing office of the National Steering Committee for ASW, NSW and trade facilitation (Committee 1899)) issued a written request to the Ministry of Industry and Trade (the C/O form D issuer) to notify enterprises applying for ATIGA C/O form D for goods exported to Myanmar and Laos on the implementation.

Review e-data on ATIGA C/O form D for goods exported to Myanmar and Laos to send to the National Single Window.

The General Department of Vietnam Customs has proposed the Ministry of Industry and Trade to coordinate with the Standing office of Committee 1899 in connecting the ASEAN Single Window with Laos and Myanmar.

In addition, The General Department of Vietnam Customs will issue written guidance to instruct local customs departments to check and process ATIGA C/O form D sent from Laos and Myanmar and coordinate during the implementation.

Currently, Vietnam has exchanged C/O form D with six ASEAN countries via ASEAN Single Window, including: Singapore, Malaysia, Indonesia, Thailand, Brunei and Cambodia.

By the end of November 15, the total C/O sent from Vietnam to ASEAN countries was 185,026 C/O; The total C/O that Vietnam received from ASEAN countries was 111,841 C/O.

Risk management widely applied in the management of imports and exports

VCN – Changing management methods by applying risk management to shorten customs clearance time has been directed by the Government and Prime Minister Nguyen Xuan Phuc. Customs authorities and other ministries and sectors have implemented, bringing many benefits to enterprises in customs clearance.

Changes from policies

According to the General Department of Customs, specialised inspection has been revised significantly. Many legal documents have been amended and supplemented towards risk management-based inspection such as: inspection method and level has based on the law compliance of enterprises; many goods have been shifted from pre-customs clearance inspection to post customs clearance inspection and goods subject to inspection have been reduced; regulations that enterprises take responsibility for the quality of their imports and exports have been issued.

Some ministries have cut more than 50 percent of goods subject to specialised inspection and some regulations and administrative procedures at customs clearance stage have been abolished such as: circular No. 14/2018/TT-BNNPTNT of the Ministry of Agriculture and Rural Development cut some commodities subject to pre-customs clearance inspection; circular No. 10/2017/TT-BXD of the Ministry of Construction changed certification of conformity of goods as construction materials into post clearance; decision No. 3842/QD-BKHCN of the Ministry of Science and Technology cut more than 90 percent of commodities subject to quality inspection before customs clearance; and circular No. 08/2019/TT-BCA of the Ministry of Public Security promulgates a list of products and goods which do not need pre-customs clearance inspection.

In addition, the change of inspection method also has had significant impact on the number of shipments subject to pre-customs clearance inspection, like decree No. 74/2018/ND-CP dated May 15, 2018 amends and supplements articles of decree No. 132/2008/ND-CP, which changes the State management method based on risk assessment of goods, state inspection procedures of quality for imported goods in group 2 are implemented by considering the announcement of the conformity of importers.

Decree No. 15/2018/ND-CP dated February 2, 2018 replacing decree No. 38/2012/ND-CP dated April 25, 2012 detailing the implementation of some articles of the Law on food safety stipulates appropriate inspection methods based on the law compliance of enterprises with specialised inspection, adds goods exempted from inspection. Accordingly, 95 percent of imported shipments subject to State inspection on food safety were cut.

New policies in specialised inspection at border gates

Remarkably, on November 2019, the Government issued decree No. 85/2019/ND-CP stipulating administrative procedures according to National Single Window mechanism, ASEAN Single Window and specialised inspection for imports and exports. Accordingly, the decree details the application of risk management principles according to law compliance of organisations and individuals with the specialised inspection to ensure the efficiency of State management and to facilitate import and export activities.

Particularly, the specialised inspection principles are detailed: only goods, which are subject to at least one of causing insecurity, spreading epidemics, harming to human health and life, polluting the environment, affecting social morality, traditions and customs, hampering the economy and national security, are put on the list of imported goods subject to specialised inspection before customs clearance.

According to the General Department of Customs, based on Decree 85/2019 / ND-CP, the unit will advise the Ministry of Finance to urge ministries and sectors to review specialised inspection as assigned and relevant regulations in compliance with the principle of specialised inspection for import and export goods and transit goods described in Decree 85/2019 / ND-CP.

In the near future, the General Department of Customs will report to the Ministry of Finance for submission to the Prime Minister to amend and supplement Decision No. 1254 / QD-TTg, which continues to assign ministries and sectors to revise documents on specialised inspection in the direction of applying risk management principles in specialised inspections for imports and export.

One of the remarkable new points is that the General Department of Customs is developing a scheme on reforming the specialised inspection towards the Customs agency as a focal point for the implementation of specialised inspections at border gates (except for goods related to national security and defence and quarantine), and specialised management ministries perform post-inspection. This will be a new direction to reform specialised inspection for import and export goods under the Government's direction in resolution 99 / NQ-CP. This scheme is expected to be submitted to the Government in the first quarter of 2020.

Not only in specialised inspection field, the General Department of Customs has been implementing many activities and measures to computerise procedures and reduce administrative procedures in the field of customs, helping enterprises shorten customs clearance time and restricting direct contact between customs officers and enterprises.

In particular, risk management is increasingly a focus, expanded on the scope and content, professional techniques and applied in customs operations. The application of risk management in the declaration channel classification has achieved significant results, in which the physical inspection rate decreased to five percent in the first six months of 2019 and the inspection channel classification was based on the compliance assessment and risk classification of enterprises in customs operations.

On November 15, 2019, the General Department of Customs advised the Ministry of Finance to promulgate circular No. 81/2019 / TT-BTC on risk management in customs operations to publicize the criteria for assessing law compliance, which specifies the risk application to customs operations for customs declarants, customs authorities, customs civil servants and State agencies in coordination in State management of customs; and organizations and individuals involved in import and export activities, transit of goods, entry and exit, transit of means of transport.

Vietnam – US signs an agreement on mutual assistance in customs

VCN - On December 6, 2019, at the headquarter of the Ministry of Finance, authorised by Vietnam’s Government and the US government and under the witness of the Deputy Prime Minister Vuong Dinh Huy and Minister of Finance Dinh Tien Dung, Deputy Minister of Finance Vu Thi Mai and US Chargé d'affaires to Vietnam Caryn McClelland signed a agreement on mutual assistance in customs between Vietnam and the US.

Efforts to close the negotiation

According to Vu Thi Mai, 2020 is the 25th year of diplomatic relations between Vietnam and the US, marking achievements in bilateral cooperation from economy, culture-society, medical, defence and security. Particularly, the bilateral economic relationship between the two countries has gained outstanding progress with bilateral turnover of over US$60 billion.

According to Vietnam’s trade data, import-export growth between the two countries for 2010-2019 reached 16.3 percent per year. Vietnam’s export growth to the US market from 2010 to 2019 averaged more than 16 percent per year.

Meanwhile, the US’s imports to Vietnam in this period saw average growth of 16.5 percent per year. The US stayed as one of Vietnam’s largest exporters and its third largest trading partner.

Based on the comprehensive partnership between the two countries, with the aim of enhancing cooperation between Vietnam Customs and the US Customs and in the context that international cooperation activities of Vietnam Customs are expanding in accordance with international integration commitments in new-generation free trade agreements and the operational competence of Vietnam Customs has expanded under the 2014 Customs Law, the Ministry of Finance proposed the Government approve the negotiation of the agreement in openness and approaching to the draft agreement approved by the Government.

Vietnam attaches importance to the partnership with the US, which is expressed by Vietnamese Government’s efforts to remove problems in trade and economic relations with the US to facilitate market access for US enterprises in Vietnam

In recent times, the General Department of Customs under Vietnam’s Ministry of Finance and the US Customs – Border Guard Agency under the US Department of Homeland Security have taken efforts to close negotiations for the customs mutual assistance agreement between Vietnam and the US. The efforts of the two sides gained good results with the signing of the agreement, said the Deputy Minister Vu Thi Mai.

The signing of the agreement is important for creating a legal basis for the official relationship and regulations on cooperation, technical support, information exchange between the two customs administrations to prevent, detect and handle violation acts of customs law.

Especially amid expanding trade and economic relations between Vietnam and the US, mutual assistance activities and cooperation under the agreement will create contributions to fighting against fraud and illicit transshipment to avoid trade remedies, said the Deputy Minister

Speaking at the signing ceremony, US Deputy Chief of Mission in Vietnam Caryn MacClelland said the agreement is an important milestone marking the bilateral agreement between Vietnam and the US. The US expects long-term cooperation with Vietnam on the customs area as well as in others related to bilateral trade between the two countries.

Agreement contributes to deepening bilateral relations

At the signing ceremony, Deputy General Director of General Department of Customs Mai Xuan Thanh said the customs mutual assistance agreement will create a legal basis for the official relationship and mutual cooperation between the two customs administrations, helping deepen the comprehensive partnership between the two countries.

The signing and implementation of the agreement after signing will be in line with Vietnam's guidelines, and policies on foreign affairs in proactive international economic integration and one of measures to realise Vietnam's commitments on trade facilitation in the bilateral cooperation framework.

Specifically, the signing of the agreement is an activity that contributes to implementing the policy of improving the business environment and developing enterprises in the spirit of the Government's Resolution 19 / NQ-CP, annually issued from 2014 to the present, Mai Xuan Thanh said.

In addition, the agreement activities will contribute to protecting the rights and interests of the business communities of the two countries and facilitate import and export goods between the two nations.

The regular and timely information exchange mechanism established when the agreement comes into force will contribute to the fight against customs violations, trade fraud and illicit transshipment, helping correct collection of all revenues for the budget, thereby creating a favourable, secure and safe environment for trade, investment and business activities between the two countries, contributing to socio - economic development in each country.

“The signing of the agreement is only the first step in establishing an official cooperation policy between the two Customs administrations. More importantly, we need to ensure the implementation of the agreement in an effective and substantive manner, meeting the legitimate cooperation needs of each side.

“To do this end, it requires commitments and close guidance of the Governments of the two sides as well as efforts of the two Customs administrations in exchanging, sharing information and agreeing on the roadmap of the implementation.

“With the results we have achieved in the negotiation process to finish the agreement, I am confident the two sides will continue cooperation to implement this agreement effectively, contributing to carrying out the tasks of each Customs administration and promoting trade and economic relations between the two countries", Mai Xuan Thanh said.

The agreement is based on the model of administrative mutual assistance agreement in the area of customs, recommended by the World Customs Organization to member Customs administrations, which provides assistance scopes and methods to fulfil requests for assistance between customs administrations of the two countries in the form of information exchange to prevent, detect, investigate and fight against violations of customs violations during the performance of customs duties.

The assistance scopes shall comply with the national laws and regulations of each party and comply with the competence and existing resources of each Customs administration. Immediately after the agreement is signed, both Vietnam and the US will carry out internal procedures for the agreement coming into force. Thereby, the parties will discuss and agree on the plan, roadmap as well as methods of the implementation of contents committed in the agreement.

In particular, the two sides provide assistance in the form of information to ensure the enforcement of customs laws and the accuracy of customs duties and other taxes by each customs administration.

New US tariffs loom over $160 billion in Chinese goods

Americans for Free Trade spokesman Jonathan Gold said the White House needs to “finalize a deal with China to end the trade war and remove all tariffs.”

The Trump administration remains on schedule to impose a new round of tariffs on Dec. 15 covering $160 billion of additional U.S. goods imports from China, but major retail and agriculture trade associations hope they can still be avoided.

“This trade war has lasted long enough and done enough damage. It’s time the administration finalize a deal with China to end the trade war and remove all tariffs,” said Jonathan Gold, a spokesman for Americans for Free Trade, in a statement.

As reported by CNBC, some trade analysts believe there will be an “eleventh hour” trade deal reached between the U.S. and China before the Dec. 15 deadline.

Many U.S. importers and exporters were relieved on Oct. 11 when the Trump administration suspended a threatened Oct. 15 increase in tariffs from 25% to 30% on $250 billion worth of Chinese goods. So far, U.S. tariffs cover an estimated $550 billion of Chinese goods.

That increase was first announced by the White House in late August in response to China’s decision to impose new tariffs on U.S. goods. The Trump administration has justified the use of tariffs as a way to force China to negotiate more favorable trade conditions for U.S. industries. However, the tariffs have caused trade between the two countries to decline in recent months.

President Trump said on Oct. 11 that trade talks in Washington between China’s Vice Premier Liu He and U.S. Trade Representative Robert Lighthizer and U.S. Treasury Secretary Steven Mnuchin resulted in a “phase one deal,” which will encompass new intellectual property and financial services protections and require China to import up to $50 billion in U.S. agricultural products.

Both U.S. and Chinese government officials said the phase one deal negotiations are continuing.

Tariffs paid by American consumers and business continue to mount. According to Tariffs Hurt the Heartland, $7.2 billion was spent to cover the cost of existing tariffs on Chinese goods imports in October. More than $42 billion has been spent by Americans to cover tariffs between February 2018 and October 2019.

“Yet even when faced with this staggering number, it’s still unclear whether the president will follow through with his threat to raise taxes yet again on Dec. 15th with another rounds of tariffs, this time on primarily consumer-facing products like toys and consumer electronics,” Gold said.

Tariffs Hurt the Heartland compiled the data in partnership with The Trade Partnership, a Washington, D.C.-based international trade and economics consulting firm. The monthly import figures were calculated based on data from the U.S. Census Bureau, while the monthly export data was compiled from Census Bureau and U.S. Department of Agriculture numbers, the group said.

Chinese tariffs on American exports have totaled $12 billion since February 2018 and have primarily focused on U.S. agricultural exports.

Analyst: The US-China trade war is ‘sucking the life’ out of trans-Pacific trade

The U.S.-China trade war is prompting manufacturers to leave China for lower-tariff climes, not least in southeast Asia. However, in its latest container shipping analysis, Drewry argues that there are limits to how much production can be relocated, and that moving factories is neither easy nor swift.

Moreover, while the switch of some production to southeast Asia has boosted container export volumes from the region, the increase has not compensated for lower volumes out of North Asia which have been hit by the contraction in trade between the U.S. and China this year.

“The U.S.-China trade dispute appears to have sucked the life out of the trade, beyond which even the very evident trade substitution could not hope to cover,” noted the analyst.

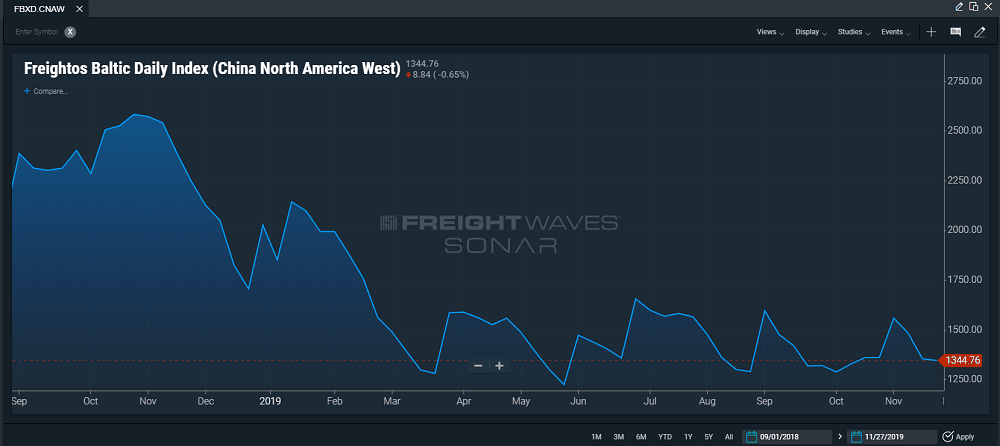

The bearish impact of tariffs has been readily apparent in trans-Pacific spot rates for much of 2019. According to Freightos, China-U.S. West Coast rates are currently 45% lower than a year earlier, while China-U.S. East Coast prices are 31% lower year-over-year.

Drewry forecasts that with eastbound trade from Asia to the U.S. flat after 10 months of the year, and given the strength of the market in the final two months of 2018, “an annual deficit seems inevitable.”

As reported in FreightWaves, should the trans-Pacific headhaul trade contract this year, it will be the first annual decline in a decade.

The 2019 shortfall, Drewry argues, is entirely driven by the stagnation of volumes out of North Asia and specifically China.

Volumes from North Asia are down by 5% year-to-date. In contrast, growth out of southeast Asia was up 27% to the end of October.

“Clearly, a sizable number of cargo owners have sought a safe haven from the ongoing tariff uncertainty by relocating some of their production,” said Drewry.

“Customs data heavily implies that the preferred choice thus far has been Vietnam, which saw its total exports to the U.S. rise by approximately 35% after nine months of the year, dwarfing the growth of any other trading partner.”

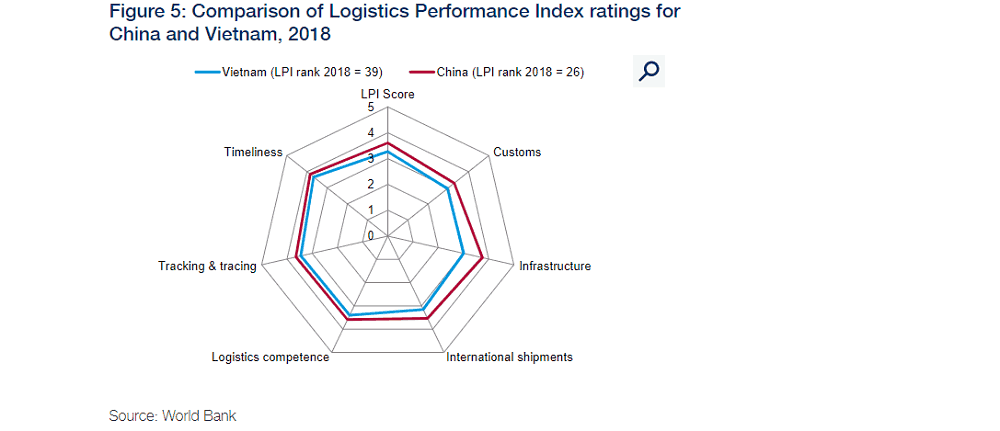

However, Drewry warns that although export numbers out of Vietnam are impressive, this does not make it a ready-made exporting replacement for China.

“Even after the events of the last two years, China’s share of US total imports (in dollar value) was 18% after nine months of this year, down by around 3 percentage points on the same period in 2018 but still far in excess of the combined 7% share of the supposed pretenders to its export crown – Vietnam, Malaysia, Thailand, Indonesia and the Philippines,” said the analyst.

“The sheer scale of China’s export machine means that it will retain its dominant position for the foreseeable future, although it seems likely that it will gradually diminish.”

Drewry notes that moving production out of China to a low tariff country is no easy task.

“Cargo owners have to weigh a myriad of factors, including local labor costs and skills, infrastructure, proximity to demand as well as political and legal stability that all vary in importance depending on the industry,” said Drewry.

Adding to the complexity, having identified a new location, there are also no guarantees that the new production countries will not become fresh targets of U.S. trade policy and subject to future tariffs. “It is a costly endeavor with no safety assurances,” said the analyst.

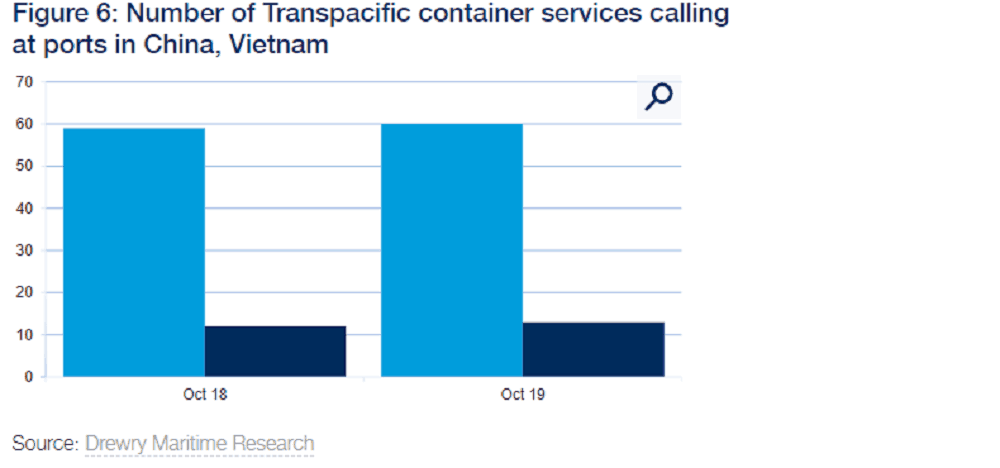

Another factor shippers must consider is the availability of logistics and shipping services outside of China. For example, as of October, only 13 weekly trans-Pacific services were calling at Vietnam, one more than the same month last year but well below the 60 loops serving various Chinese ports (see below).

“As demand grows so surely will the number of services,” added Drewry. “But current infrastructure constraints will limit the possible expansion in the short- to medium-term.”

The analyst also notes that countries in southeast Asia rely on imports of raw materials and intermediate goods from neighbors (including China) to support the production of exports. This places a ceiling on how much manufacturing can realistically be diverted from China.

“China’s scale has meant that it has increasingly been able to produce everything domestically and has therefore been able to meet more and more of the world’s demand, until recently at least,” said Drewry.

With China in the process of rebalancing toward a more consumption-based economy, Drewry believes Vietnam is well placed, both geographically and economically, to pick up some of the slack in the making of finished goods.

“Its population is younger than that of China and with a higher proportion of people living in rural areas there is a lot of latent manufacturing labor on tap to suppress wage inflation,” argued the analyst.

“The inflow of cargo owners setting up shop will continue; just don’t expect it to be the cure-all for the trade war slump.”

As a result, while Drewry expects container exports to the U.S. to be more dispersed than previously, it believes the production switch away from China will only be modest over the next few years.

“A lack of viable alternative capacity and infrastructure will force many shippers to decide the cost-benefit of moving versus the additional tariff cost from staying is not compelling enough,” it concluded.

Upside down: Asia-to-Oceania rates rise but volumes fall

Spot market freight rates on the southbound Asia-Oceania trade lane are defying the laws of economics as rates are rising but volumes are falling, according to new insights from maritime analyst Drewry.

Declining ocean volumes

Volumes have declined for four consecutive quarters on the Asia-to-Oceania route, according to data derived from Container Trade Statistics. This last occurred in the early part of the decade.

Year-to-date volumes to Oceania from Northeast Asia have fallen by 5.3% and from Southeast Asia by 6.2%. Container volumes into Australia, which covers 84% of the trade (the rest mostly to New Zealand), have fallen by 7%, Drewry said.

Drewry attributed the fall in volumes to a “sluggish” Australian economy, noting that there has been “weak spending growth in the household sector.”

Australia’s economy

According to Peter Martin, visiting fellow at the Crawford School of Public Policy at the Australian National University, the Australian economy barely grew this year. In the quarter ending March this year, the economy grew by 0.5%. In the quarter ending June this year, the economy grew by 0.6%. And for the quarter ending September this year, the economy grew 0.4%.

Over the year to September, the Australian economy grew 1.7% “well short of the budget forecasts, which in year average terms were 2.25% for 2018-19 and 2.75% for 2019-20”, Martin writes. The 10 year average is about 2.6%.

And that’s important for maritime trade because, as shown by Martin Stopford in his book “Maritime Economics,” gross domestic product is highly positively correlated with the volume of maritime trade — the higher the levels of gross domestic product country then higher the volumes of trade.

Meanwhile, real household spending grew by 0.1% in the July-to-September quarter and, over the year to September, inflation-adjusted spending grew by 1.6%, “meaning [that] the volume of goods and services bought per person went backwards,” Martin said.

It’s true. Seasonally adjusted retail figures from the Australian Bureau of Statistics show that the percentage change from June to September quarters of “turnover in volume terms” went marginally backward with a figure of minus 0.1% recorded.

One of the main reasons for the slowdown in consumer spending is that wages in Australia are stagnating. Annual wage growth in total hourly rates of pay (excluding bonuses) in June was about 2.3%. In mid-2012, that figure was close to 4%, according to the Australian Bureau of Statistics. Obviously, higher wages should (barring a huge surge in costs) translate into higher disposable income. Conversely, lower wages should (barring a huge fall in costs) translate into lower disposable income.

Attempts at stimulus

Meanwhile, Australia’s federal government tried to boost spending by making tax cuts, delivered in the form of a tax rebate (i.e., actual cash in the taxpayer’s pocket), from July 1 onward.

Drewry said it “remains to be seen” whether the tax cuts to stimulate consumer spending will translate into imports from Asia. But the signs don’t look good for that scenario.

According to Martin, by the end of November, the Australian Taxation Office had issued more than 8.8 million tax refunds totaling A$25 billion (just over $17 billion).

“Instead of being largely spent, they were mostly saved, pushing up the household saving ratio from 2.7% to 4.8%, its highest point in more than two years,” Martin wrote.

Meanwhile, the Reserve Bank of Australia has announced it will begin quantitative easing as the overnight cash rate (the rate of interest that banks pay each other overnight) approaches 0.25%. Eight years ago the cash rate was 4.5% and now it is about 0.75%.

Quantitative easing happens when a central bank, here the Reserve Bank of Australia, buys existing government bonds. That tends to push asset prices up, force interest rates down (thereby lessening the burden on companies and households with large debts such as working capital overdrafts and mortgages) and, in theory, should encourage people and companies to borrow more money as debt becomes cheaper. The hope is that they will invest and buy more.

Meanwhile, as previously reported in FreightWaves’ Down Under Trucking, the Australian government has announced that it will bring forward A$3.8 billion ($2.6 billion) of infrastructure investment.

An intriguing anomaly: freight rates rise despite fall in volumes

Although the fundamental of the Asia-Oceania trade (i.e., Australia’s domestic economy) is weakening, Drewry has noticed an intriguing anomaly.

“Curiously, while container demand has ebbed away for most of the year, freight rates — at least from Northeast Asia — have actually taken the opposite path since June. Drewry’s Container Freight Rate Insight reports that average 40-foot container prices from Shanghai to Melbourne have nearly trebled over the course of seven months, rising from $1,090 in May to $2,800 in November,” the maritime analyst writes.

Drewry attributed the November peak (the highest since February 2018) partly to the introduction of IMO 2020-related emergency bunker fuel surcharges and also to increased port handling fees by container terminal operators, which FreightWaves has extensively reported on.

Reduced supply of container slots drove rates higher

However, it appears that higher freight rates on the north Asia-Oceania corridor have been caused by a reduction in the supply of marine carriage. Maersk, Hamburg Sud and MSC suspended one of their loops earlier in the year, which cut capacity by four ships of 5,000 twenty-foot equivalent units (TEUs).

Although a rival consortium (HMM, APL and Evergreen) later added capacity back to the trade, Drewry reports that “the total number of slots available to the market was still lower than in March thanks to other service rationalisations and void sailings … fewer slots countered the demand lull and pushed Northeast Asia-to-Oceania ship utilisation up from around 60% in March to just over 80% in October.”

Southeast Asia was different

Rates from Southeast Asia to Oceania have not experienced the same upswing because a consortium of shipping lines has added seven ships of 8,500 TEUs and six ships of 5,700 TEUs into the trade (although Maersk took a large amount of capacity away from Southeast Asia when it rededicated it to the Northeast Asia trade).

Drewry reported that slot capacity from Southeast Asia to Oceania in November rose by 11% in October.

“Unsurprisingly, spot rates ex [Southeast] Asia have not had the same impetus as from [Northeast] Asia with Singapore-to-Melbourne spot rates currently only around $1,500/40-foot, according to Drewry’s Container Freight Rate Insight, which is roughly $200 down on where they were at the start of the year,” the maritime analyst concluded.

Source: American Shipper, G-Captain, Vietnam Customs

.png)

.jpg)