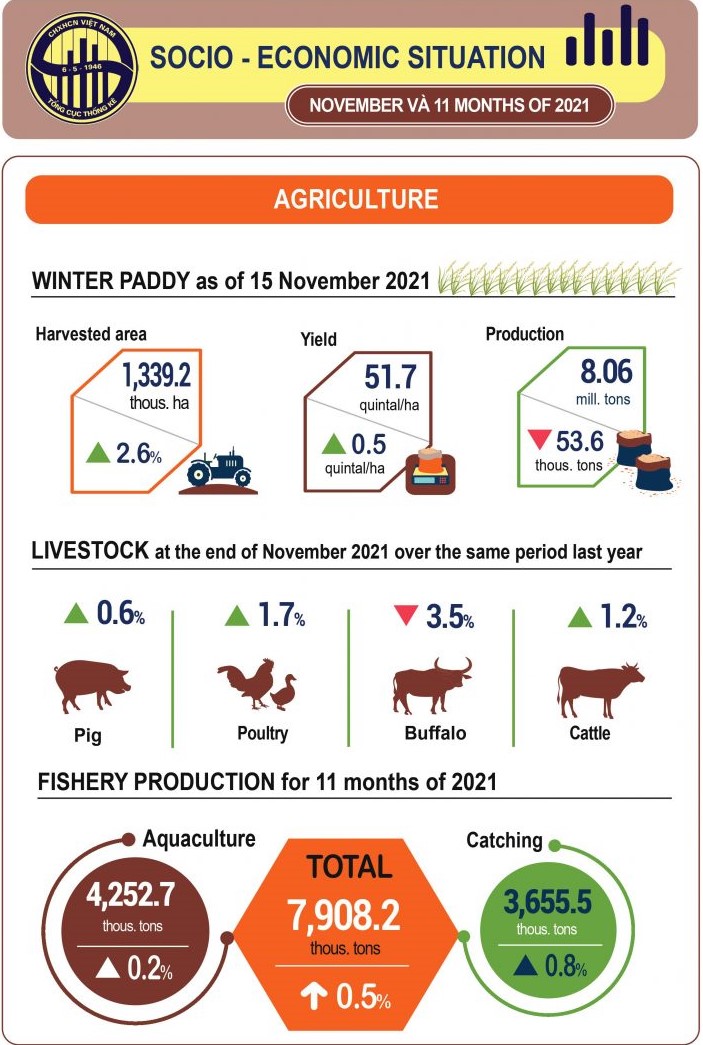

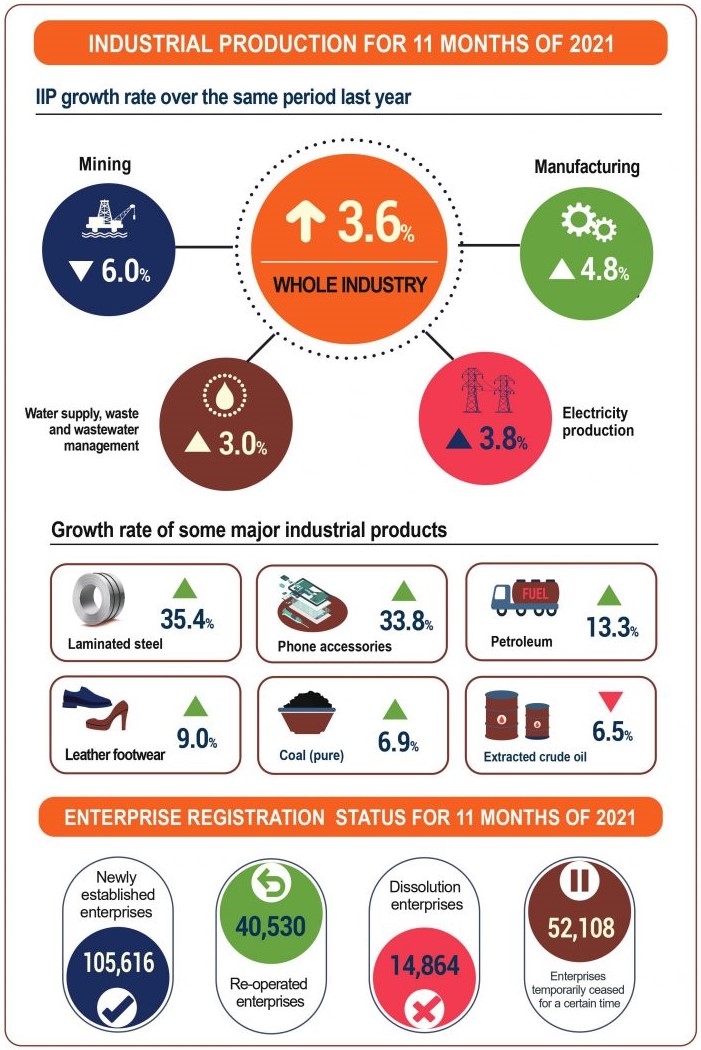

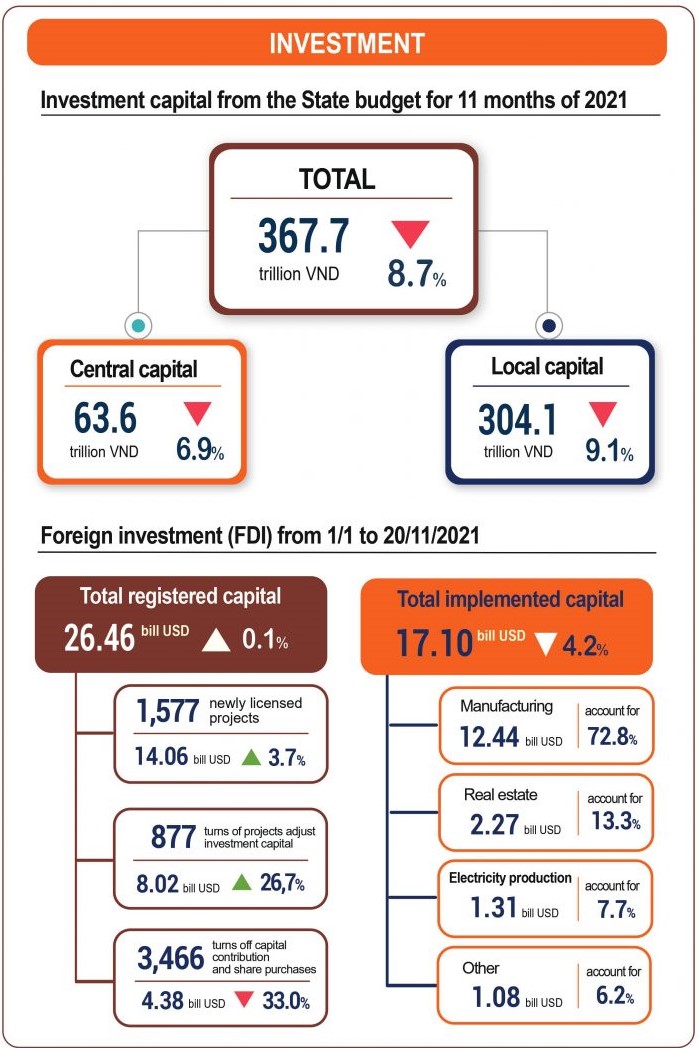

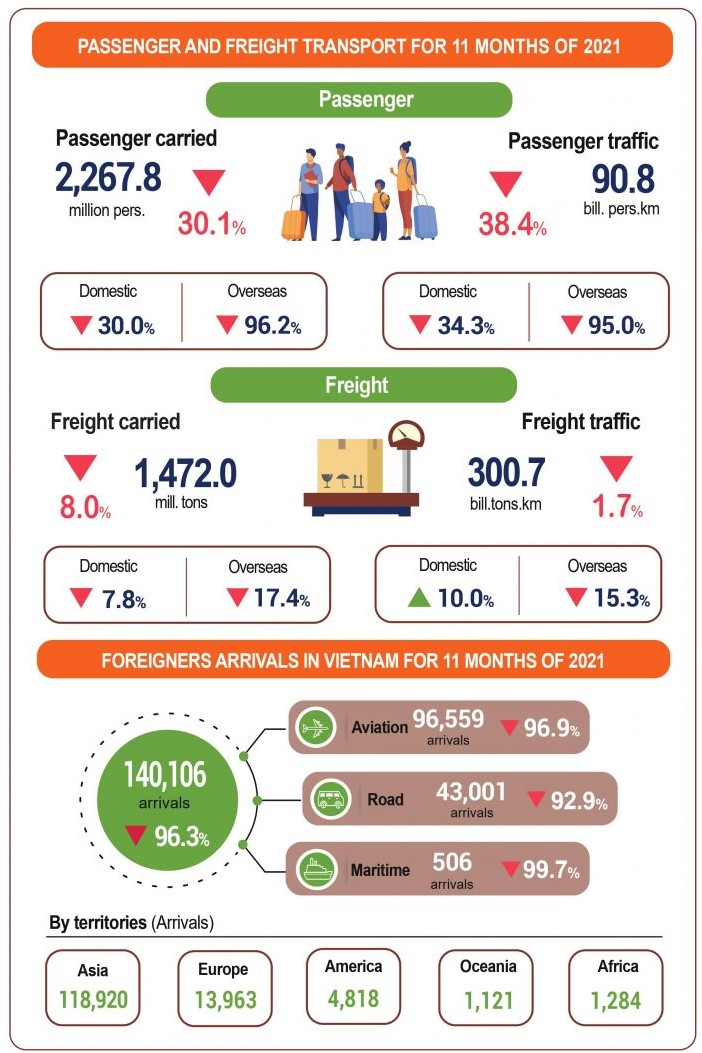

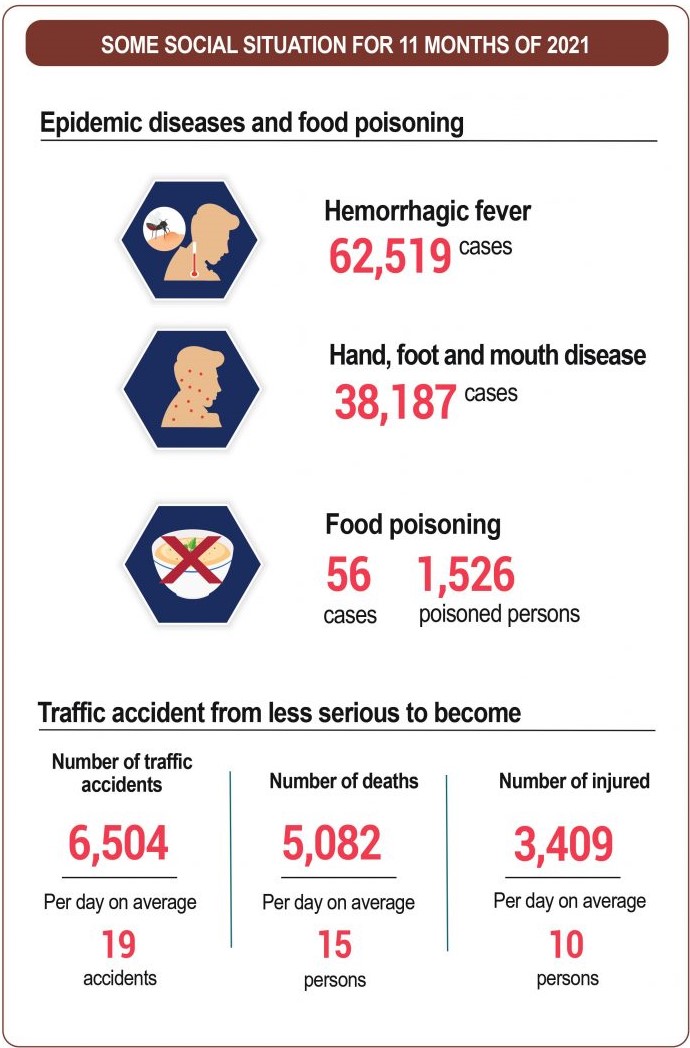

Infographic Vietnam’s Social-Economic Situation 11/2021

Source: Vietnam General Statistics Office

Dalian port customs restrict reefer imports following Covid outbreak

Hapag-Lloyd is advising customers to divert inbound reefers to other ports or return reefer containers to origin ports due to a restriction concerning frozen meat and seafood products into the port of Dalian.

The restrictions follow an outbreak of the Delta variant of Covid-19 in Dalian, which hit the headlines a week ago. The Chinese authorities pointed to the cold supply chain as the source of the outbreak with the first infection reported at a cold storage base.

Dalian is the biggest cold supply chain import city in China. Nearly 70% cold supply chain goods are imported through Dalian port, with more than 600,000 employees are handling imported cold-chain products.

Hapag-Lloyd advised customers to divert reefers bound for Dalian to Qingdao, Tianjin or other Chinese ports, or return the containers to the port of origin. If there no instructions from the customer the line would make what it deemed to be necessary arrangements.

“Please note that for all options, all additional costs, risks and liabilities related to the storage or movement of the cargo after discharge will be for the account of the cargo owner,” Hapag-Lloyd said.

China continues to adopt a zero Covid strategy and Dalian residents have faced travel restrictions and city-wide testing in the wake of the outbreak. The cold supply chain is an area Chinese authorities see as having a high risk of transmission.

Covid outbreaks in Chinese ports are of major concern to shipping, especially the container sector which saw major impact from the three-week closure of around 70% of Yantian port earlier this year. In August Ningbo-Zhoushan’s Ningbo Meishan Island International Container Terminal (MSICT) was closed due to a single Covid case among its workforce. However, the rest of the port continued to operate meaning the impact on global shipping was not as great as that of the Yantian closure.

Source: Seatrade Maritime

COSCO's 9-month net profit increased by 1,650% thanks to soaring volume and freight rates

Cosco Shipping Holdings today reported net profit for the first nine months of the year had shot up by a massive 1,651%, to $10.45bn, on the back of surging container volumes and freight rates.

During the period, the group, including Cosco Shipping Lines and Cosco Shipping Ports, moved 20.45 million TEU, up 8% year on year, and reported revenues of $33.24 billion, which represents growth of 117.5%.

A mother vessel of Cosco Shipping Lines at TCIT ‘s berth

The Asia-Europe route was the largest contributor to turnover, accounting for 30%, followed by the transpacific lane, which contributed 27%, while average revenue per TEU on its international routes was $1,944, a near-100% year-on-year increase.

Meanwhile, port throughput was 96.43m TEU, up 6% year on year, with 17.28 million TEU going through Cosco-controlled terminals, an increase of 5%, year on year, while throughput at terminals in which it has a minority stake was 79.15 million TEU, on a non-equity adjusted basis, representing an increase of 6%.

Source: The Loadstar

Taiwanese shipping lines share in USD 6 billion of profits

Taiwanese lines Evergreen, Yang Ming and Wan Hai have transformed a collective net profit of less than USD 500 million a year ago into one of nearly USD 6 billion in the latest quarter as revenues continued to rise in the last period.

The three lines reported net profits attributed to shareholders of USD 2.88 billion, USD 1.83 billion and USD 1.28 billion respectively for Q3, setting more records for the 7th, 9th and 10th largest global carriers. The three companies also continue to reach new heights in terms of operating margins, which remain some of the most elevated in the industry, though they have recently been challenged by other carriers.

Wan Hai Lines achieved a near 260% increase in revenue year-on-year. The company has grown its fleet nearly 40% over the past twelve months, with most of the new capacity by volume purchased rather than chartered. Revenue growth was comparatively smaller for Evergreen and Yang Ming, at 160% and 150%. Evergreen’s fleet is 15% larger than a year ago, while Yang Ming’s is largely unchanged.

The companies’ stocks are now 50% down on their 52-week highs, however, after fears of inflation and a surge in Covid cases sent Taiwanese stocks plummeting.

Source: Alphaliner

.png)

.jpg)