HMM ORDERS TWELVE 13,000 TEU CONTAINER SHIPS

HMM has signed newbuilding contracts with Daewoo Shipbuilding & Marine Engineering (DSME) and Hyundai Heavy Industries (HHI) for twelve 13,000 TEU container vessels, at a total cost of USD 1.57 billion.

Under the agreement, DSME and HHI will build six vessels, respectively, scheduled for delivery in the first half of 2024. All ships will be installed with hybrid scrubbers and designed to be LNG-ready.

An HMM official said, “Our newly ordered containerships will be fitted with the latest energy-efficient technologies. We expect these ships to give us strong environmental credentials, as well as to provide us with the capacity and flexibility to get our customers’ cargo to the right place at the right time.”

CULINES EXPANDING WITH NEW SOUTHEAST ASIA AND BRAZIL SERVICES

CULines - a Chinese container shipping company - will expand three new services to Southeast Asia and Brazil in July.

The new services CPX (China-Philippines) and CT3 (China –Thailand) will be launched on July 2 and July 15 respectively to expand express shipping services in Asia regions.

The port rotation of CPX service is Qingdao-Shanghai-Ningbo-Manila North-Manila South.

The port rotation of CT3 service will be Hong Kong – Qinzhou -Hai Phong – Bangkok - Laem Chabang.

In addition, starting from July 15, CULines will launch a CBS service directly connecting Ningbo, China and Santos, Brazil. Under the cooperation with COSCO Shipping Lines, COSCO Shipping Honor will be deployed on this route.

ONE FORECASTS $6BN PROFIT FOR FIRST HALF 2021

Underscoring the huge turnaround in fortunes for containers shipping financially Ocean Network Express (ONE) booked a profit of $2.56bn for the first quarter ended 30 June 2021.

2 mother vessels of ONE at TCIT berth.

Reporting a 1,432% increase in profit over the same period in the previous year, ONE is expecting even better results in the current quarter ended 30 September with a forecast $6bn profit after tax for H1. Revenues for Q1 this year jumped 111% to $5.78bn.

“Whilst the current demand is rapidly increasing, the excessive strain on the entire global supply chain triggered by operational restrictions resulting from Covid-19 pandemic still remains,” ONE commented.

While sharp increases in volumes on some trades, port congestion and container shipping capacity issues have put stress on the global supply chain, container lines have benefited for a huge increase in freight rates.

ONE said that Asia-North America trade market volume from January to June increased by 40% year-on-year and by 27% compared to the same period of FY19 before the pandemic.

CONGESTION STARTS TO GROW AGAIN AT US WEST COAST PORTS

The number of ships moored in San Pedro Bay waiting to enter the ports of Los Angeles and Long Beach has begun to increase again.

San Pedro Bay.

Mid-July data from the Maritime Exchange in the region showed more than 20 vessels moored waiting for berths - reflecting an increase in imports from China following a pause in June, when only 10 Container ships are waiting in the Gulf. The suspension coincides with the closure of several major areas of the Yantian port export hub in South China, causing significant disruption to global container shipping.

Newly released results for June show that, in June, the Port of Los Angeles operated 82 container ships with a capacity of 876,430 TEU. It was the busiest June in the port's history - and up nearly 27% from June 2020, when cargo volumes fell due to the pandemic.

Shipping has become a major issue, as supply chain disruptions continue. Carl Bentzel, a Commissioner at the Federal Maritime Commission, was quoted in the mainstream Washington Post as saying: "I am extremely concerned now about the economic impact caused by the current situation. This could be the first time the public sees the impact of maritime shipping disruption since World War II."

This comes at a time when cargo interested lobbyists, in Washington, DC, are pushing the U.S. Congress to review the carrier's actions, including expediting the return empty containers to Asia, instead of supplying them to exporters in the US.

Data from the Port of Los Angeles offers a recent perspective. A mid-July report found the average time at berths is six days for container ships, as opposed to mid-June which is typically four or five days (and sometimes as low as three).

The latest issue of the McCown Report, which details year-over-year container throughput, notes that overall, the top US container ports saw a 32.5 percent increase in imported goods trade by container in June, down from the previous month's 52.2%. McCown, who has four decades of management experience in the container business, has noted that most of the growth has occurred at ports in the Gulf region and the US East Coast.

Additionally, he commented that: “The data and news reports indicate that shippers are electing to switch containers ultimately destined for eastern points to East Coast ports in an attempt to avoid congestion issues that have been most visible at West Coast ports.”

This shift from the West Coast, to the Gulf/East Coast, closer to the majority of US consumers, is part of a long-term trend that began in 2016 when the Panama Canal expanded. McCown notes that direct rail shipping to Eastern destinations after the container is unloaded (from Asian countries) at West Coast ports will be faster than full ocean freight to All water route, he said: “The recent congestion issues may have shippers rethinking their routing preferences, as East Coast/ Gulf Coast were less impacted and some also have more room to grow.”

He also mentioned the challenge for shippers in terms of “the carbon emissions of their freight related activities”. This could also lead to shippers switching to full ocean freight services to reach the Gulf region and the East Coast of the United States, he said.

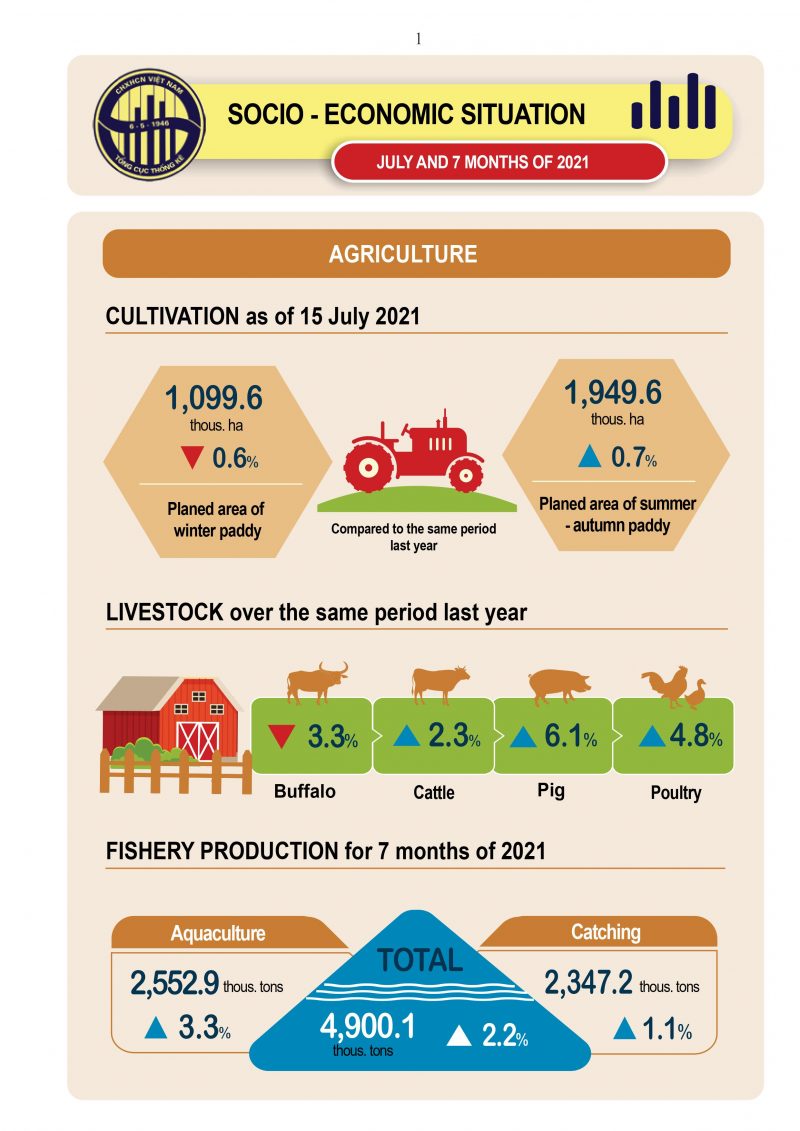

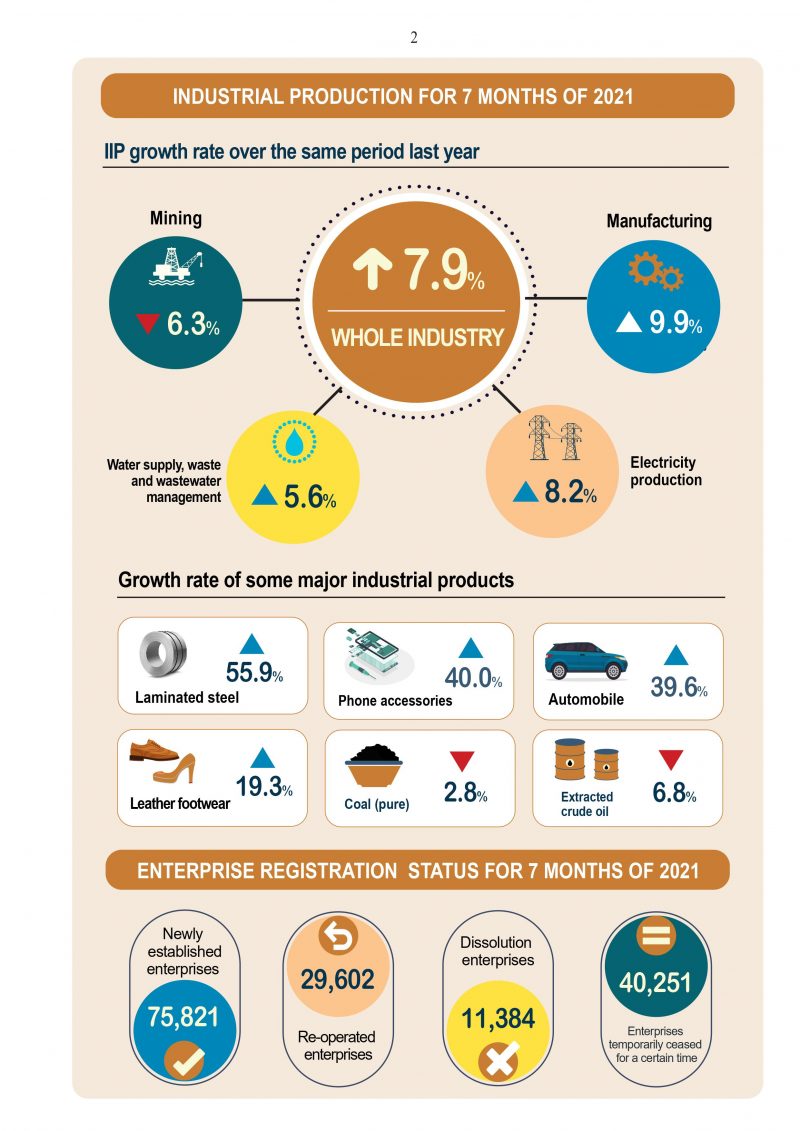

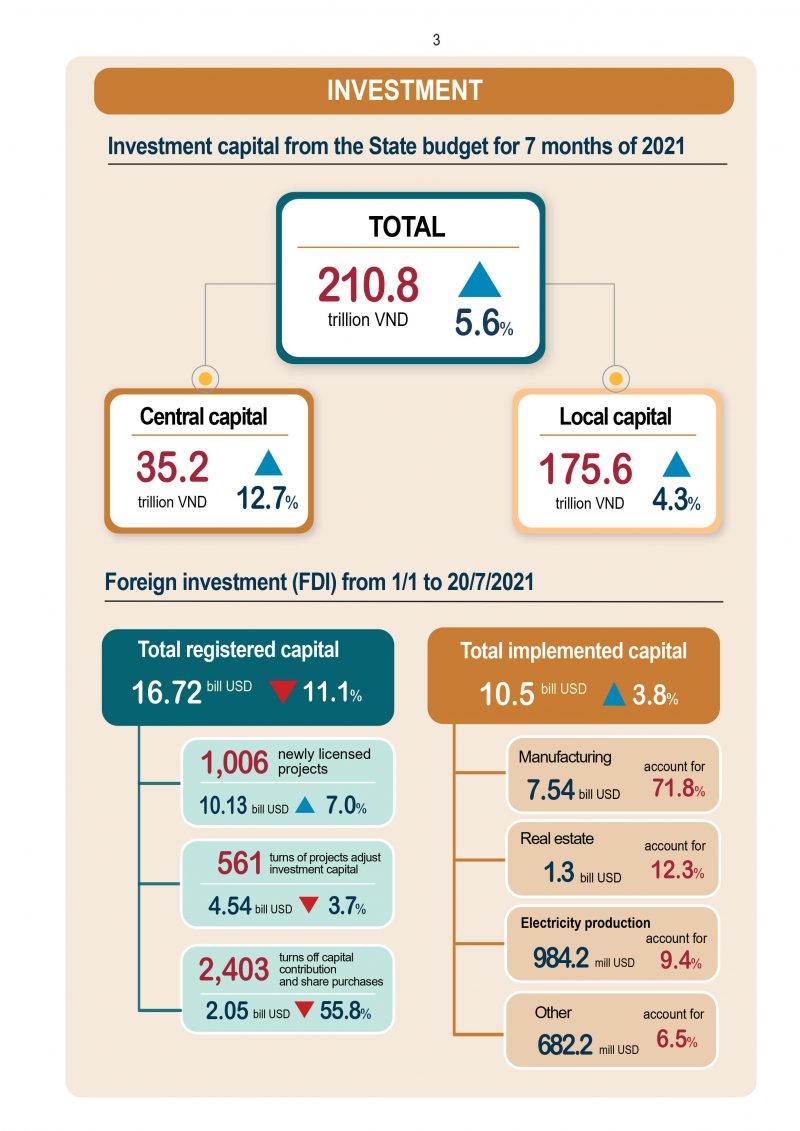

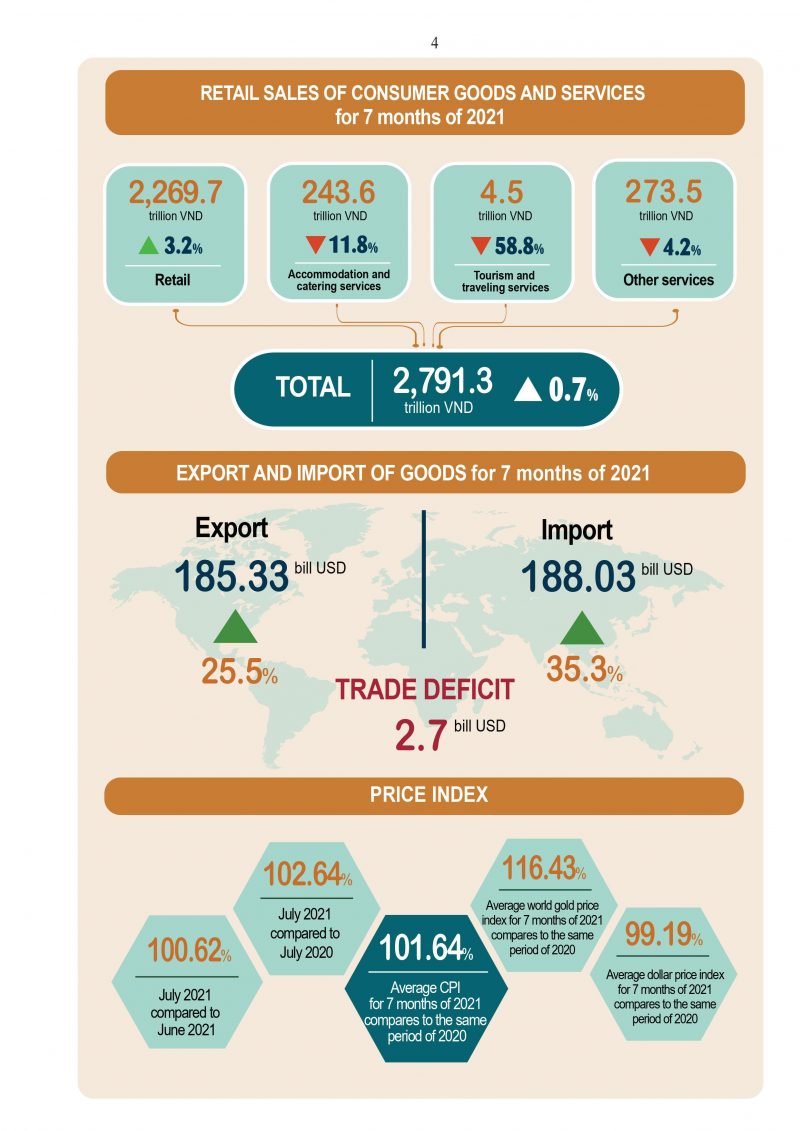

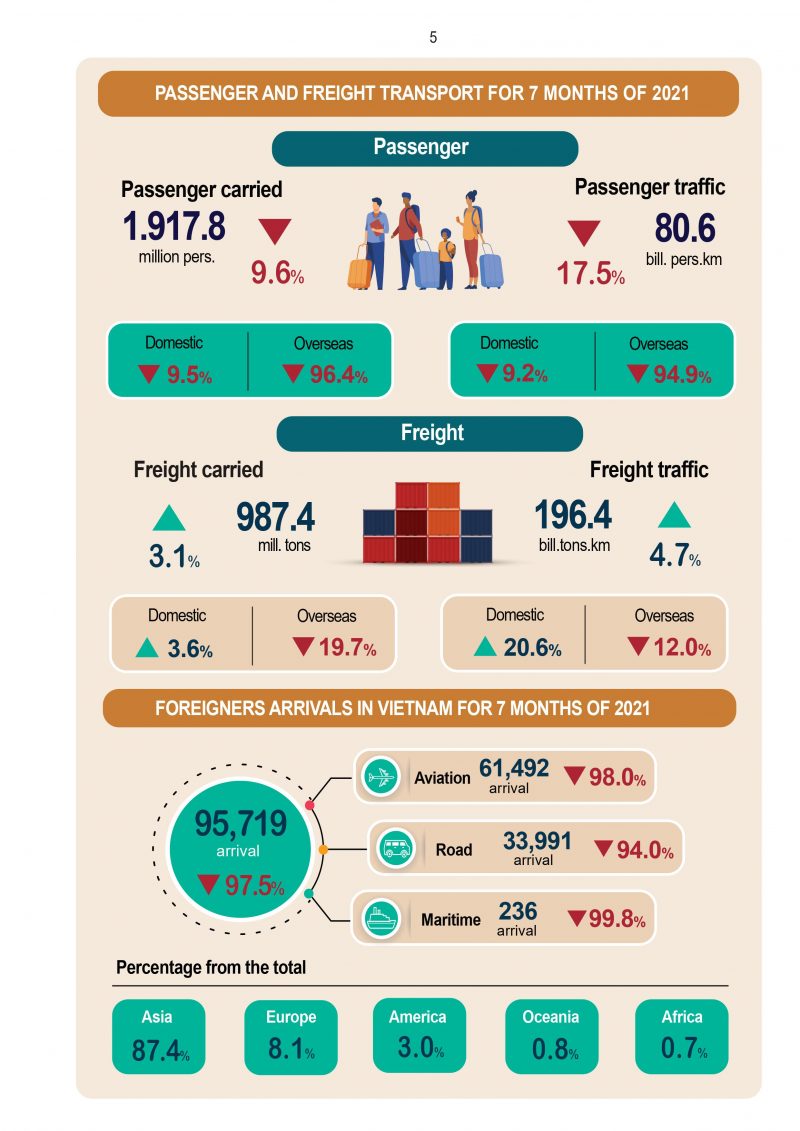

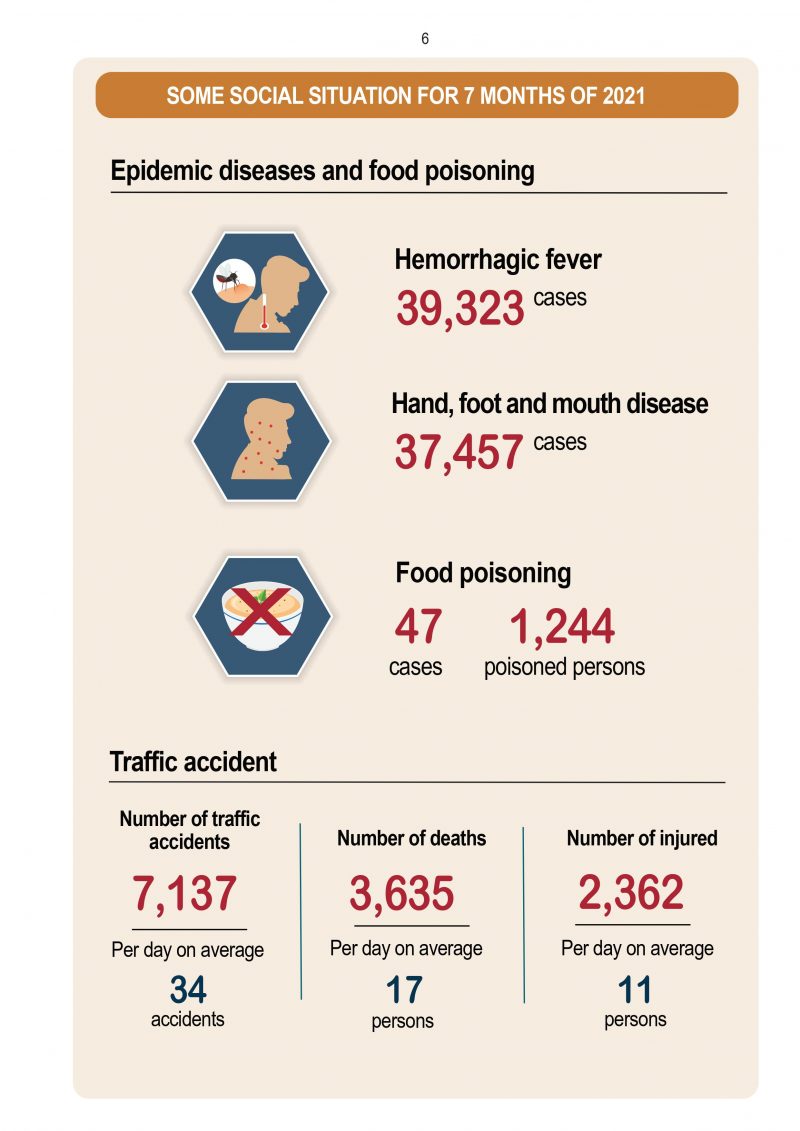

INFOGRAPHIC VIETNAM’S SOCIAL-ECONOMIC SITUATION IN JULY AND 7 MONTHS OF 2021

Sources: Vietnam General Statistics Office, HMM’s website, Seatrade Maritime News

.png)

.jpg)