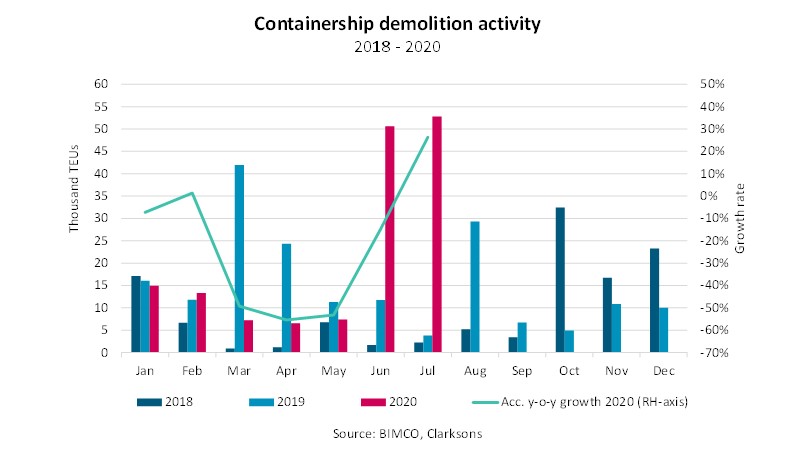

BIMCO: Boxship demolition at 41-month high in July

Container shipping demolition has hit a 41-month high in July reaching 52.8 thousand TEU, thereby surpassing the 50.6 thousand TEU demolished in June, data from BIMCO shows.

In the first seven months of the year a total of 152.8 thousand TEU has been demolished, up 26.3% from last year.

16 ships have been demolished in July, including the 1998 built Sine Maersk, the largest container ship ever to be demolished at 9,600 TEU.

The strong demolition volumes in June and July come after a very slow few months for demolition activity.

In particular, the three months between March and May saw very little activity with only 21.1 thousand TEU being removed from the market, 72.8% lower than in the same three months of 2019, BIMCO’s data shows.

This was a result of the lockdown measures in the major shipbreaking nations of the world, which saw many owners unable to send their ships to the yards.

Back in April, BIMCO revised its full-year forecast for containership demolitions from 200,000 TEU to 300,000 TEU, which would be a 63.8% increase from 2019 levels.

Back in April, BIMCO revised its full-year forecast for containership demolitions from 200,000 TEU to 300,000 TEU, which would be a 63.8% increase from 2019 levels.

The change, as explained by BIMCO, reflects the current market conditions as the coronavirus crises has caused a dramatic drop in demand with container shipping demand down 7.7% in the first five months of 2020 compared to 2019.

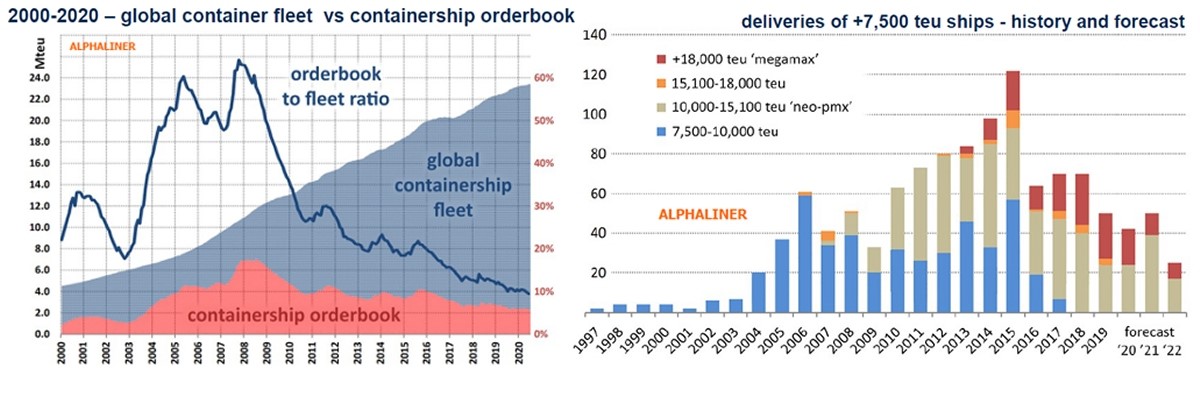

Moving on to the supply side, the global containership orderbook, seen as a percentage of the world fleet, has dropped to a historic low point this month, continuing the declining trend of the past few years, according to Alphaliner.

As per Alphaliner’s July data, the orderbook-to-fleet ratio now stands at only 9.4% or 2.21 Mteu.

“For the first time in more than 20 years, the global newbuilding pipeline thus fell below the 10% threshold. While much of the past decade’s declining ratio was primarily a statistical side effect of an ever-growing global fleet, this has fundamentally changed in more recent years,” the maritime data provider said.

Ship orders collapse; will rate boom follow?

Pre-COVID, the bull case for shipping rates was all about plunging newbuild orders. A drop in orders in 2019 pointed to rising freight rates in 2021, given the lag between contract signing and delivery.

Mid-COVID, the bull case for rates is even more about plunging newbuild orders than before. There will be a lot fewer vessels on the water in 2021, 2022 and beyond than previously thought.

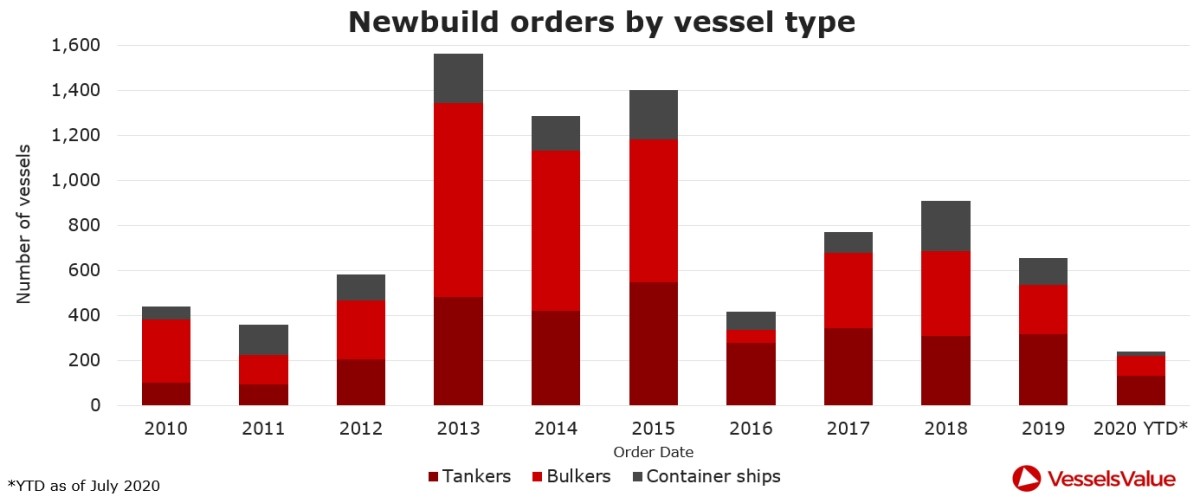

New data provided to FreightWaves by U.K.-based VesselsValue confirms that 2020 is shaping up to be an exceptionally weak year for tanker, bulker and container-ship orders.

New data from Alphaliner shows that container-ship newbuild capacity is down to just 9.4% of capacity on the water. “For the first time in more than 20 years, the global newbuilding pipeline fell below the 10% threshold,” reported Alphaliner on Wednesday, calling it a “historic low.”

The number of ship orders year-to-date is extremely low.

VesselsValue data shows just 134 tanker orders through July, 28% below last year’s pace, despite historically high spot rates. Only 88 bulkers are on order, 31% below last year’s pace.

(Chart: VesselsValue)

Clarksons Platou Securities has released data for specific tanker and bulker segments. For very large crude carriers (VLCCs, 200,000-plus DWT), the orderbook is only 7.4% of the on-the-water fleet. For Suezmaxes (120,000-199,999 DWT), it’s 11.3%.

In the products sector, the ratio is just 6.5% for medium-range (MR) tankers (30,000-59,999 DWT). It is 0.8% for long-range 1 (LR1) tankers (60,000-79,999 DWT) and 9.6% for LR2s (80,000-119,999 DWT).

In the dry bulk sector, Clarksons puts the orderbook-to-fleet ratio at 10% for Capesizes (120,000-plus DWT). It is 8% for Post-Panamaxes (85,000-119,999 DWT) and 6.8% for Panamaxes/Kamsarmaxes (65,000-84,999 DWT).

Container-ship orderbook

According to Alphaliner, the container-ship orderbook is down to just 2.21 million twenty-foot equivalent units (TEUs). This contrasts to a high of around 7 million TEUs in 2008. In that year, orderbook capacity was more than 60% of on-the-water capacity.

Of ships on order, virtually all are in the 10,000-plus TEU category or the 3,999-TEU-or-less category. There are effectively no orders in the midsized 4,000-9,999 TEU category.

(Charts: Alphaliner)

Fear of premature obsolescence

Orderbooks are evaporating for two main reasons.

The first is regulation. The International Maritime Organization (IMO) has vowed to create rules to compel shipping to cut greenhouse gas (GHG) emissions by 50% by 2050, a regulatory target known as IMO 2050.

Owners don’t want to order until they know the rules, lest their assets suffer premature obsolescence.

As Star Bulk (NASDAQ: SBLK) President Hamish Norton explained during a Marine Money virtual forum in June, “What may be legal today may not be legal in five years. In the old days, ships were grandfathered in until the end of their useful life. Given the political situation, people are afraid — I think with good reason — that a ship they order today will not be grandfathered in, and will become obsolete.”

Coronavirus effects

The second reason for the orderbook shortfall is COVID-19. Travel restrictions in the first half of the year made newbuild contracting extremely impractical. Furthermore, current and future economic fallout make it much tougher to pull the trigger on orders and get financing.

“If economic uncertainty can be measured by ship-ordering activity, then shipowners must be feeling completely lost at the moment,” wrote Stifel analyst Ben Nolan in a recent research note.

The pricing of secondhand ships is also undercutting the case for newbuilds. Newbuild prices are at too high a premium to secondhand prices for most orders to make sense.

Stamatis Tsantanis, CEO of Seanergy (NASDAQ: SHIP), explained during a Capital Link webinar last week that a secondhand 5-year-old Capesize costs around $30 million, whereas a newbuild costs $50 million. “The price differential is not justified by the incremental earnings [of the newbuild],” he pointed out.

Risks to rate upside

The IMO 2050-coronavirus one-two punch sounds like a guaranteed recipe for future freight-rate strength. But there are no guarantees in ocean shipping. Following is a devil’s advocate list of things that could go wrong:

Cargo demand could slump — A multiyear virus-induced recession or depression could cut cargo demand as much or more than vessel capacity. This would erase owners’ future rate-negotiation advantage.

Another demand risk relates to GHG emissions. If the world’s governments are serious about forcing GHG cuts by shipowners, wouldn’t they also force cuts of fossil-fuel consumption? And if so, wouldn’t this reduce future demand for tankers, bulkers and gas carriers?

Shipping regulations are not a sure thing — The IMO has no power to enforce regulations. Only IMO member nations do. GHG regulations for shipping can only move forward if they’re supported by countries with the most to gain from ocean trade, and by the world’s largest charterers.

The coronavirus changes the equation. One theory is that the cleaner post-lockdown skies and waters will drive momentum for environmentalism and GHG regulation. In this scenario, shipping decarbonization is more likely.

Another theory is that the outbreak will spur an extended period of economic pain and geopolitical unrest. In this scenario, countries would focus on rescuing economies and keeping transport costs cheap, making shipping decarbonization less likely.

If owners believe GHG regulations face significant delays, or may not happen at all, they could lose their fear of ordering.

Orders may go forward regardless of IMO 2050 and COVID headwinds — If rates jump in 2021-22 due to lower vessel supply, owners could decide to order regardless of the premature-obsolescence risk, on the belief that they’ll earn sufficient returns before obsolescence strikes. This would limit the duration of the upcycle.

Alternatively, if there is a deep economic slump due to the coronavirus and owners do not order ships, there could still be newbuilds — a lot of newbuilds.

Commercial shipbuilding is almost entirely based in China, South Korea and Japan. Asian governments could fill yard slots with orders by state-controlled shipowners tapping state-backed financing.

This would not only preserve Asian shipbuilding jobs, it would also depress freight rates — a plus for economies that benefit from cheap transport of raw-material imports and finished-goods exports. Economies like China’s.

Talk to a shipping veteran who has been around since the 1980s and the conversation will often turn to the infamous Sanko orders. In 1983, Japan’s Sanko Steamship Co. placed a $1.25 billion order at Japanese yards for 103 dry bulk newbuilds totaling 4 million DWT. The order helped Japanese yards but crippled rates for years.

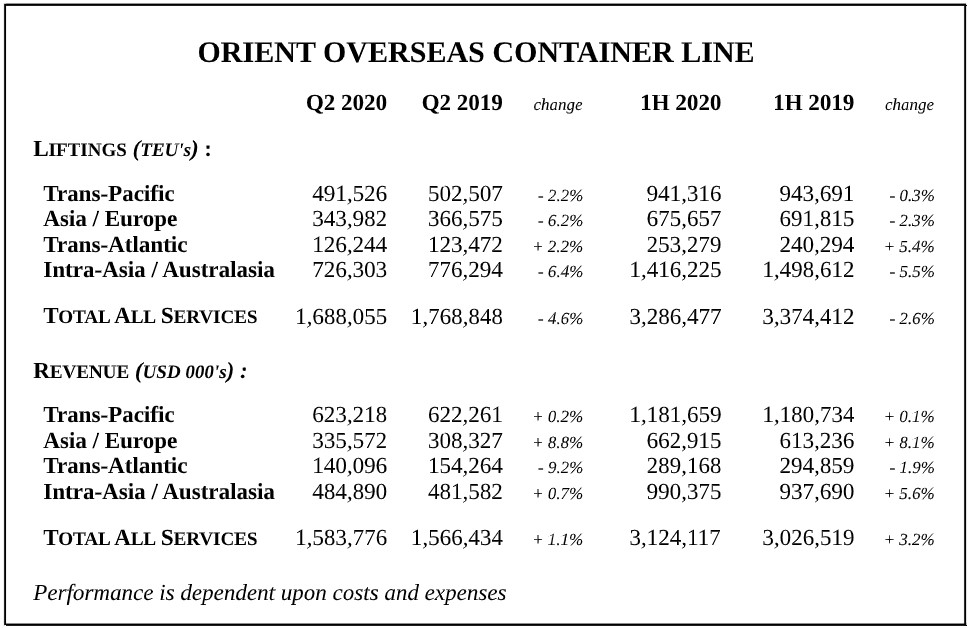

OOCL second-quarter revenues up, volumes down

Orient Overseas Container Line (OOCL) said that although second-quarter volumes were down 4.6% year-over-year, total revenues increased 1.1%.

OOCL’s parent company, Orient Overseas (International) Ltd. (OOIL), covered the second quarter of 2020 in a one-paragraph overview dated Friday.

According to the release, second-quarter revenues totaled $1.58 million. Average revenue per twenty-foot equivalent unit (TEU) increased 5.9% compared to the same period last year.

OOCL said loadable capacity decreased by 6.4% year-over-year. The overall load factor was 1.6% higher than the same period in 2019.

OOCL typically provides little or no commentary in its earnings releases. Its second-quarter release was no different.

A second paragraph covered the first six months of 2020. OOCL said total volumes decreased 2.6% in that period compared to 2019. Loadable capacity decreased 4.2% compared to the first half of last year, but the overall load factor was 1.3% higher.

Revenues, however, were 3.2% higher in the first half of 2020 than in 2019. OOCL said the overall average revenue per TEU increased 6% in the first half of this year compared to the same period in 2019.

OOCL has managed to increase revenues throughout the COVID-19 pandemic. It said in April that despite the turbulent times of the coronavirus crisis, it had managed to increase its year-over-year first-quarter revenue by 5.5%.

China’s COSCO Shipping Holdings acquired a 75% stake in OOIL in 2018. OOCL, COSCO, CMA CGM and Evergreen are members of the Ocean Alliance, one of the space-sharing agreements among container liner companies.

OOCL to expand Latin America coverage with new service

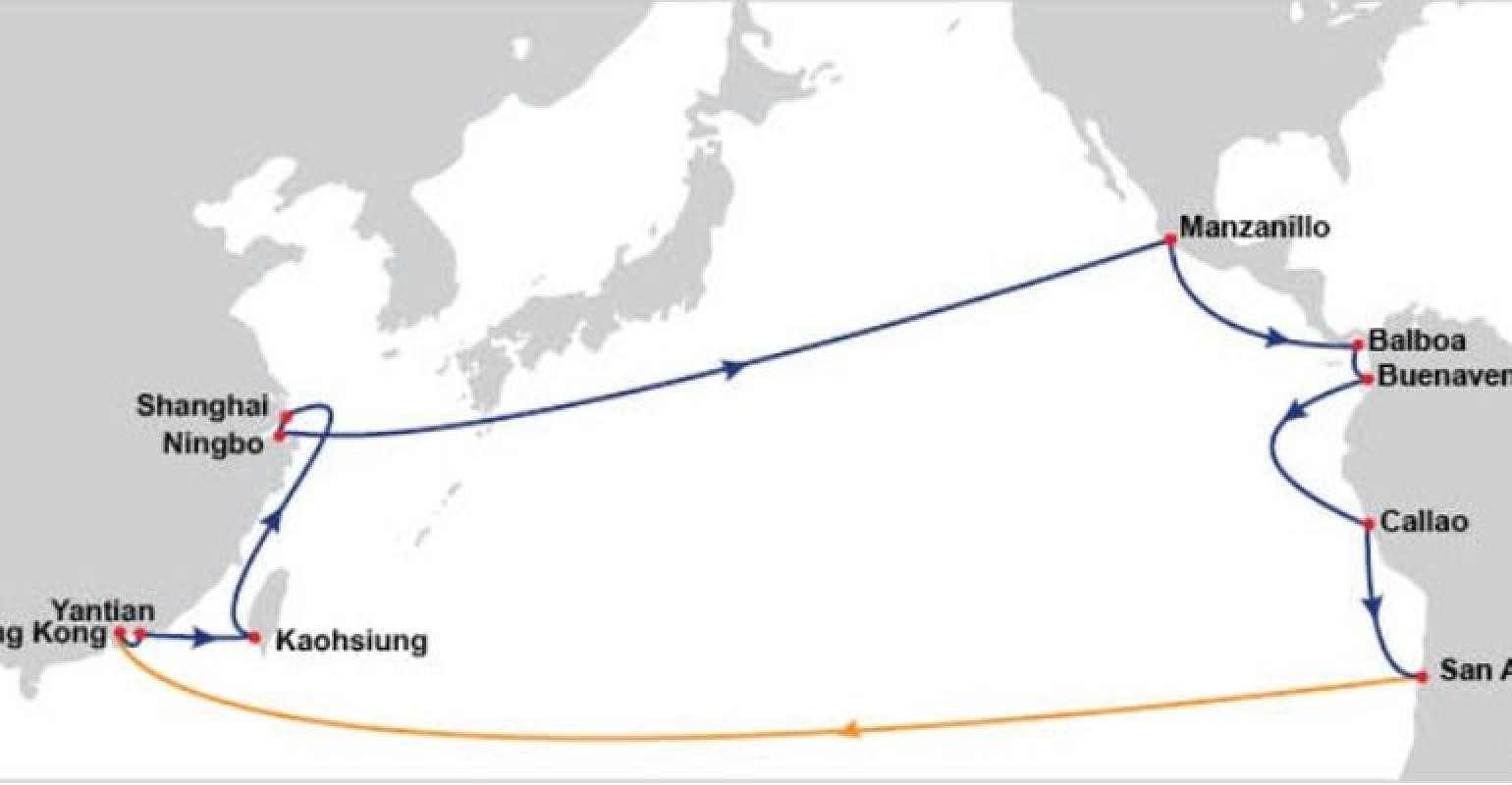

Orient Overseas Container Line (OOCL) is expanding its network coverage in Latin America with the introduction of a new Transpacific Latin Pacific 3 (TLP3) service.

The TLP3, scheduled to start from 2 August 2020, will be OOCL’s new service in its Asia-West Coast South America network.

“To cater to the demand for quality and customised reefer services from West Coast South America to Asia, the TLP3’s direct connection between Chile and South China offers a competitive transit time of just only 26 days (San Antonio to Hong Kong),” OOCL stated.

The port rotation for TLP3 will be Hong Kong, Yantian, Kaohsiung, Shanghai, Ningbo, Manzanillo (Mexico), Balboa, Buenaventura, Callao, San Antonio, and back to Hong Kong.

The new service will start with the container vessel Ever Lissome in Hong Kong on 2 August.

Container lines re-instate 30 sailings on transpacific west coast for Q3

Global carriers have re-instated sailings on the transpacific west coast for the third quarter on optimism about peak season demand and as the impact of the coronavirus (Covid-19) pandemic eases, according to analyst Sea-Intelligence.

On the Asia-North America west coast, carriers have re-instated 30 previously announced blank sailings for the third quarter. Of these 30, 22 were re-instated by THE Alliance.

“We see a similar picture on Asia-North Europe where of the 11 sailings that were ‘un-blanked’, nine were on THE Alliance services,” said Alan Murphy, ceo of Sea-Intelligence.

And of the total of 49 sailings re-instated on transpacific and Asia-Europe, THE Alliance has contributed to 36. “This goes to show that THE Alliance blanked capacity too aggressively and have dialled it down keeping in line with the other alliances,” Murphy observed.

“What we can see is that from week 29 (13 July) onwards, virtually no blank sailings are scheduled on the trade lane, bar a few in week 36, with the year-on-year capacity growth suggesting that from the carriers’ deployment considerations, coronavirus is no longer as big a challenge,” he said.

“This can either be due to a demand pickup, or an expected pickup in the coming weeks.”

Murphy added that for Asia-North Europe, on the other hand, carriers seem to be heading towards parity with the 2019 levels with their currently scheduled capacity deployments, although there might be a capacity drop for (China’s) Golden Week from closer to September – carriers usually announce Golden Week blank sailings 4-6 weeks out.

THE ALLIANCE ANNOUNCES COVID-19 RESPONSE MEASURES FOR AUGUST 2020

The members of THE Alliance would like to update the service adjustments in August to reflect the impact of the COVID-19 pandemic on the global shipping market. For more details, please refer here.

ONE to increase direct sailings from China to Southeast Asia

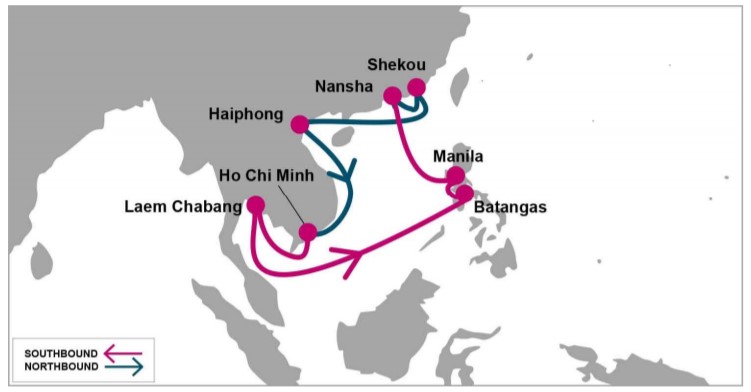

Ocean Network Express (ONE) is pleased to announce two new direct services connecting China and Southeast Asia.

Following the previously announced CID connecting China and Indonesia, ONE will further expand the China-Southeast Asia network by introducing China Thailand Service (CTS) and the revamped Thailand Philippines Service (TP2). The services will add direct sailings between China and South east Asia, namely Thailand, Vietnam, and the Philippines.

The direct sailings will improve transit times and further strengthen ONE’s already robust portfolio in Asia providing an excellent, more reliable and efficient service for ONE’s valued customers.

The first sailing for the CTS will be the KMTC LAEM CHABANG 2010S arriving Shanghai on 24th July 2020, and for the TP2 will be SITC INCHON 2029N/2030S arriving Laem Chabang on 4th July.

The CTS rotation is as follows: Shanghai (WGQ) – Ningbo – Xiamen – LaemChabang – Bangkok – Laem Chabang – Hong Kong – Shanghai

The TP2 rotation is as follows: HCMC (Cat Lai) – Laem Chabang – Batangas – Manila (Northport) – Nansha – Shekou – Haiphong – HCMC

Wan Hai Lines to Launch Taiwan to Vietnam and Thailand Services Coverage

Wan Hai Lines is pleased to announce a new service string connects Taiwan to Vietnam and Thailand. This service to be named TVT (Taiwan – Vietnam – Thailand) and is operating jointly with Interasia Lines.

TVT service will be operated with 2 vessels with an intake of 1,200 TEU and run on 14 days round trip with port callings at Taipei – Taichung – Cat Lai, Ho Chi Minh – Bangkok – Laem Chabang – Taipei.

Wan Hai Lines will deploy 1 vessel while its partner Interasia Lines will operate another one, with the maiden voyage commencing from Taipei on 24th July 2020.

To optimize our service coverage simultaneously, current KVS service is going to add Kaohsiung call from 23rd July 2020, rotation is Incheon – Kwangyang – Busan – Ulsan – Taipei – Taichung – Kaohsiung –Cat Lai, Ho Chi Minh – Port Kelang (North Port) –Port Kelang (West Port) –Cat Lai, Ho Chi Minh – Kaohsiung –Taichung – Taipei – Incheon

TVT service will be the forth string service connected Taiwan - Ho Chi Minh and the third string service connected Taiwan - Thailand to provide clients more options. It will also strengthen Wan Hai Lines’ current services to better serve customers’ needs.

(Source: American Shipper, Shipping Lines' websites)

.png)

.jpg)