THE Alliance Announces Updated Service Adjustments for November 2020

In response to the COVID-19 pandemic, the members of THE Alliance have been making service adjustments to better align their resources with the fluctuating demand in the global shipping market. You will find details on the November 2020 updates as below.

Asia and North Europe

FP1 will maintain weekly sailings in November

FP2 will maintain weekly sailings in November

FE2 will maintain weekly sailings in November except in Week 45

FE3 will maintain weekly sailings in November except in Week 47

FE4 is temporarily suspended. THE Alliance will continue the Extra Loader Program with sailings on Week 45 to 48 in November. Participation of the Extra Loader Program will be separately advised by respective Lines.

Asia and the Mediterranean

MD1/MD2/MD3 will maintain their weekly sailings in November, except for in the following weeks:

Week 45 – MD2, MD3 void

Week 48 – MD1 void

Transpacific – West Coast

All PSW and PNW loops will maintain their weekly sailings in November except for the following PS3 Asia-India-Asia leg:

PS3 Asia to India – Week 44, 46 void

PS3 India to Asia – Week 46, 48 void

Transpacific – East Coast (via Panama and Suez Canals)

All USEC loops will maintain their weekly sailings in November except for in the following weeks:

EC3 – Week 45, 48 void

Asia and Middle East

AG1 will remain merged with AG3, and AG2 & AG3 will maintain all sailings in November.

Transatlantic

All Atlantic sailings will be maintained except for in the following weeks:

Week 46 – AL1, AL4 void

Week 48 – AL1 void

Since the outbreak of the coronavirus pandemic, THE Alliance has acted with speed and agility to keep supply chains moving, and have done everything in their power to continue doing so. The members of THE Alliance would like to thank their customers for their support and understanding in these unprecedented times.

Source: https://www.hapag-lloyd.com/

Wan Hai Lines to Enhance China to Vietnam Services Coverage

Wan Hai Lines Ltd. Is going to expand its existing service network between China to Southeast Asia by launching a new weekly service from South China to Vietnam on 25th November 2020.

The service, named CV8, will be operated with 3 vessels with an intake of 1,200 TEU. Wan Hai Lines will deploy 2 vessels while Interasia Lines will deploy 1 vessel. The service rotation shall cover Qingdao – Dalian – Tianjin – Ningbo – Xiamen – Cat Lai, Ho Chi Minh – Da Nang – Qingdao.

Through this new service deployment, Wan Hai Lines is confident to be able to provide customers with a more comprehensive service coverage from China to Southeast Asia.

Source: www.wanhai.com

Pricing power drives Q3 profits for Cosco, ONE

Soaring demand on the trans-Pacific and Asia-Europe trades during the third quarter drove up volume, revenue, and profitability for Cosco Shipping and Ocean Network Express (ONE), the container carriers reported Friday.

The two carriers are the first to report earnings for the July through September period, and the results are an indication that the container shipping industry is solidly on track for a profitable year. Drewry earlier this month upgraded its operating profit expectation for container shipping in 2020 by 16 percent to $11 billion — a level not seen in a decade — following “meteoric third-quarter rate increases.”

Singapore-headquartered ONE booked a 30 percent improvement in its net profit at $515 million during its fiscal second quarter ended Sept. 30, which it attributed to a strong improvement in spot market rates and a return to steady cargo demand.

The improved demand was certainly reflected in ONE’s results, as the carrier reported 100 percent vessel utilization on the Asia–North America trades, handling 765,000 TEU from July to September, a year-over-year increase of 25 percent. On the Asia-Europe headhaul trade, ship utilization was at 98 percent, with the carrier handling 20 percent more containers in the quarter at 419,000 TEU. ONE’s vessel utilization has been in the low- to mid-90s percent level all year, initially as the carrier matched its capacity with weak demand, and then as demand began to recover from mid-June on the trades out of Asia and blanked capacity was steadily reactivated through the third quarter.

In the first half of its financial year beginning April 1, ONE’s reported revenue of $682 million was nearly identical to the same period in 2019, capitalizing on the steady recovery in cargo demand, but the carrier warned that the outlook for the next six months remains uncertain.

ONE said in an earnings statement that after taking into account the coronavirus disease 2019 (COVID-19) and a traditionally slow fiscal fourth quarter — i.e., January to March 2021 — the carrier has forecast a profit of $245 million for its fiscal second half. If that is achieved, it would see ONE report a net profit of $928 million, seven times its previous fiscal year.

Cosco surfs Q3 profit wave

The container shipping business of China Cosco Holdings, which includes the Cosco Shipping and OOCL brands, saw its operating profit jump 25 percent year over year to $954 million in the first nine months of 2020, with the company’s net profit surging 51 percent to $667 million.

Cosco Shipping Lines made the most of soaring demand for consumer goods made in Asia. Total revenue for the third quarter increased 13.5 percent to $5.77 billion compared with the same three-month period last year, on transport volumes that grew 5.6 percent to 5.13 million TEU.

In an operational update released last week, OOCL reported a 16.3 percent increase in third-quarter revenue to $1.9 billion on the back of strong volume growth across all four of its major trade lanes.

But as with ONE, it was the two major east-west trades that stole the show, with heavy and sustained volumes driven by record US import demand filling all available capacity and pushing up rates. Cosco Shipping Lines reported a 20 percent increase in trans-Pacific revenue to $1.95 billion during the third quarter, as container volume grew 7.8 percent to 775,549 TEU.

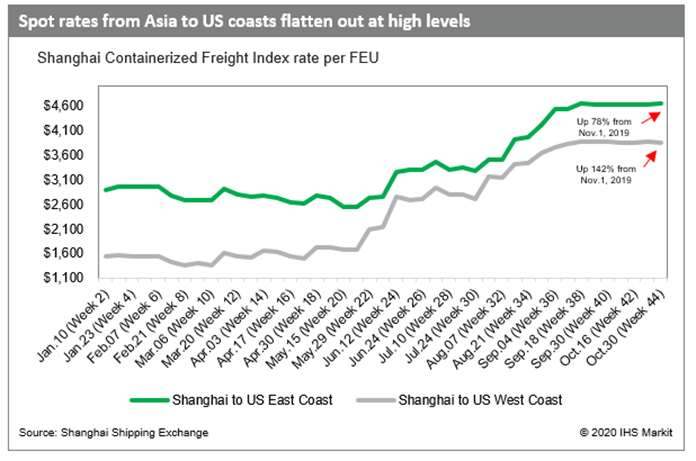

In addition to the increase in volumes, revenue growth was driven in part by spot rates that reached record levels during the quarter. Spot rates from Asia to the US West Coast from the beginning of July through Sept. 30 increased by 32 percent, according to the Shanghai Containerized Freight Index (SCFI). The average rate this week is $3,849 per FEU, up 142 percent year over year. Asia-US East Coast rates rose 36 percent from July through September and are currently at $4,641.

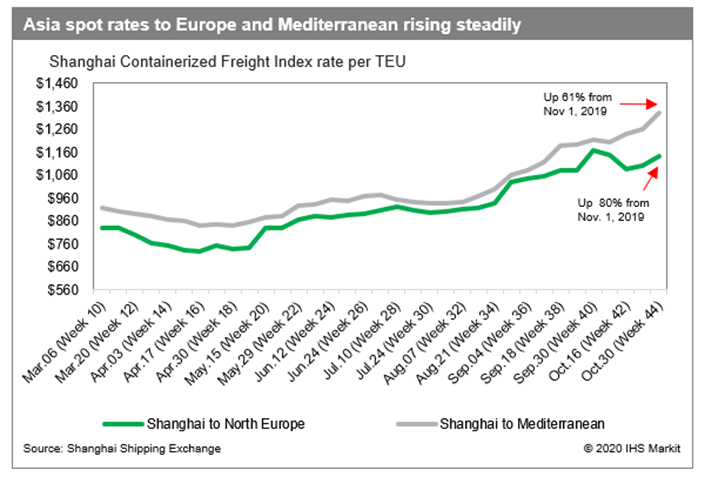

In the Asia–Europe trade, Cosco Shipping Lines’ revenue jumped 20.3 percent year over year to $1.27 million in the third quarter, with volume up 4.1 percent to 933,606 TEU. This trade also benefited from rising spot rates, although the increase in the third quarter was not as significant as on the trans-Pacific.

Pricing from Asia to North Europe rose 22 percent from July through Sept. 30, and the rate has continued to increase since. As of Oct. 30, the rate was $1,140 per TEU, up almost 5 percent from last week and up 61 percent year over year. Asia-Mediterranean spot rates increased 5.4 percent sequentially this week to $1,329 per TEU, an 80 percent increase from the same week last year.

Source: Joc.com

Exports to EU, ASEAN, RoK, Japan yet to bounce back

Vietnam’s exports during the past 10 months of the year witnessed an increase of 4.7% to US$229.27 billion in comparison with the same period from last year, although exports to the EU, ASEAN, the Republic of Korea (RoK), and Japan endured negative growth, according to figures released by the General Statistics Office (GSO).

The export of Vietnamese commodities from to the EU, ASEAN, the RoK, and Japan throughout the reviewed period were hit by declines of 3%, 11.6%, 2.6%, and 7% to US$28.9 billion, US$18.9 billion, US$16.3 billion, and US$15.6 billion, respectively.

The United States remained the country’s largest export market during the 10-month period, with export turnover soaring by 24% to reach US$62.3 billion, while exports to the Chinese market also increased by 14% to US$37.6 billion.

Meanwhile, Vietnam enjoyed a trade surplus of over US$18.72 billion as its 10-month export turnover rose by 2.5% to US$439.32 billion.

Phones and components achieved the highest export value of US$42 billion, making up 18.3% of the country’s total export turnover. They were followed by electronics, computers and components with US$36.2 billion, textiles and garments with US$24.8 billion, machinery, equipment, and spare parts with US$21 billion, and footwear with US$13.4 billion.

Throughout the ten-month period, heavy industrial and mineral groups are estimated to have grossed US$123.8 billion in exports, representing an annual increase of 8.4%, followed by the light industry and handicraft products with US$81.8 billion, agricultural and forestry products with US$16.8 billion, and aquatic products with US$6.9 billion.

Source: VOV

Trade surplus set new record of more than US$18 billion

VCN - Import and export turnover in October is estimated at more than US$50 billion and Vietnam continues to set a new record of trade surplus, according to a press release from the General Department of Customs on the afternoon of October 28.

Regarding import and export activities, the total value in October is estimated at US$50.7 billion, down 1.3% from the previous month. Of which, total export value is estimated at US$26.2 billion, down by 3.5% and total import value US$24.5 billion, up 1.2%. The country's export value increased by 7.9% and import value increased by 10.1% compared to the same period in 2019.

With the above developments, Vietnam’s merchandise trade balance of Vietnam in October is estimated to see a surplus of US$1.7 billion.

Thus, by the end of October, the total import-export turnover is estimated at US$439.32 billion, up 2.5% over the same period in 2019. Of which, the total export value is estimated at US$228.77 billion, up 4.2% and the total import value is estimated at US$210.55 billion, up 0.4% over the same period in 2019.

Vietnam merchandise trade balance in the first 10 months of 2020 maintains a record surplus of over US$18.22 billion.

The exported items with notable fluctuations in October are crude oil and ores of all kinds.

Specifically, crude oil exports in October are estimated at 446,000 tons, up 6.9% and worth US$135 million, up 3.9% over the previous month.

In the first 10 months of the year, the volume of exported crude oil is estimated at 4,341 million tons and valued at US$1,447 billion, up 28.1% in volume and down 16.4% in value over the same period in 2019.

Exports of ores of all kinds in October are estimated at 400,000 tons, up 99.3% and worth US$9 million, down 18.8% over the previous month.

By the end of October, the export volume of ores is 2.767 million tons, worth US$188 million; up 10% in volume and down 1.2% in value compared to the same period last year.

The imported goods with notable fluctuations include crude oil estimated at 1.35 million tons and valued at US$424 million. By the end of October, it is estimated at 10.219 million tons and valued at US$3.338 billion, up 51.6% in volume and 4.7% in value over the same period in 2019.

Petroleum of all kinds is estimated at 450,000 tons, up 0.9% and valued at US$170 million, up 3.1% over the previous month. By the end of October, it is estimated at 6,841 million tons and valued at US$2,703 billion, down 15.4% in volume and 45.4% in value over the same period in 2019.

Computers, electronic products and components are estimated at US$6.2 billion, down 2% from the previous month; by the end of October, they are estimated at US$51.28 billion, up 20.2% over the same period in 2019.

Notable imported products are CBU cars estimated at 15,000 units, up 14.4% and valued at US$297 million, up 16.1% over the previous month.

By the end of October, car imports are estimated at 81,000 units, worth US$1,774 billion, down 33.1% in volume and 34% in value over the same period in 2019.

Customs revenue from 1st to 26th of October reached VND22,418 billion, thereby bringing the accumulated revenue from the beginning of the year to October 26 to VND247,219 billion, or 73.1% of the estimate, reaching and 69.7% of the desired target, a year-on-year decrease of 13.59%, according to the press release from the General Department of Customs on the afternoon of October 28.

Source: Vinamas

An overview of social economic situation 10/2020

Source: www.gso.gov.vn/

.png)

.jpg)