THE Alliance Announces Covid-19 Response Measures For September 2020

The members of THE Alliance would like to update the service adjustments in September to reflect the impact of the COVID-19 pandemic on the global shipping market. For more details, please refer here.

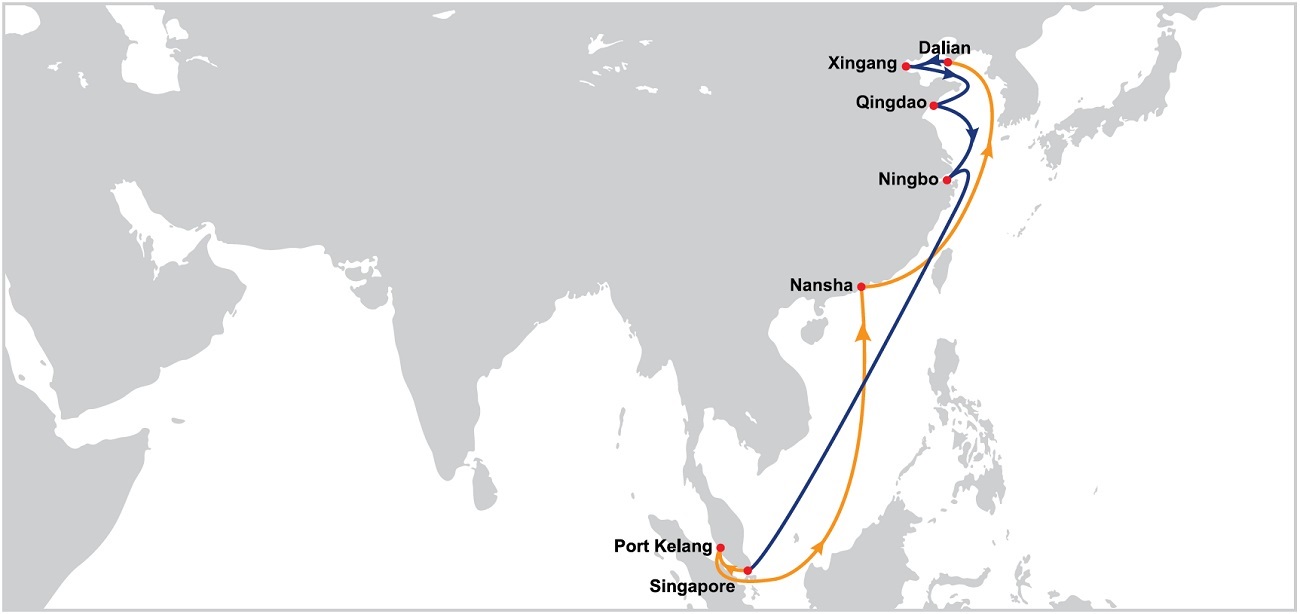

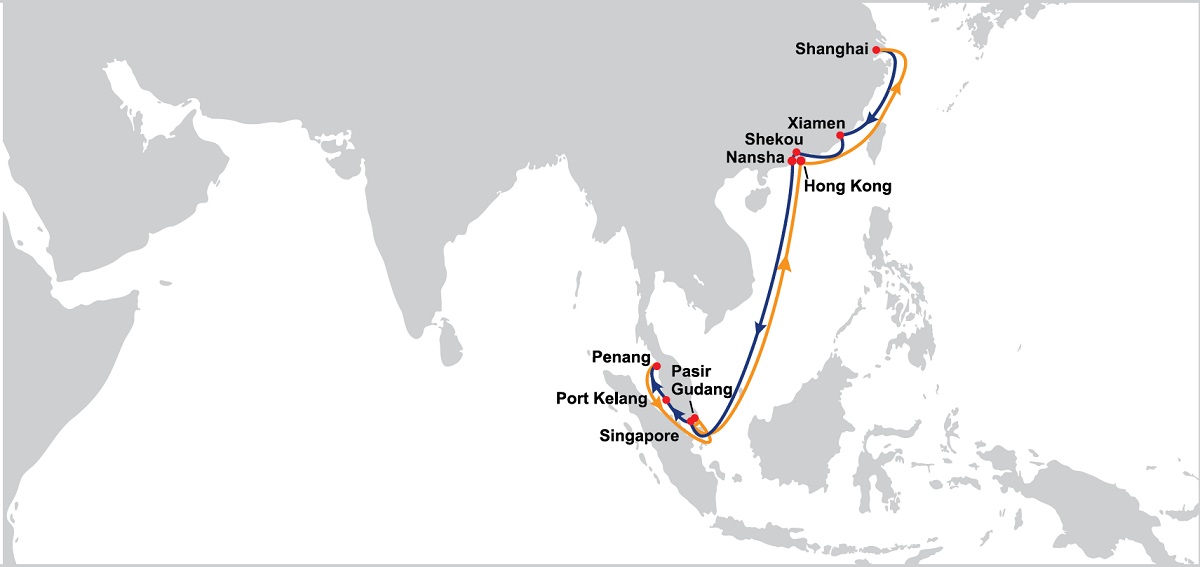

OOCL introduces two new China-Southeast Asia services

Orient Overseas Container Line (OOCL) will offer two new China to Southeast Asia services next month to enhance its market coverage.

The China Straits Service 1 (CSS1) and China Straits Service 2 (CSS2), both to start in September, are expected to provide OOCL customers with competitive and reliable shipment options in the intra-Asia network, the carrier said.

“CSS1 and CSS2 will directly connect multiple ports in China to Singapore, Port Klang, Penang and Pasir Gudang to cater for the changing demand in the market,” OOCL stated.

CSS1 port rotation: Dalian - Xingang - Qingdao - Ningbo - Singapore - Port Kelang (West Port) - Nansha - Dalian

The first sailing of CSS1 will start from Dalian on September 15, 2020.

CSS2 port rotation: Shanghai - Xiamen - Shekou - Nansha - Singapore - Port Kelang (West Port) - Penang - Pasir Gudang - Singapore - Hong Kong – Shanghai

The first sailing of CSS2 will start from Shanghai on September 18, 2020.

Cosco to boost box-making business with funds from CIMC sale

Cosco is set to boost its container manufacturing business after it raises nearly $1 billion from selling down part of its stake in rival box maker China International Marine Containers (CIMC) later this year.

Cosco Shipping Development confirmed the move in a statement to the Hong Kong stock exchange late Tuesday after Cosco signed a letter of intent for the share sale to a state-owned assets management company in Shenzhen, southern China.

In the stock exchange statement, Cosco Shipping Development said the share sale “is expected to optimize the asset structure of the group” and would facilitate “the development of the shipping leasing business, the container manufacturing business” and related businesses.

Cosco currently has a 22.7 percent stake in CIMC that will drop to 4.7 percent after the share sale is completed, although the proposed deal includes further talks for Cosco to sell all remaining shareholding. CIMC’s largest shareholder now is property conglomerate China Merchants Group, while CIMC has an extensive semi-trailer manufacturing business in the US.

“It appears to be a state-mandated move to allow China Merchants to consolidate its control of CIMC, with Cosco to exit completely from CIMC while building its own container manufacturing business,” Tan Hua Joo, principal at Liner Research Services, told JOC.com.

“However, the logic of having COSCO and CIMC compete directly in the same industry is not something that I can comprehend,” Tan added.

Lars Jensen, chief executive and partner of Denmark’s Sea-Intelligence Maritime Consulting, told JOC.com the sale “could be a move to concentrate ownership of CIMC in fewer hands.”

Move comes days before H1 results

Under the sale plan, Cosco Container Industries and Cosco subsidiary Long Honour Investments will sell 645 million CIMC shares at a price of 9.83 RMB each to Shenzhen Capital Operation Group, controlled by the state-owned Assets Supervision and Administration Commission of Shenzhen. The sale will generate total proceeds of 6.34 billion RMB ($919.3 million). The Shenzhen company will also acquire shares from two minority shareholders to become CIMC’s largest shareholder with a 29.8 percent stake, while China Merchants will maintain its 24.6 percent interest.

The move came a day before CIMC reported a first half-loss of 183 million RMB ($26.5 million) on Thursday, compared with a 679.8 million RMB net profit in the year-ago period. This was partly due to disruption to its box-making business caused by the coronavirus pandemic, which saw sales of dry containers fall 37.5 percent to 358,300 TEU in the first half.

Orient Overseas (International) Limited Announces 2020 Interim Results

OOIL announces operational update for the 2nd quarter 2020, please click here for details.

How Vietnam turned crisis to the advantage?

Vietnam has been always very good at taking advantage of crisis to accelerate reforms and move faster and grow better, Jacques Morisset, World Bank Lead Economist and Program Leader for Vietnam, has said.

In an interview granted to the Vietnam News Agency (VNA), Morisset explained why the WB Bank has recognized Vietnam as one of the most successful emerging economies, apart from China, India, Malaysia and Thailand, in its latest report.

He said during the 2010-2019 period, economy growth rate in Vietnam has been the second fastest in the world, behind China. Not only Vietnam has been growing very fast, but it has also been creating many products and jobs.

And this explains why Vietnam has been very successful, he noted.

Morisset said Vietnam has done two things very good, with the first being agriculture, adding that during the 1990-2000 period, Vietnam has been able to multiply agriculture productivity – a revolution of the country.

Jacques Morisset, World Bank Lead Economist and Program Leader for Vietnam

The second lies with the opening of the economy to manufacturing and FDI enterprises, according to the WB expert.

Since the early 2000s, new businesses have come to Vietnam, creating millions of jobs, including new, more productive and better paid ones, Morisset said.

Regarding the COVID-19 outbreak, Morisset said he himself and many governments and multinationals believe that the pandemic crisis gives an opportunity for Vietnam to attract more foreign investors.

“A perception that many multinationals will need to diversify because of the crisis, and Vietnam is clearly a country that can host more FDI, so that would be the first opportunity,” he further said.

Speaking of digitalization, he said Vietnam has been a bit slow in developing digitalization. It was too difficult or impossible to pay by phone, and most of the government procedures have been carried out on papers.

But the crisis would accelerate the need and the reform to more digitalization in Vietnam, the expert said.

The Vietnamese government has been implementing many new reforms to digitalize, including the building of e-government, he said, adding that in terms of digitalization in the financial system, the Vietnamese government is gearing towards an e-payment system.

“It means that hopefully in next few months, most of Vietnamese will be able to use the phone for payment, which will be a big change compared to the situation before the COVID-19 crisis,” the expert said.

The pandemic has also proven the significance of information sharing, he said, adding that the Vietnamese Government has shared a lot of detailed information about COVID-19 transparently and effectively via the media.

Vietnam is already on the radar screen of many investors. Investors are coming to the country and the pandemic crisis has been helping it to attract more investors, he emphasized, commending Vietnam’s initial successes in containing the virus, with low rates of both infections and fatalities.

Except Da Nang that is focusing on fighting the disease, other major cities in Vietnam have maintained their normal activities, showing the world that Vietnam has been an attractive place for investment.

Morisset suggested Vietnam balance the opening and closure of the border amidst the pandemic outbreak, and seek ways to attract good investors who create jobs, provide technologies, train Vietnamese workers and work with major suppliers.

“That is good to make difference to Vietnam,” he said.

In addition, the Vietnamese government should consider spending more and better in public investment, and further support people and businesses most affected by the pandemic, he said, adding that such sectors as tourism, garment-textile and footwear need assistance.

According to the expert, e-commerce and digitalization will thrive during and after the crisis. /.

Exceeding Thailand, Vietnam becomes world’s 2nd largest rice exporter

With a bumper crop and good export prices, Vietnam’s rice export volume and turnover have exceeded Thailand’s, making the former the second largest exporter amid the Covid-19 crisis.

While the exports of many farm produce items have fallen dramatically because of the epidemic, exports of rice have been high.

The Ministry of Agriculture and Rural Development (MARD) reported that in the first seven months of the year, Vietnam exported 3.9 million tons, earning $1.9 billion. Though the export volume decreased by 1.4 percent, export turnover increased by 10.9 percent compared with the same period last year.

In the first half of 2020, China imported 458,000 tons of rice, an increase of 88.9 percent.

The second biggest importer has been the Philippines which consumed 1.4 million tons worth $634.3 million in H1, up by 13.3 percent in volume and 30.5 percent in value.

The Vietnam Food Association (VFA) updated export price list on August 14 showed that Vietnam’s 5 percent broken rice was traded at $493-497 per ton, Thailand’s at $473-477 per ton. Pakistan’s rice at $423-427 and India’s $378-382 per ton.

According to VFA, of the three biggest rice exporters in the world (Vietnam, Thailand and India), Vietnam’s 5 percent broken rice price is the highest, higher by $20 per ton than Thailand’s.

An expert on farm produce market said Vietnam’s rice export price peaked thanks to the demand increase in the context of limited supply from India and Thailand.

Besides, the improvement of Vietnam’s rice quality, especially scented rice, also helped raise the export price.

The expert believes that Vietnam’s rice price may continue increasing because some countries have lowered exports, while the demand is high.

Besides traditional markets, Vietnam now can export rice to the EU, about 80,000 tons a year under the EVFTA (EU-Vietnam Free Trade Agreement).

The USDA (US Department of Agriculture) has predicted that the global total rice output would be 495.2 million, a decrease of 0.3 percent, while the consumption level would be 490.4 million tons, an increase of 1.3 percent over 2019.

The high exports have pushed domestic rice prices up. Mekong Delta rice was traded at VND5,000-6,700 per kilogram, up by VND200-500 per kilogram.

Nguyen Van Tam in Can Tho City, who cultivates rice on 6 hectares, said though rice is still unripe, merchants have committed to buy fresh rice at the fields at VND5,700 per kilogram, or VND500-700 per kilogram higher than the previous year.

The farmers in Phu Dien commune of Dong Thap province also said merchants have committed to collect rice at high prices.

E-commerce changing peak-season shipping patterns

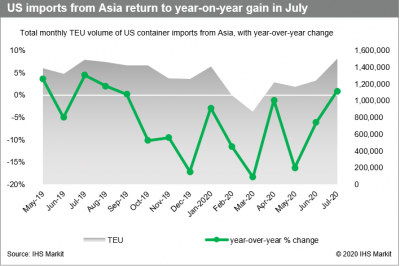

Freight forwarders and logistics experts are now predicting that US imports will remain at elevated levels at least through October, fueled primarily by e-commerce fulfillment and a steady flow of personal protective equipment (PPE).

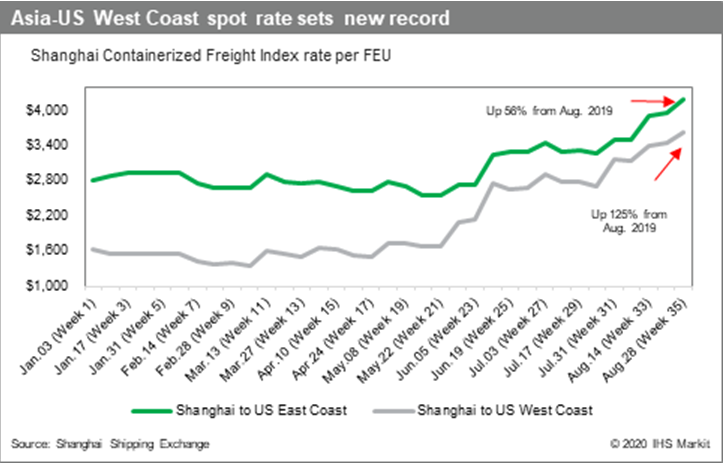

Non-vessel-operating common carriers (NVOs) told JOC.com this week the continued surge in imports will push the already record-high spot rates in the eastbound trans-Pacific even higher. As of Aug. 28, the Asia–US West Coast rate reached $3,639 per FEU, up 5.8 percent from the previous week’s record high and 125.3 percent from the same week in 2019, according to the Shanghai Containerized Freight Index (SCFI), published in the JOC Shipping & Logistics Pricing Hub. The rate from China to the US East Coast stood at $4,207 per FEU, up 6.4 percent from last week and 56.3 percent year over year.

Earlier this month, NVOs were predicting that the import surge that began in late June would last at least through September. Now they are extending that timeline, based on continued growth in e-commerce fulfillment, as shoppers favor online shopping during the COVID-19 crisis.

“We can see demand strength through October,” Jon Monroe, a consultant to NVOs, said in his weekly newsletter on Wednesday. PPE shipments, which contributed to the surge in July, remain strong due to large-volume purchases by federal and state governments, he said.

However, e-commerce fulfillment is also playing an important role in the import surge. Consumers are shopping online for a broad range of merchandise, more than replacing the weakness in in-store purchases due to COVID-19. Analysts say the growing role of e-commerce imports could be changing the timing of peak-season shipping patterns in the eastbound trans-Pacific.

“E-commerce is replacing in-store shopping. The entire Black Friday shopping scene ain’t going to happen,” a transportation consultant and former logistics executive for national retailers told JOC.com.

However, the same consultant, who asked not to be identified, noted that some big-box retailers are still replenishing inventory that was burned off when the US emerged from COVID-19 lockdowns. Those retailers are ordering both for e-commerce fulfillment and for the restocking of inventory at the stores. “There are still a lot of stores that are low on replenishment,” he said.

Imports may stay strong for rest of year

NVOs do not have a clear view of demand beyond October, but purchase orders placed with factories in China may point to the strength in US imports continuing until the end of the year. Monroe cited a recent survey of factories in China conducted by Nansha Port, which found that purchase orders were strong for the rest of 2020.

“End of the year? It could very well be,” Monroe said in his newsletter.

US imports from Southeast Asia, especially Vietnam, continue to set records. Nerijus Poskus, global head of ocean freight at Flexport, told a webcast Wednesday that imports from Vietnam in July were up 39 percent from June. July was the best month ever for imports from Vietnam through the West Coast, he said. In order to meet growing demand for premium services from Vietnam, APL Logistics next week will add Haiphong to the list of Asian ports served by its OceanGuaranteed product., which already included Ho Chi Minh City.

Monroe added that the two tightest trade lanes in Asia in terms of vessel capacity are Ho Chi Minh and Yantian, China, to Los Angeles and Long Beach.

Strong US imports from China and Southeast Asia, coupled with weak US exports to Asia, have resulted in equipment shortages in those regions, said Jan Hinz, head of North America and Turkey at Flexport.

“There is a significant shortage of equipment in Asia,” he said. Hinz advised shippers attending the Flexport webcast to be flexible when shipping from Asia. For example, 40-foot high-cube containers are difficult to secure, so shippers who are turned down for those containers should consider moving their freight in standard 40-foot containers if that’s what’s available, he said.

Asia–East Coast spot rates also increasing

Strengthening import demand, equipment shortages in Asia, and tight vessel capacity on vessels leaving Asian ports are boosting spot rates in the eastbound trans-Pacific. NVOs told JOC.com last week that carriers are forecasting a rate of $4,000 per FEU to the West Coast when a Sept. 1 general rate increase (GRI) takes effect next week.

Friday’s SCFI reading also indicated that demand for all-water services from Asia to the East Coast is increasing. Normally, the difference between the East Coast and West Coast rate is close to $1,000 per FEU. However, that gap closed considerably in July as retailers concentrated their imports through the ports of Los Angeles and Long Beach. Imports through the Southern California gateway increased 33.8 percent in July from June, whereas total US imports in July increased only 0.9 percent month-over-month, according to PIERS, a JOC.com sister company within IHS Markit.

The East Coast spot rate on July 31 was $3,495 per FEU, or only $328 per FEU higher than the $3,167 rate to the West Coast. On Friday, the differential had increased to $568 per FEU, according to the SCFI. East Coast port directors earlier this month told JOC.com their bookings for August were looking strong.

Port Logistics Group, which has distribution warehouses on both coasts, said the East Coast facilities are increasingly busy.

“Southern California has always been number one, but we’re seeing high demand all around the country,” said Scott Weiss, vice president of business development at Port Logistics Group. He said the company’s warehouses serving Savannah are especially busy.

Demand growing for priority trans-Pacific services from Vietnam

APL Logistics Monday announced the addition of Haiphong, Vietnam, to its OceanGuaranteed product, a move that capitalizes on importers’ requirements for priority loading in Vietnam and time-definite delivery to destinations throughout North America.

The third-party logistics provider’s OceanGuaranteed now serves 13 load ports in Asia, including Ho Chi Minh City. US retailers have shifted some of their sourcing and manufacturing from China to Vietnam and other countries in Southeast Asia during the two-year-old US-China trade war.

US imports from China of household goods, one of the largest categories of imports, declined 15.6 percent last year, while increasing 33.6 percent from Vietnam, according to PIERS, a JOC.com sister company within IHS Markit.

“Our customers are asking for this,” Phil Tran, director of international services, North America region, told JOC.com.

OceanGuaranteed ensures priority loading in Asia, priority unloading at the Fenix Marine Services terminal in Los Angeles, team-driver truck service to destinations throughout the US and Canada, and time-definite delivery to the door of the receiver, or the customer receives a 20 percent refund, Tran said. Other Asian load ports for the product include Qingdao, Shanghai, Ningbo, Xiamen, and Shenzhen in China; Hong Kong; Kaohsiung, Taiwan; Bangkok, Thailand; Singapore; Jakarta, Indonesia; and Busan, South Korea.

Since the priority product was launched more than 10 years ago, APL Logistics has consistently maintained on-time delivery by working closely with its ocean carrier, terminal, and trucking partners, and by “minimizing the number of touch points,” Tran said.

Premium services from Asia in high demand

Non-vessel operating common carriers (NVOs) have told JOC.com that priority trans-Pacific ocean services such as those offered by APL Logistics and ocean carriers Matson Navigation Co. and Zim Integrated Shipping Services have been in high demand since late June as carriers continue to roll shipments from one voyage to the next because ships leaving Asia are overbooked.

US imports from Asia in Southern California surged almost 40 percent in May through July over the same period last year as retailers restocked merchandise that flowed out of warehouses when stores and factories began to reopen following COVID-19 lockdowns. In addition, sales of personal protective equipment (PPE), home furnishings, at-home office products, and seasonal merchandise have been brisk. Vessels leaving Asia are still overbooked, according to NVOs.

When APL Logistics accepts a booking, the customer is guaranteed loading on the vessel that is booked in Asia, and date of delivery at cities throughout North America. The booking guarantees equipment availability and team-driver truck service from Los Angeles, Tran said. On cross-country routes, transit times are faster than via intermodal rail, he said.

“It’s a white-glove service,” Tran said. OceanGuaranteed is priced about 75 percent lower than air freight, and with ocean spot rates in the eastbound trans-Pacific approaching $4,000 per FEU to the West Coast, the product is competitive with some carriers’ premium services that add surcharges on top of the spot rates, he said.

APL Logistics is also helping OceanGuaranteed customers navigate disruptions in the Southern California supply chain, which has experienced marine terminal congestion, chassis shortages, and domestic railcar shortages, Tran said.

“We don’t guarantee just one leg; it’s an end-to-end service,” he said.

Source: Shipping Lines' websites, JOC.com

.png)

.jpg)