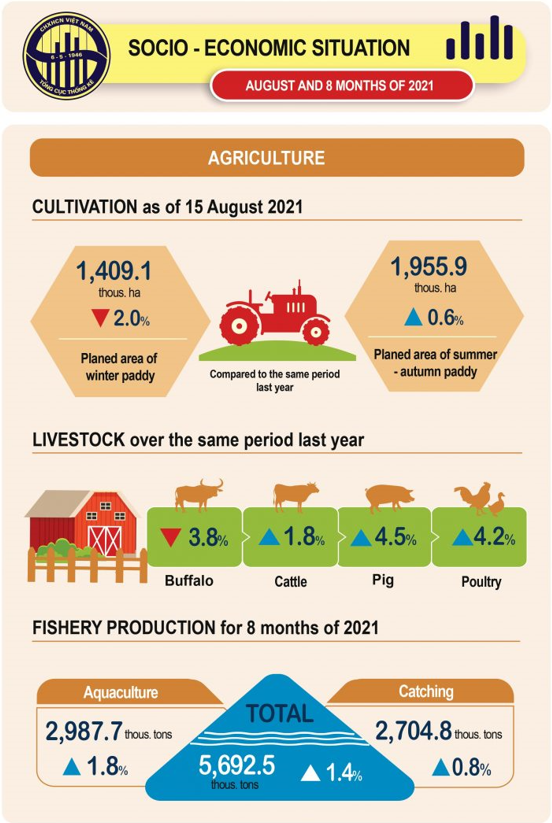

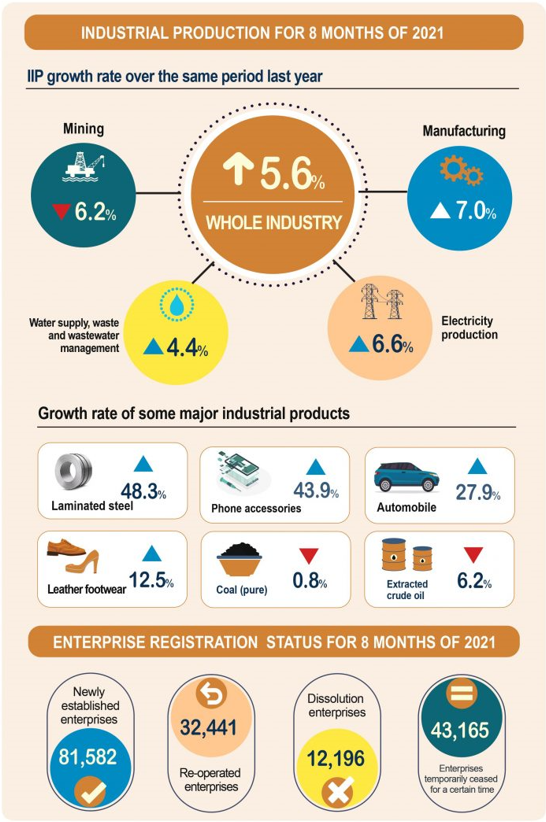

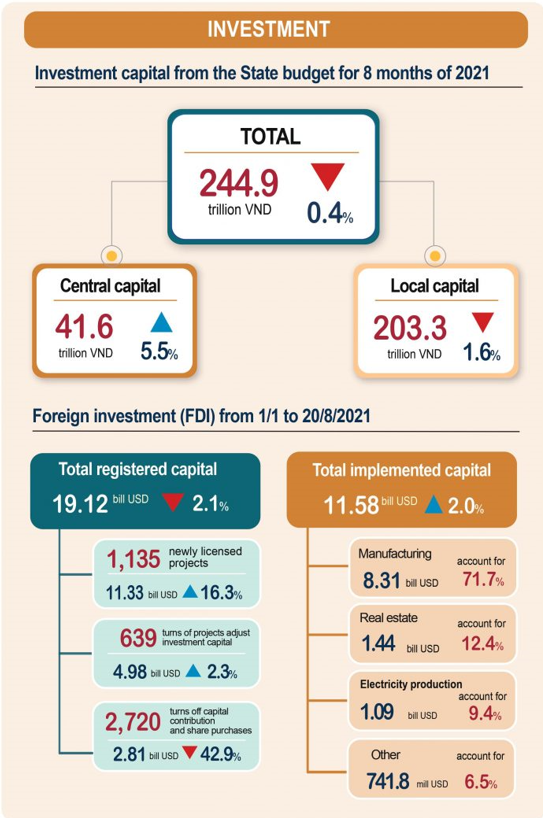

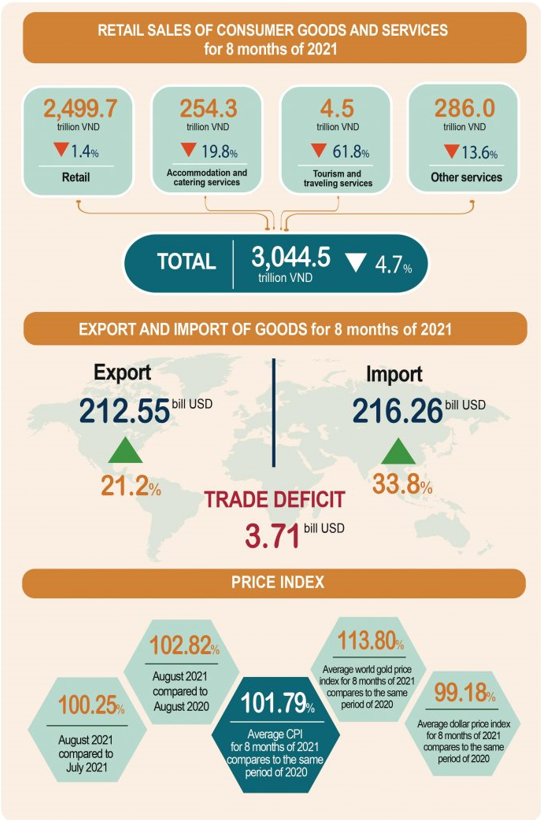

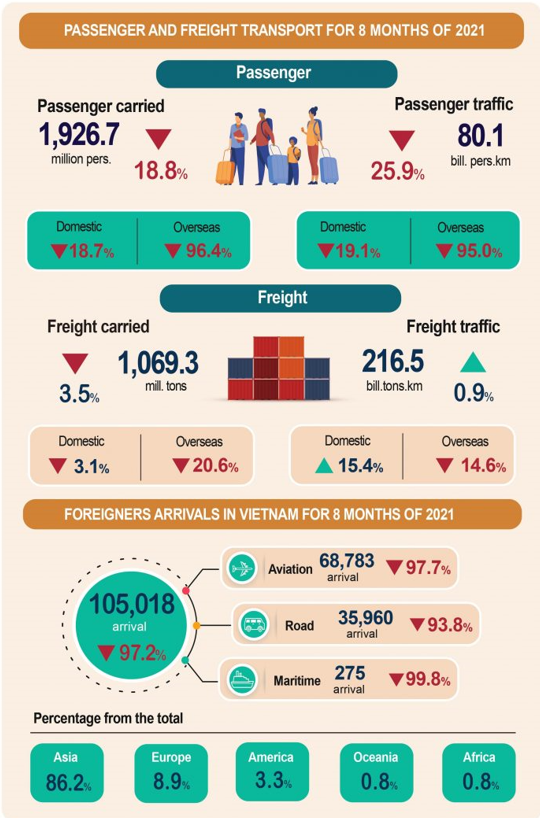

Infographic Social-Economic situation in August and 8 months of 2021

Source: Vietnam General Statistics Office

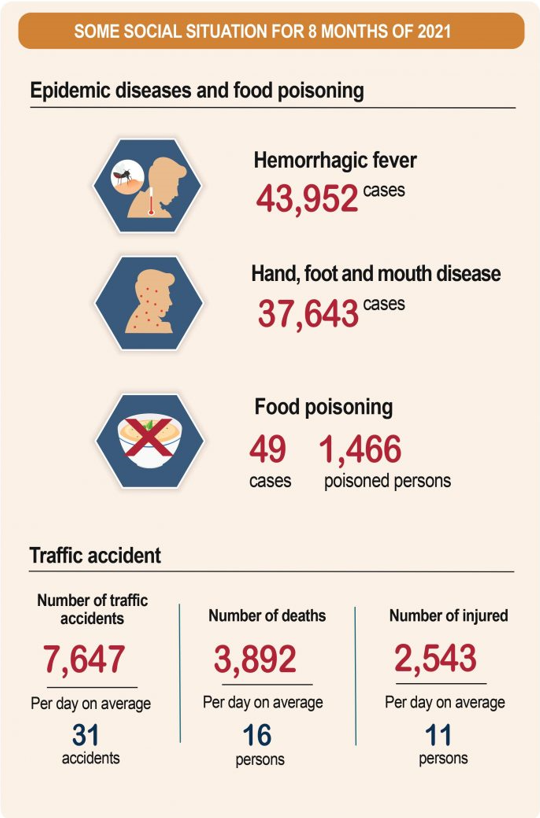

THE Alliance cancels 12 sailings in August, double the blank sailings of 2M and Ocean Alliance

Over the next four weeks, The Alliance (Hapag-Lloyd, ONE, Yang Ming, HMM) has announced 12 cancellations, followed by 2M (Maersk, MSC) and Ocean Alliance (CMA CGM, COSCO, Evergreen) with four and two cancellations, respectively, according to the latest Drewry's weekly "Cancelled Sailings Tracker", which provides a snapshot of blank sailings announced by each Alliance versus the total number of scheduled sailings.

Number of sailings canceled compared to the schedule.

On major lines such as Trans-Pacific, Trans-Atlantic and Asia - North Europe & Mediterranean, 18 sailing cancellations were reported between week 32 and week 35, out of a total of 496 sailings scheduled, equivalent to a cancellation rate of 4%.

“The summer rush is adding strain to an already overstretched supply chain,” Drewry notes. "Shippers and beneficial cargo owners continue to find themselves having to accept the very high rates and various additional premiums to stand any chance of their cargo being loaded on time," Drewry added.

As Drewry reports, a shortage of truck drivers in Europe, particularly the United Kingdom (UK), also contributes to delays to cargo arrival times. In which UK supermarkets and retailers with high turnover are being affected the most.

Source: Container News

Container vessels resume docking at Ningbo Meishan terminal after two-week shutdown

Meishan Island International Container Terminal (MSICT) at Ningbo-Zhoushan port reopened on 25 August after a lockdown started on 11 August.

The terminal at one of the world’s largest container ports caused by a Covid-19 Delta variant infection detected from a worker at the port. China is operating on a zero Covid policy with strict lockdowns put in place when infections are detected.

According to a notice released by Meishan Bonded Area Port Affairs Administration, Meishan bonded area lifts the lockdown in the morning of 25 August.

All the units and companies in Meishan bonded area will fully support and handle the loading and unloading of stranded cargos while the import container pick-up services at Meishan terminal are gradually resuming.

Container line CMA CGM said in customer advisory that MSICT had resumed partial operations on 18 August with two of its vessels alongside completing operations. However, at the time the yard remained closed.

MSICT is the second Chinese container terminal to be hit by a Covid-related lockdown and closure in recent months. In May and June Yantian International Container Terminal (YICT) suspended much of its operations causing major disruption to global supply chains. The impact of the Ningbo terminal closure has been considerably less on global container shipping line operations.

Source: The Economic Times

More sailing cancellations forecast during Chinese Golden Week

Shippers could face more difficulties in the coming weeks ahead of expectations of more sailing cancellations during China's Golden Week holiday in early October.

Record-high freight rates in recent weeks can be seen in many global freight rates index, such as the Shanghai Containerized Freight Index (SCFI), Drewry’s composite World Container Index, Ningbo Container Freight Index (NCFI) and Baltic Freight Index (FBX) are not expected to decline in the coming months.

The partial closure of the port of Ningbo (due to the closure of the Ningbo Meishan Terminal) so close to the Chinese Golden Week holiday, is ideal for shipping lines to execute another round of blank sailings.

With a peak period of three to four weeks before the golden week event, importers will require accelerated production in order to ship their products out of China on time. Restrictions in sea and land transport increase the risk of goods being dropped and deliveries delayed.

Closer to the national holiday in China, shipping lines will often plan to cancel many sailings to ports in the country due to the subsequent drop in demand when factories are closed for a period of time holidays and thus rates continue to be pushed higher.

Although many sailing cancellations close to Golden Week is a traditional practice intended to make up for the low demand afterwards. But this year, shippers still expect shipping lines to maintain full fleet deployments on trans-Pacific routes due to strong demand and soaring freight rates.

Maersk said in an announcement that "This year’s Golden Week might as well increase the number of repercussions in ocean freight and inland transportation across multiple trades and regions."

The Danish carrier notes that while operations can still remain open at most ports and customs offices - ocean carriers may limit operations during this period.

"To avoid waiting for the typical pre-golden week rush, we strongly recommend you to book your containers as soon as possible", Maersk said.

Source: Phaata

COSCO accepts to pay the highest charter rates when hunting for container ships

As the container ship rental market in the last 12 to 24 months has almost no ships available, shipping lines are taking the last resort of hiring new vessels.

But at the same time, they are also anxious to protect the ships they have locked in from belligerent adversaries by actively opening early renewal negotiations.

Shipping lines MSC, CMA CGM, ZIM and COSCO competed in trying to reach the top shipowners with very high charter rates for 36 months.

A mother vessel of COSCO shipping line at TCIT berth.

According to Alphaliner data, China's state-owned carrier - COSCO - has agreed to lease no fewer than eight new ships and five renewals in the past few weeks.

The charter contracts, ranging from the 1,296-TEU Trader to the 4,957-TEU Jogela, are almost entirely fixed for 36 months, thus ensuring that these vessels will remain in COSCO's fleet for the foreseeable future and are important. It is important not to be poached by competitors.

Alphaliner said: “This fixing spree follows a wave in June, which saw Cosco fixing and extending six classic panamaxes from Navios for periods of 36 months in the low $40,000 a day level.”

The consultant noted that COSCO has also renewed two Costamare-owned vessels, the 9,469 TEU post-Panamax fleet consisting of Cosco Guangzhou and Cosco Ningbo, for a period of 36-39 months at a charter rate of $72,700 a day.

Previously, COSCO shipping line paid US$30,900 a day for the COSCO Guangzhou vessel and for a period reduced its charter to US$16,000 during a period of excess capacity in 2017.

COSCO's closing operations are perhaps one of the 'last hurdles' for carriers in their quest to secure more ships, as any vessel with the capacity to operate this year, and the next year will be hampered by longer charter periods and shorter delivery times according to the market, especially in the past six months.

One broker told The Loadstar he has "mixed feelings" about how the container charter market has evolved.

He said: “It has been a great buzz concluding these deals and, with our charterers telling us to ‘fix anything that floats’, there has been very little delay for subjects from charterers for vessel suitability or inspections.” And, “What I worry about is what we are going to do for the next year or so with container tonnage availability all but wiped out,” he said.

This also means that there is nothing left on the container charter market to accommodate any special requirements. “The carriers with big bucks have taken everything off the market, right down to the smallest feeder, and we can barely cover our commitments,” he said. “And now owners are asking us to agree new long-term extended charter deals at vastly inflated hire rates.”

Source: The Loadstar

.png)

.jpg)