ONE aims for 2019 turnaround

After struggling through last year’s startup, Ocean Network Express shows a small profit.

Ocean Network Express (ONE) expects slightly better profit this year than previously forecast as costs drop one year into its full operation.

But overall demand remains tepid as it lowered full-year revenue targets and reduced service in the transpacific shipping market.

ONE, the containership joint venture of Japan’s largest shipping companies, made the forecast as it reported a fiscal first-quarter profit of $5 million, compared to a year-earlier loss of $120 million.

Revenue of $2.87 billion for the quarter ending June 30 was up 39% from a year earlier. ONE credited the profit and revenue rise to higher container liftings, which “improved significantly with stabilized services,” the company said.

ONE saw total container liftings of 1.8 million TEUs, compared to 1.25 million TEUs in the first quarter. Freight rates were up 3% for the Asia-North America trade lane, while the Asia-Europe lane saw no change in rates.

“The freight rate market hovered at the same low level as last year because supply grew faster than demand, though overall demand was relatively strong,” ONE said of the results.

For 2019, ONE said revenue would be lower than previously forecast, $12.4 billion versus an earlier announced $12.7 billion. The company cited a decrease in demand that has occurred in the first half of the year on the major European and North American shipping routes. Overall worldwide demand growth for 2019 will stay around 3%.

ONE said it was able to get better rates on long-term contracts. The company projects a $190 million yearly improvement in results due to better contract rates.

Spot market rates remain firm, but ONE said spot container volumes “stayed stagnant” as the U.S.-China trade war disrupts trade flows.

Despite this, the profit outlook has improved slightly. ONE forecast full-year profit of $90 million compared to an earlier forecast of $85 million. The gain is the result of lower terminal and inland shipping costs.

Service reductions because of weaker growth also will save on operating costs. It reduced transpacific service by 12 sailings in response to weaker demand, while Asia-Europe sailings were reduced by five.

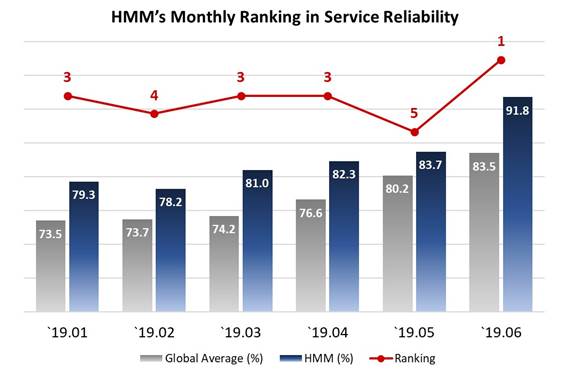

HMM Record Highest Schedule Reliability

HMM toped highest on-time performance among 15 global carriers in June.

According to the ‘Global Liner Performance Report – July 2019’, issued by SeaIntelligence, HMM ranked the most reliable carrier in June 2019 with a score of 91.8 percent - improved 8.2 percent points compared to last month.

HMM’s performance was also 8.3 percent points higher than global average of 83.5 percent. This result was calculated on the basis of a range of services, including Trans-Pacific, Asia-Europe, Trans-Atlantic, India, Middle East and South America etc.

Since 2017, HMM has put its continuous efforts to restore customer trust and enhance its service quality as part of the improvement of customer satisfaction.

HMM official said, “This performance in schedule reliability is a rewarding result of our redoubled efforts to strengthen service quality.” And that “With a pride of Korea’s national flagship carrier, HMM will do its best to maintain top-level of service competitiveness to ensure customer satisfaction and trust.”

Bulk carrier FAREAST HONESTY collided with pier at SSIT Port, Vung Tau, Vietnam

On the afternoon of August 1, Maritime Administration of Vung Tau (Vietnam) decided to suspend operation for pilots leading Fareast Honesty (Hong Kong nationality, China) that crashed into SP-SSA International Terminal (SSIT) on July 31 to serve the investigation of the incident.

At around 13:00 on July 31, the ship Fareast Honesty (56,841 DWT tonnage, 189.99m in length, 32.26m wide) carrying coal was traveling on Vung Tau-Thi Vai channel to enter the buoy wharf anchoring BP9 on Go Gia River suddenly bumped into SSIT wharf and collided with SG 3452 barge anchoring here.

The crash has caused SSIT jetty to break the "barrier," but by eye observation has not yet found huge damage to the wharf. Fortunately, the collision did not cause any damage to people and pollute the environment.

Currently, the ship Foreast Honesty has been loaded into the buoy BP9 and safely anchored.

The Maritime Administration of Vung Tau also issued a decision to temporarily suspend Foreast Honesty and coordinate with Maritime Administration of Ho Chi Minh City and registration agency to investigate the cause of this accident.

Global container port volumes forecast at 973m teu by 2023: Drewry

Global container port demand is forecast to rise for the next five years with box throughput reaching 973m teu by 2023, though capacity expansion plans are likely to be muted, according to a latest analysis by Drewry.

The consultant has projected a global growth of 4.4% a year on average for the next five years in container port demand, lifting the world’s container port throughput from 784m teu in 2018 to 973m teu by 2023.

The latest five-year forecast is a far cry from the heady days of the 2000s when forecasts were around 9% growth per annum until the global financial crisis of 2007-08 brought this to a shuddering halt, Drewry noted.

Global container port capacity, on the other hand, is expected to increase approximately 2% a year, based on confirmed additions only. This is well below the projected demand growth and reflects the continued easing off from greenfield projects by investors over the last few years.

Consequently, average utilisation on a global level is forecast to increase from 70% in 2018 to 79% by 2023.

The sharpest upward swings on utilisation level is expected in Greater China and Southeast Asia, with the former hitting 100% by 2023.

“The previous very rapid pace of capacity expansion is on hold, with the focus instead being on consolidation of port and terminal ownership into large groups. This, plus the uncertainty about China’s international trade growth in the face of tariff wars and protectionism, suggests that the government is taking a cautious approach,” said Neil Davidson, Drewry’s senior analyst for ports and terminals.

At present, the world’s top seven terminal operators are PSA International, Hutchison Ports, China Cosco Shipping, DP World, APM Terminals, China Merchants Ports, and Terminal Investment Limited (TIL). They accounted for nearly 40% of global throughput in 2018.

[Vietnam] - 28 items see import value of over 1 billion USD in seven months

As many as 28 commodities reported import value of more than a billion USD in the first seven months of 2019 according to the General Statistics Office

In combination, the 28 commodities made up 85.8 percent of total purchase from foreign countries in the reviewed period.

Vietnam splashed out 143.34 billion USD on imports during January-July, up 8.3 percent against the same period last year.

Of the sum, some 60.83 billion USD was contributed by the domestic economic sector, a rise of 12.6 percent, and 82.51 billion USD by the foreign-invested sector, growing 5.3 percent.

The country bought 28.2 billion USD of electronic products, computer and parts, up 19 percent year-on-year; 20.8 billion USD for telephone and parts, up 12.7 percent; 7.8 billion USD for cloth, up 1.5 percent; 5.2 billion USD for plastic, 1.5 percent.

Most of the goods were bought from China, the Republic of Korea, the US, ASEAN and European countries.

Vietnam earned 145.13 billion USD from shipping goods abroad in the first seven months of the year, a year on year surge of 7.5 percent, resulting in a trade surplus of 1.8 billion USD.

The growth in export value was mainly contributed to by 24 ‘billion dollar’ goods items, which accounted for 88.1 percent of total export revenue. Telephones and spare parts were the largest earners, followed by electronics, computers and spare parts, and garment and textiles.

Meanwhile, shipments of vegetables and fruits, coffee and cashew experienced a fall compared to the same time last year.

The US was the largest importer of Vietnam in the period while the EU and China came second and third, respectively.

Vietnam attends 20th ASEAN+3 Foreign Ministers’ Meeting

Vietnamese Deputy Prime Minister and Foreign Minister Pham Binh Minh joined his counterparts from ASEAN member states China the Republic of Korea and Japan to attend the 20th ASEAN Plus Three Foreign Ministers Meeting

Vietnamese Deputy Prime Minister and Foreign Minister Pham Binh Minh at the 20th ASEAN Plus Three Foreign Ministers’ Meeting in Bangkok, Thailand, on August 2

The event formed part of the 52nd ASEAN Foreign Ministers’ Meeting (AMM-52) and Related Meetings that are underway in the Thai capital from July 29 to August 3.

During the meeting, the FMs reaffirmed the important role of the ASEAN Plus Three in promoting peace, security, stability and prosperity in East Asia and acknowledged the results of the implementation of the ASEAN Plus Three Cooperation Work Plan for the 2018 – 2022 period.

They emphasised the need to have a free and fair multilateral trading system and voiced their concern over accelerating trade tensions and protectionism that may take a toll on economic development.

They reiterated the determination to early conclude the negotiations on the Regional Comprehensive Economic Partnership (RCEP) and agreed to enhance support for the development of micro-, small- and medium-sized enterprises (MSMEs).

They also agreed to continue the effective implementation of the Chiang Mai Initiative Multilateralization (CMIM) and strengthen the role of the ASEAN Plus Three Macroeconomic Research Office (AMRO).

Additionally, the ministers welcomed the adoption of the Strategic Directions of ASEAN Plus Three Finance Process on the occasion of the 20th anniversary of ASEAN Plus Three Financial Cooperation.

They acknowledged recent positive progress of the settlement of issues on the Korean Peninsula with the US – DPRK summits held in Singapore in June last year and in Hanoi in Februrary this year and most recently, the meeting of US President Donald Trump and DPRK chairman Kim Jong Un at the demilitarized zone (DMZ) in the DPRK.

They voiced support for continued diplomatic efforts to promote sustainable peace and denuclearisation in the region.

In his remarks at the meeting, Deputy PM and FM Pham Binh Minh said he welcomed efforts to expand cooperation within ASEAN Plus Three in innovation-driven development areas, such as digital connectivity, e-commerce, and smart city, in order to reduce development gap.

He also applauded a closer partnership within the bloc in promoting the development of the MSMEs, food security, and response to epidemics and natural disasters.

The minister affirmed that Vietnam will play an active part in fostering and promoting the role of ASEAN Plus Three to contribute to peace, stability and development in East Asia.

[Vietnam] - Removal of 13 codes of scrap from the list of scrap allowed to be imported

VCN – Deputy Minister of Natural Resource and Environment Vo Tuan Nhan said: “Rejecting imported scrap with high risk of causing environmental pollution, low efficiency of recycling, plastic scap containing dangerous additives with high risk of causing environmental pollution in the recycling process or plastic scrap recovered mainly from household waste.”

Removing a number of imported scraps with high risk of causing pollution

By implementing Directives No.27/CT-TTg dated November 17, 2018 of the Prime Minister about some urgent solutions to strengthen management of import activity and using imported scrap as raw material, the Minister of Natural Resource and Environment reviewed and revised the list of scrap allowed to be imported as material for production in Decision No.73/2014/QĐ-TTg.

At the meeting, the General Department of Environment (Ministry of Natural Resources and Environment) said that, on the basis of reviewing and researching relevant domestic and international documents and directives of the Prime Minister in Directive 27/CT -TTg, the Ministry of Natural Resources and Environment proposed to remove 13 of 36 types of scrap allowed to be imported from abroad under Decision No.73/2014/QĐ-TTg, including: removing three types of scrap (corresponding to three HS codes): gypsum, silk and chemical elements for use in electronics; seven HS codes belonging to the group of non-ferrous metal scrap, including Vonfram, Molypden, Magie, Titan, Zircon, Antimon, Crom; one type of scrap is reboilded ignot waste (iron, steel, pig iron); two HS codes of plastic waste, including: plastic waste and scrap (plastics) from polymers styrene (PS): spongioid, non-hard forms (HS code 3915.20.10); plastic waste and scrap (plastic) from Polyme Vinyl Clorua (PVC): spongioid, non-hard form.

As these were plastic scrap that are less recyclable, the recycling rate is not high, the recycling efficiency is low, plastic waste contains many harmful additives as claimed by some international documents, there was a high risk of environmental pollution in the recycling process or plastic waste recovered mainly from domestic waste (straws, yogurt boxes, foam packaging for food).

A roadmap of removing some types of scrap from the list of scrap allowed to be imported

Through the process of coordinating with ministries, sectors and localities in implementing regulations on environmental protection and pollution control in the process of importing and recycling imported scrap as production material, the Ministry of Natural Resources and Environment realized that some types of scrap which are allowed to be imported from abroad under Decision No. 73/2014/QĐ-TTg also contained a risk of environmental pollution, including some types of scrap such as: waste and scraps of plastic (plastic) from Polyme Styren (PS); Other (hard form); Waste and scrap of plastic (plastic) from Polymer Vinyl Clorua (PVC): Other (hard form); Recovered (waste and scrap) paper or paperboard: Other, including unclassified waste and scrap.

Therefore, the Ministry of Natural Resources and Environment found that it is necessary to restrict and disallow the import of these wastes in the future. However, the demand for importing these kinds of scrap of enterprises for production materials was huge, so if regulating to stop importing these kinds of scrap, it would affect the demand of raw materials as well as production processes of these enterprises at the present time.

In order to facilitate the stabilization of raw materials for production of these recycling enterprises in the current period, the Ministry proposed to apply a roadmap till January 1, 2022 which would remove these scraps from the list of scrap allowed to be imported from abroad as production materials. Besides that, the application of the roadmap would also facilitate some businesses to prepare in terms of time and capacity to invest in infrastructure, machinery and equipment to use scrap as raw materials for production, use these scraps in the production of products and goods.

For imported scraps: Granulated slag (sand slag) from the manufacture of iron or steel (Granulated slag, including small granulated slag, sand slag from iron, steel and pig iron), according to the report of Steel Association. In the future, Vietnam’s domestic scrap market could meet the demand of supplying this scrap as raw materials for construction material production. Therefore, the Ministry of Natural Resources and Environment proposed a plan to apply the roadmap to January 1, 2022 for removing this scrap from the list of scrap allowed to be imported from abroad as production materials in order to make use of domestic raw materials and minimize the risk of environmental pollution during the import and use of this scrap.

Deputy Minister Vo Tuan Nhan said that in recent years, the demand for importing scrap as raw materials in the main manufacturing industries which were steel, paper and plastic tended to increase strongly. The import and use of imported scrap if it was not managed and strictly controlled, could lead to the risk of import of waste into Vietnam, adversely affecting human health and the environment. Currently, Vietnam is also abundant with scrap as production materials such as gypsum scrap, small granulated slag, sand slag.

Besides that, many kinds of imported scrap have potentially caused environmental pollution, low recycling efficiency, plastic scrap containing many hazardous additives with high risk of environmental pollution during recycling or plastic waste recovered mainly from domestic waste should be determined to tighten and remove from the list of scrap allowed to be imported as production materials.

The Deputy Minister proposed the amendment and replacement of Decision No. 73/2014/QĐ-TTg must ensure no administrative procedures arising in activity of importing scrap materials as production materials; does not affect activities, as well as human and financial resources of agencies and units during the implementation process.

ZIM introducing new Central America-Caribbean service

ZIM is introducing a new service connecting Mexico, Caribbean and Central America from the second half of August.

The new network named New Central America-Caribbean Service (CCS) will operate three ships on a weekly, fixed day service.

The port rotation will be Veracruz, Altamira, P. Cortes, Santo Tomas, Kingston, Rio Haina, San Juan, Kingston, and back to Veracruz.

ZIM said CCS will offer competitive transit time from Central America to Dominican Republic and Puerto Rico, as well as improve the dedicated fixed day service from Mexico to Caribbean and Central America markets.

“The new CCS service joins our extensive portfolio of services in Central America and the Caribbean, connected and synchronised with ZIM’s major global trades including the Cross Atlantic and transpacific services,” ZIM stated.

Source: World maritime news; Seatrade maritime; American Shipper; VN Customs News; Hyundai’s Website

.png)

.jpg)