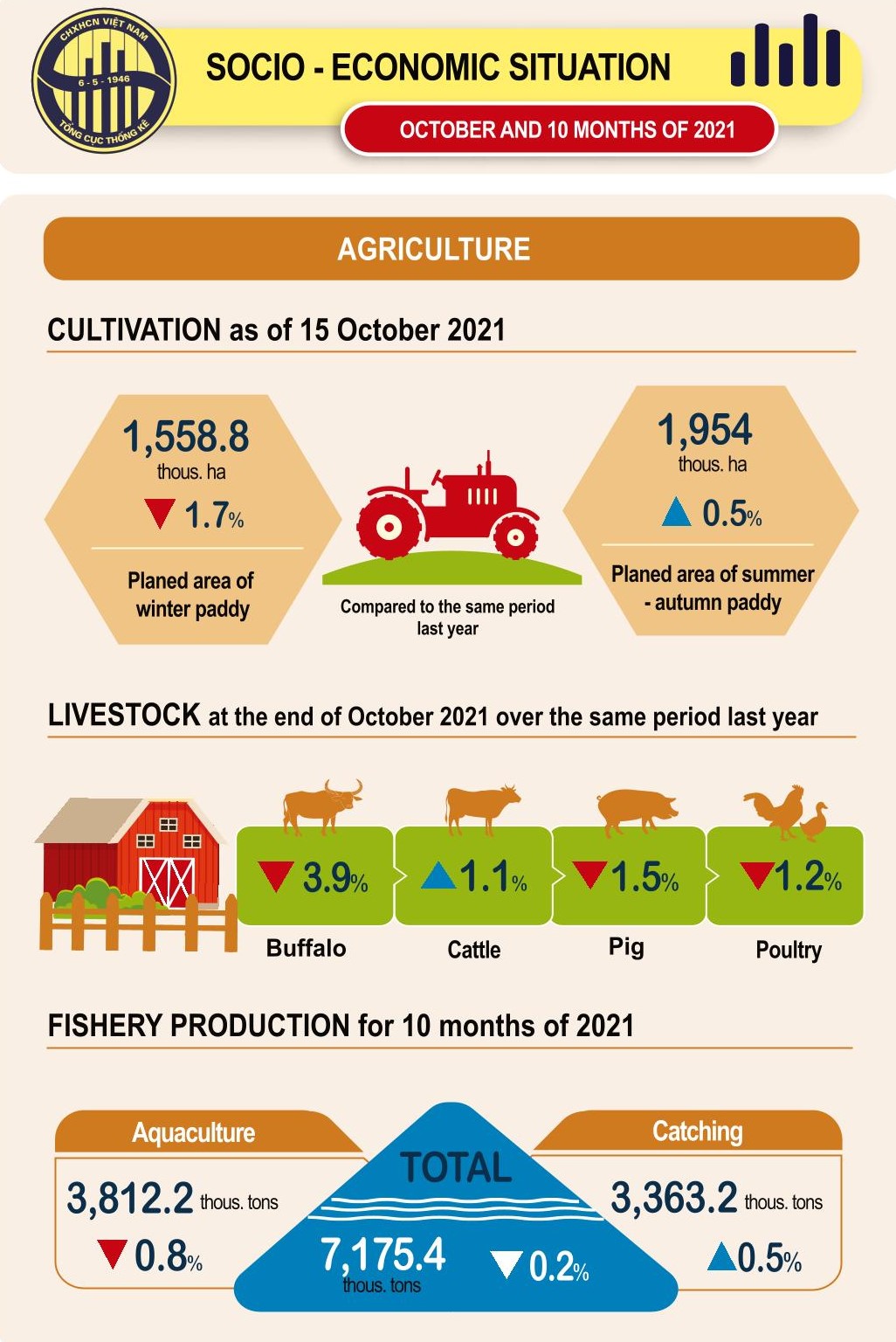

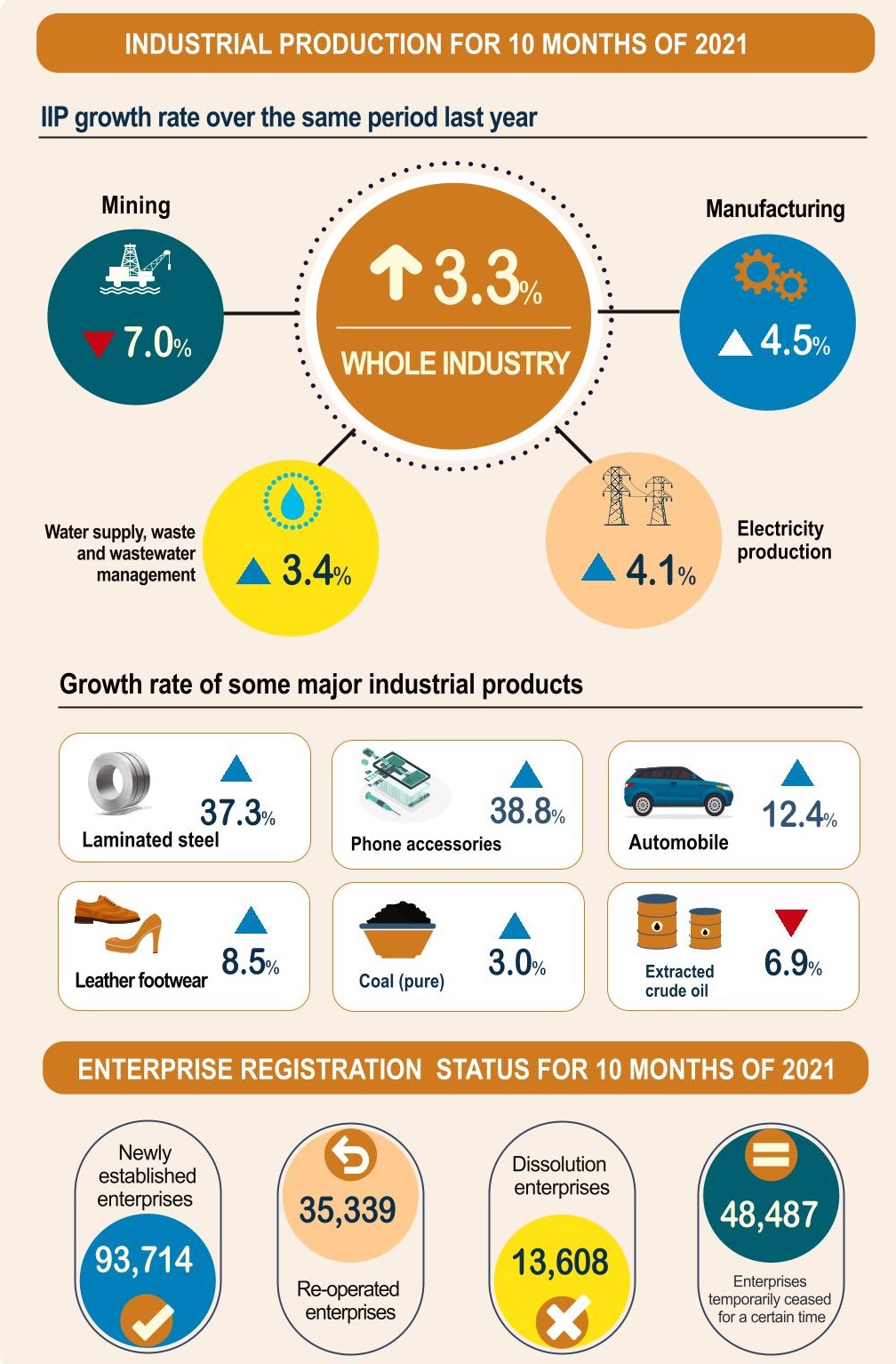

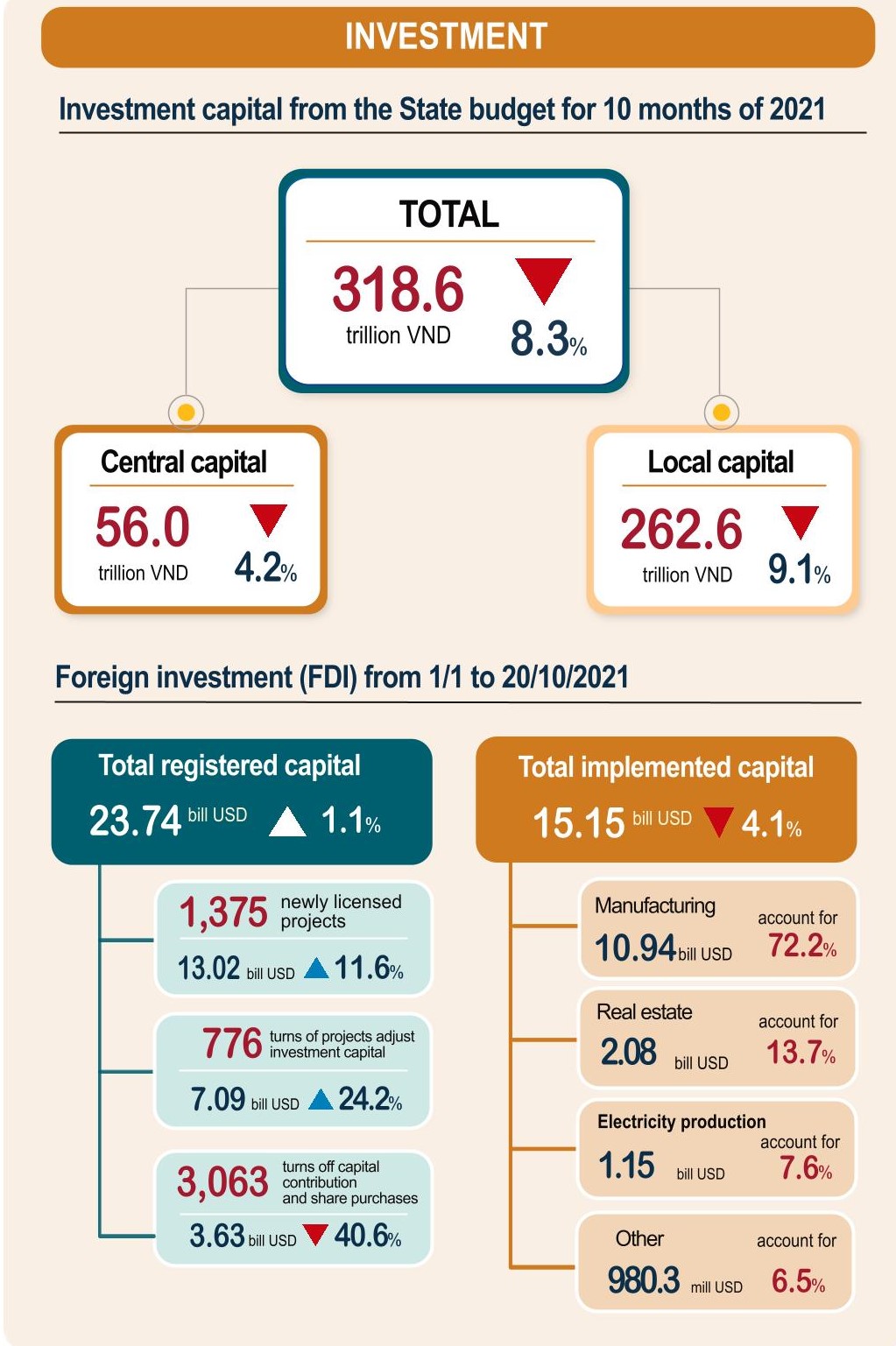

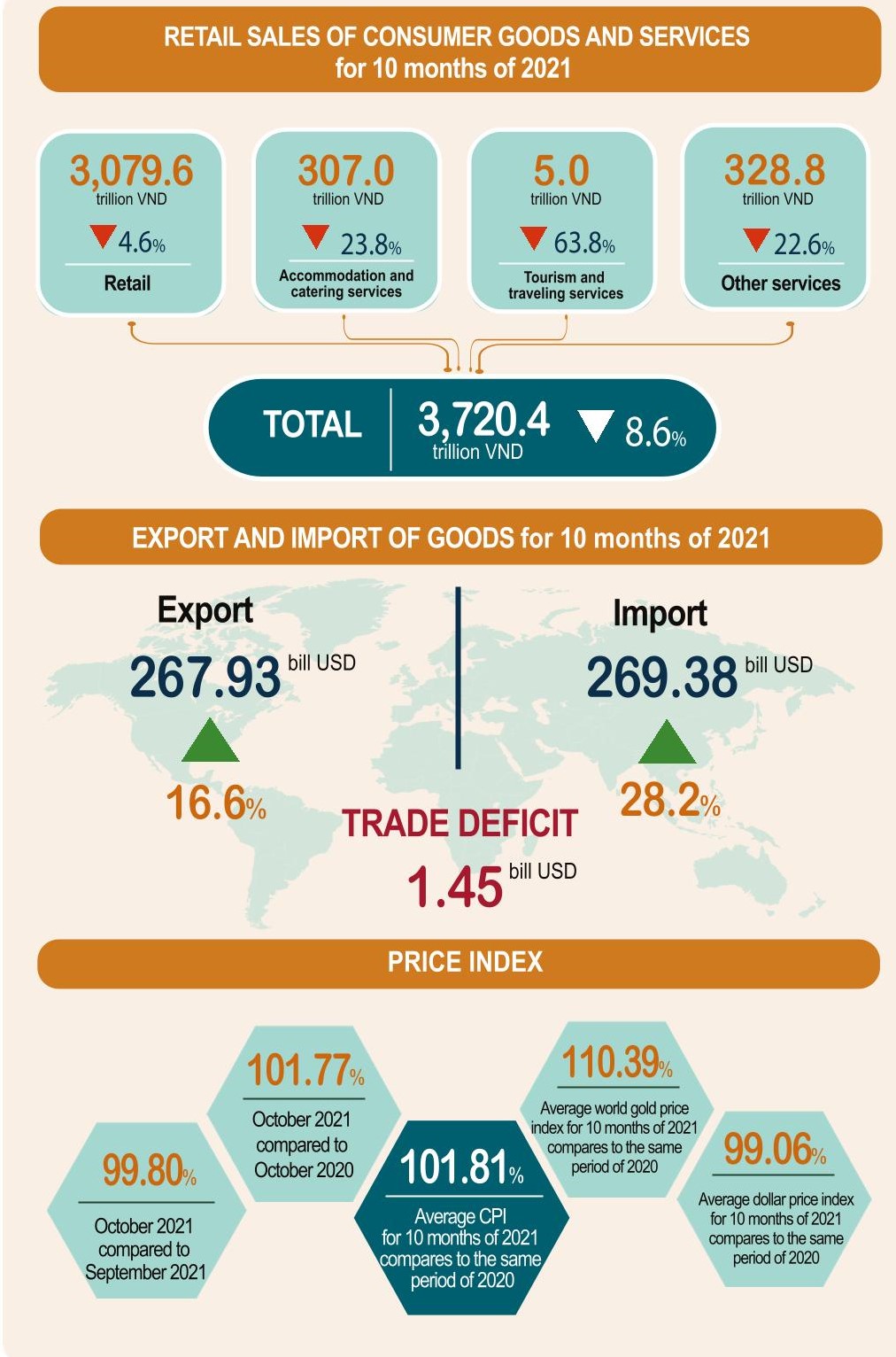

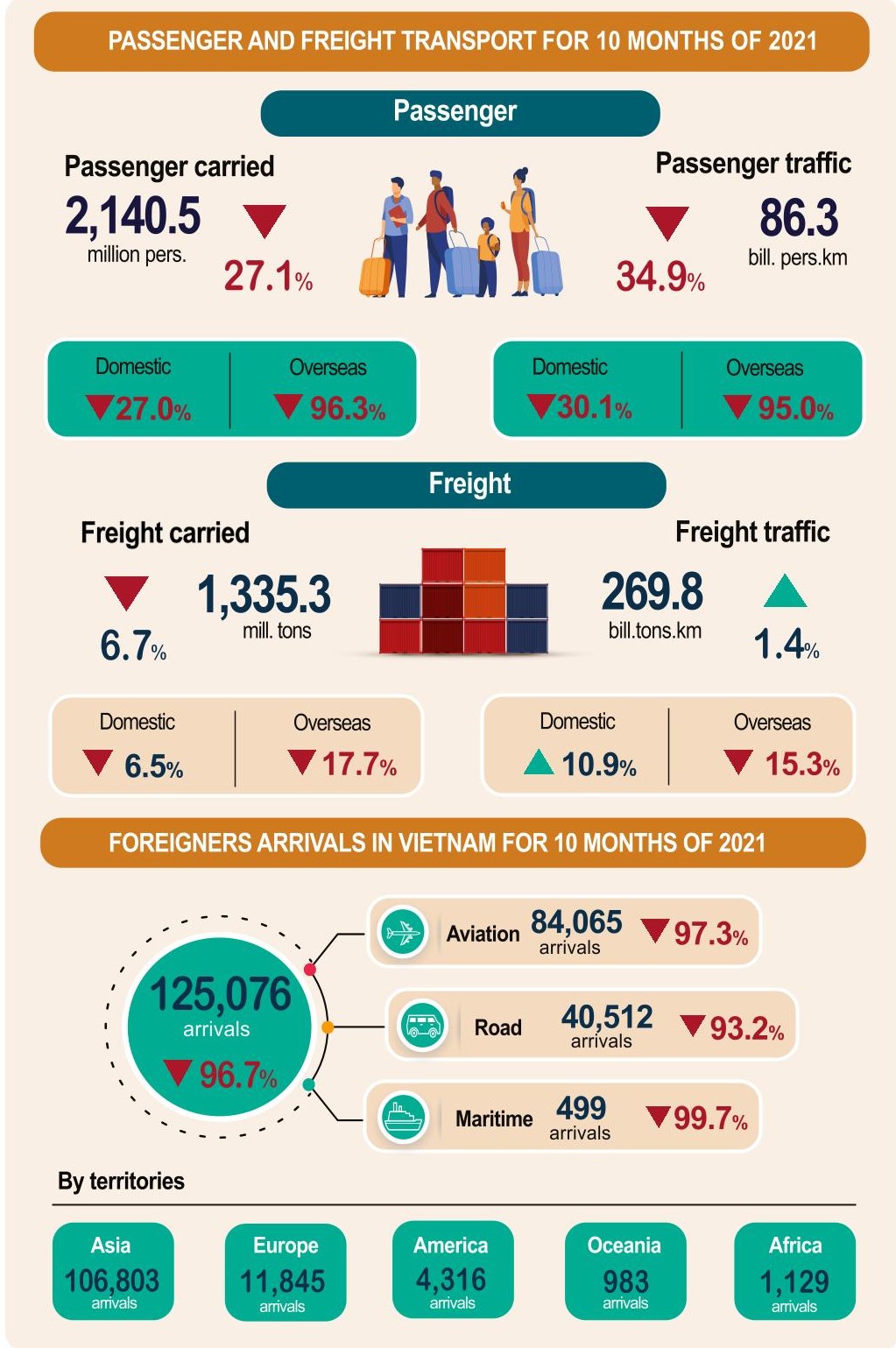

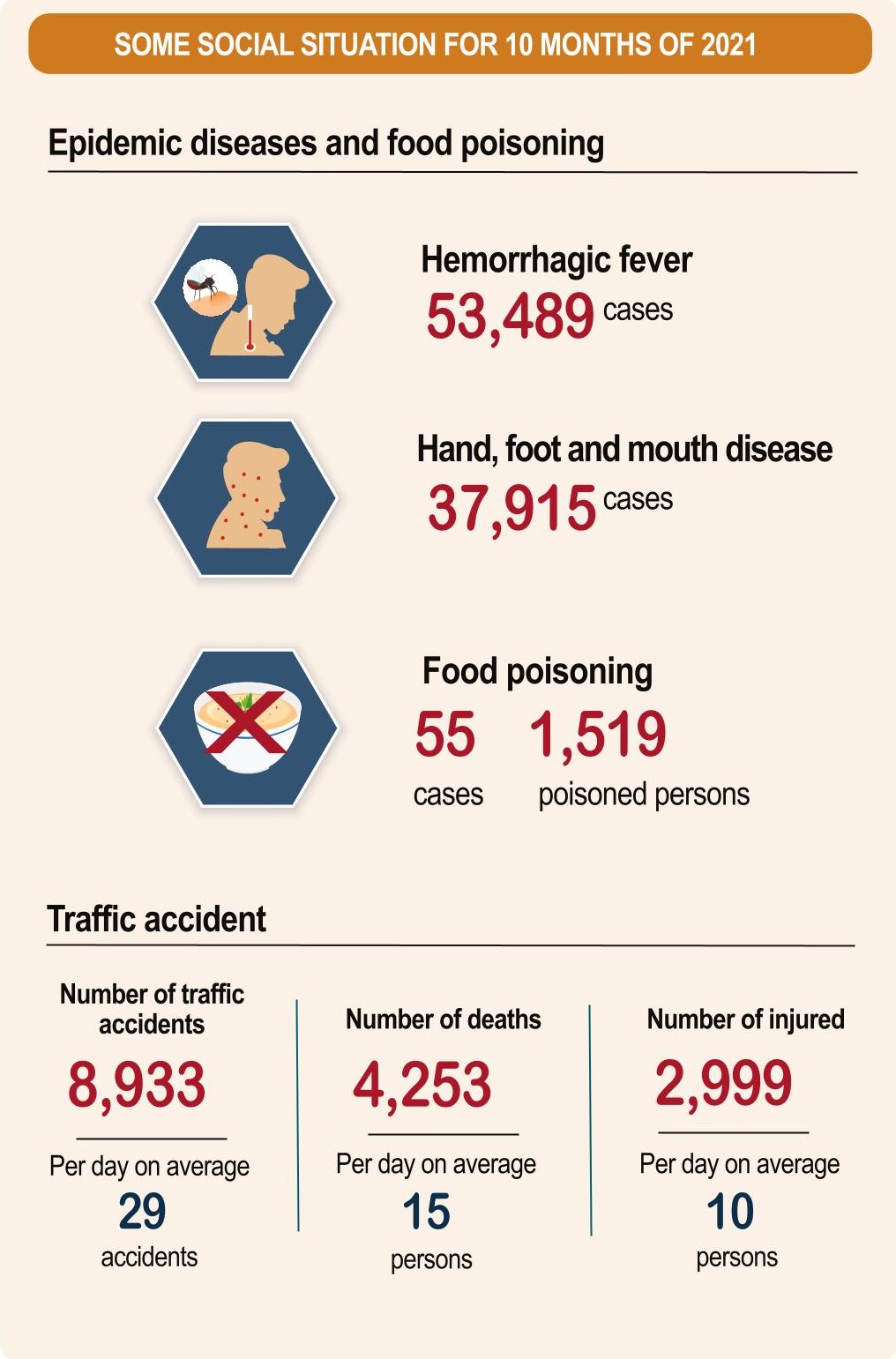

Infographic Social-Economic Situation 10/2021

(Source: Vietnam General Statistics Office)

Yang Ming leases a container ship to Maersk Line for a year

Yang Ming Shipping has agreed to lease one of its container ships to Maersk Line for a year for nearly $63 million.

Mother vessels of Yang Ming at TCIT berth

Yang Ming Marine Transport, a Taiwan's carrier, has agreed to lease one of its container ships to Maersk Line for a year for nearly $63 million.

Based on an average daily charter fee of about $172,600, this ship could be a Panamax container ship.

Yang Ming said that Maersk Broker negotiated the transaction. No other information about the ship has been revealed.

Yang Ming said in a filing on the Stock Exchange of Taiwan on October 22 that it has met its implementation obligations with THE Alliance and has sufficient capacity for its operations.

Yang Ming said it could benefit from repairing its ship for an operator with greater needs.

Yang Ming's current fleet is 88 vessels and market discussions indicate that Yang Ming is talking to shipyards about new building orders. This year, Yang Ming has started taking delivery of 10 2,800TEU ships that have been ordered with fellow shipbuilder CSBC Corp. Seven of the 14 new-build 11,000TEUs ordered through long-term charter agreements with Costamare and Shoei Kisen Kaisha have already been delivered, and the others will be delivered in 2022.

Yang Ming is expected to replace older ships with newer and more fuel-efficient ones, and repair ships with heavier fuel consumption.

(According to ContainerNews)

ZIM buys seven secondhand boxships for $320m

ZIM has acquired seven containerships of between 12 and 14 years old for $320m since the start of October.

The vessels purchased are five traditional panamax sized 4,250 teu boxships and two 1,100 teu.

The prices of secondhand containerships have soared due to the capacity crunch facing the sector. Traditional panamax vessels were all but worthless a few years ago following the expansion of the Panama Canal in 2016 with ships of that class as young as 10 years old being sent for scrap.

The sellers of the seven vessels in the $320m transactions were not revealed. ZIM primarily charters in tonnage rather than buying, however, the market is extremely tight and a traditional panamax was recently chartered at $200,000 per day

Eli Glickman, ZIM President & CEO, said: “Since going public our focus has been to allocate capital to strengthen our commercial prospects and create long-term shareholder value.

“With the opportunistic acquisition of these much-needed vessels, we have drawn on our strong cash position and our agile approach to maintain and expand our operating fleet to meet growing customer demand, while remaining committed to delivering industry superior profitability. Going forward, we will continue to complement our primary strategy of chartering-in the vast majority of our vessels, by selectively acquiring second-hand tonnage when the appropriate opportunities arise.”

(Source: Seatrade-maritime)

Wan Hai Lines expands AA7 service from Asia to US East Coast

The new route of AA7 service after being expanded is: Ningbo - Taipei - Xiamen - Shekou - Cai Mep - Port Klang - New York - Charleston– Savannah - Ningbo.

A mother vessel of Wan Hai Lines at TCIT

Wan Hai Lines is expanding its network from Asia to the US East Coast by adding three new ports to the existing AA7 transpacific service.

This upgraded service will be operated by 11 container ships with capacities ranging from 4,600 TEU to 5,600 TEU, and will add three ports: Ningbo, Port Klang and Charleston to the current route.

The new route of AA7 service will be as follows:

Ningbo - Taipei - Xiamen - Shekou - Cai Mep - Port Klang - New York - Charleston– Savannah - Ningbo

The maiden voyage is scheduled to commence from Ningbo port on November 3.

"The revamped service will provide better transit time and service coverage to meet customers’ rising demand," the Taiwanese shipping line said.

(Source: Wan Hai Lines)

.png)

.jpg)