Global Ship Lease Agrees Charter with OOCL

Containership charter owner Global Ship Lease has signed a new agreement with Hong Kong-based container shipping and logistics service company Orient Overseas Container Line Limited (OOCL).

The charter was signed for the 2003-built GSL Keta “at an improved rate”, according to GSL.

Commencing in late July, the 2,207 TEU vessel will be chartered for 50 to 90 days to OOCL at a fixed rate of USD 8,700 per day.

“With strong fundamentals driving continuing improvements across the ship sizes that make up our fleet of high-quality, mid-sized and smaller containerships, Global Ship Lease is in an excellent position to realize additional benefits for our shareholders,” Ian Webber, Chief Executive Officer of Global Ship Lease, said.

ONE, Hapag-Lloyd, Cosco and Yang Ming launching new India - Europe service

Ocean Network Express (ONE), Hapag-Lloyd, Cosco Shipping and Yang Ming Line are launching a new service covering South East India, the Mediterranean, and North Europe.

The service named Indian Ocean Service 3 (IO3) by ONE and South-East India – Europe Express (IEX) by Hapag-Lloyd will operate between India, the Middle East (Jeddah and Damietta) and Europe -Piraeus, Le Havre, Antwerp, Rotterdam, Hamburg and London Gateway.

There will be nine 6,500 teu vessels deployed on the service with Hapag-Lloyd contributing four vessels. The service will commence on 26 October operating on 63-day rotation.

“Our customers have been talking to us about their growing needs in the Indian and Bangladeshi markets, and we have been listening. The introduction of the IEX is a game changer, as it will be the first dedicated direct service from Southeast India to Europe, offering connectivity to the global network of Hapag-Lloyd,” says Maximilian Rothkopf, coo of Hapag-Lloyd.

Yang Ming installing Sperry Marine’s VisionMaster Net on 10 feederships

Taiwanese container line Yang Ming has opted for Sperry Marine’s VisionMaster Net for digital navigation on a series of 10 feedership newbuildings.

The series of ten 2,800 teu ships being built at CSBC Shipyard in Kaohsiung with the first sea trials scheduled for early 2020.

The selection VisionMaster Net will allow for standardisation across the fleet of ships and will be able to securely share data provided from the navigation systems to different locations on the ship and to operations centres ashore, for analysis and support.

“We are very happy to be working with Sperry Marine on our next generation of container feeder ships which are designed around big data and will be the most connected vessels we have built to date,” says Jackie Ho, chief marine technology officer, Yang Ming Transport Corp.

“By combining a new level of navigation technology with the reliability of Sperry’s global service network, we can build a platform for digital navigation that will contribute to safety and efficiency.”

David Watts, regional business development director, Asia-Pacific at Sperry Marine, comments, “As a global shipping company, Yang Ming are also very keen to continue their close relationship with the Sperry Marine’s global service network, with the option to use remote diagnostics when needed.”

Vinh Tan International Port (Vietnam) welcomes M/V Spring Hummer calling at Port

On July 17, 2019, Vinh Tan International Port JSC received the first international vessel calling at Port, marking a milestone in foreign trade activities and socio-economic development of Binh Thuan province, South Central and Central Highlands of Vietnam.

After one month since the day the General Department of Vietnam Customs - Ministry of Finance allowed Vinh Tan International Port to collect, monitor and supervise cargoes in the Port, the first international vessel officially calls at Vinh Tan International Port. Spring Hummer carries equipments for Vinh Tan 4 extension Thermal Power Plant Project. This event opened an opportunity for vessels transporting cargo for industry and energy projects in Binh Thuan province, the South Central and Central Highlands of Vietnam to reduce time and costs because they do not have to transit in ports of Ho Chi Minh City, Ba Ria - Vung Tau or Cam Ranh ... as previously.

Vinh Tan International Port is invested by Vinh Tan International Port Joint Stock Company (a member of Pacific Corporation). The port is constructed on an area of around 140 ha. The objectives of the port are meeting the demand of general cargo importation and exportation, satisfying socio-economic development of Binh Thuan province, neighboring provinces in the South Central and Central Highlands of Vietnam. The Port is designed with scale of one 3,000 DWT terminal, two 50,000 DWT terminals and one 70,000 DWT terminal for the future development.

Grand Opening Ceremony of Vinh Tan International Port in April 2019

Receiving Diverted U.S. Orders From China, That Doesn’t Mean Vietnam’s Winning the Trade War

There’s a common saying within the C-suite that a trade war has no winners. But recent reports suggest maybe one victor is emerging from the U.S.-China trade spat: Vietnam.

According to data from Japanese investment bank Nomura, Vietnam is the largest recipient of product orders diverted from the founding nations, as importers attempt to avoid trade war tariffs. The value of orders diverted to Vietnam in the first quarter of the year was equivalent to 7.9% of the Southeast Asian nation’s GDP. Meanwhile the second largest recipient, Taiwan, only took on additional orders equal to 2.1% of GDP. Eamon Barrett reports on Fortune.

The U.S President Donald Trump sees that shift as evidence the trade war is working. On Monday morning after Beijing revealed China’s slowest quarterly economic growth in 27 years—rising just 6.2% over the second quarter last year, when the trade war began—Trump tweeted out, “The United States tariffs are having a major effect on companies wanting to leave China for non-tariffed countries. Thousands of companies are leaving.”

In fact, manufacturers have been emigrating from—or, more often, expanding beyond—China for years. The trade war has added some impetus to that movement, but not every industry can afford to be so flexible.

Stanley Chao, managing partner of All In Consulting, which advises small- and medium-sized enterprises on how to do business with China, says there are a lot of smaller, specialized manufacturers that are stuck in China because nowhere else has an adequate supplier ecosystem.

“They’re waiting for bigger players to make a move so that they can piggyback off of the larger companies into new markets,” Chao says. “That’s exactly what they did in the past. They piggybacked into China.” Despite media reports, Chao adds, bigger companies aren’t rushing to leave China. It can take years to develop new supply chains and, ultimately, China will continue to be a valuable market.

Why Vietnam?

For those that can expand, however, Vietnam is an attractive destination. Wages are low, education is relatively high, and Hanoi has struck Free Trade Agreements with most major economies, as both a sovereign state and as a member of ASEAN. The EU ratified a free trade agreement with the Southeast Asian nation just last month, which will see duties removed on 99% of Vietnamese imports over the next seven years.

At home, the government has invested heavily in promoting high tech manufacturing, opening three multi-billion-dollar science parks across Vietnam’s major cities—Danang, Hanoi and Ho Chi Minh—and is opening three new Special Economic Zones at port towns, to add to the 18 SEZs it already has. It should be noted, however, that the new trio of SEZs have seen stiff opposition from protestors who worry about Chinese industries snapping up land on Vietnamese soil.

“The pace of Chinese investment has definitely accelerated in recent months, to the point where there are buses of Chinese investors literally running around industrial parks and pointing at plots ofland saying, ‘I want this, I want that,’” says Alberto Vettoretti, managing partner of Asia-focused consultancy Dezan Shire & Associates.

According to the consultancy, China rose from seventh to fifth place among Vietnam’s leading foreign direct investment contributors in 2018, pumping $2.4 billion into the economy. In the five months through May, China’s rank increased to fourth place; it would be a clear winner if its ranking incorporated investment from Hong Kong, which has injected over $5 billion of capital into Vietnam so far this year.

Entering the Sinosphere

The surge in Chinese investment has pros and cons for Hanoi. Some investors are bringing legitimate business, hiring opportunities and advanced tech. Others, however, are simply speculating on the real estate market as Vietnamese factory space reaches a premium. Worse yet, a number of buyers are opening tariff-dodging assembly plants where Chinese components are repackaged and exported to the U.S. in an illegal practice known as ‘transshipping.’

Vietnam’s customs agency vowed to crackdown on transshipment after finding “scores” of such cases in June, but the violation had already caught the attention of the “Tariff Man” himself.

“A lot of companies are moving to Vietnam, but Vietnam takes advantage of us even worse than China. So there’s a very interesting situation going on there,” Trump said in an interview with Fox Business on June 26. Trump went on to declare that Vietnam was the “single worst abuser of everybody.”

The U.S. commerce department slapped a 400% levy on Vietnamese steel imports at the beginning off this month, since it suspects the material has origins in other countries. Whether the U.S. will ratchet up more pressure on Vietnam is unclear. “No one has a crystal ball,” Vettoretti says. For now, the best thing or Vietnam to do is take advantage of its moment in the spotlight and put some of that increased investment to good use.

EU believes in positive impact of trade deal with Vietnam

Members of the European Union (EU) have expressed their belief in the positive impact that the bloc’s free trade agreement with Vietnam (EVFTA) will have on bilateral trade relations.

The deal, signed in Hanoi on June 30, is the first the EU has inked with a developing country in Asia, paving the way for the gradual reduction of up to 99 percent of tariffs between the two sides, as well as for the opening of the service and public procurement markets.

Vietnam is currently the second biggest ASEAN trade partner of the EU, which is also one of the key trade partners of the Southeast Asian nation. Bilateral trade reached 55.8 billion USD in 2018.

Vietnam’s key exports to the EU include telecom devices, footwear, apparel, furniture and agricultural products. Meanwhile, the EU mainly ships to the country machinery, transportation equipment, chemicals, food and beverages.

According to German Federal Minister for Economic Affairs and Energy Peter Altmaier, the EVFTA will consolidate rules-based trade and resist protectionism. It will ensure German products’ access to Vietnam as well as German businesses’ investments in this growingly important market.

Volker Treier, Chief Executive of Foreign Trade at the Association of German Chambers of Industry and Commerce, said the EVFTA creates a significant impetus to Germany’s economy. The bilateral trade is currently below 13 billion EUR (14.7 billion USD), but it will increase considerably to around 20 billion EUR in the next several years.

Meanwhile, Lucie Vondrackova, Director of the Department of Trade Policy and International Economic Organisations under the Czech Ministry of Industry and Trade, believed that the agreement will generate big benefits for both Vietnam and the EU. Particularly, the removal of the 99 percent of tariffs will help exporters and importers of both sides save cost.

That will facilitate Czech firms’ exports they have strength in like textile-garment, glass, automobiles, mechanic and electronic products, food and chemicals.

Echoing this, Vice President of the Czech Chamber of Commerce Borivoj Minar said the deal will help bolster trade between Vietnam and the EU, including the Czech Republic, noting that his country has strength in and stands ready to cooperate with Vietnam in machine manufacturing, mining, food and agricultural product processing, and beer production.

According to a recent article on the website irishexaminer.com of Ireland, the EVFTA is a good deal for the EU member states, particularly Ireland, as it will help Irish exporters of goods increase from the current 65 million EUR. More importantly, there is the long-standing services trade connection which last year amounted to exports of 164 million EUR.

Apart from officials, businesses of the EU have also put a high valuation on the trade deal with Vietnam.

Pascale Rouhier, Secretary General of the European Liaison Committee for Agricultural and Agri-Food Trade, said the deal would cause positive impact on Europe’s farm produce with the hope that Vietnam will become a medium-sized but important export market of the EU.

Once the deal becomes effective, it will promote the trade of some products that the bloc is unable to produce like nuts, coffee, tea and aquatic products, she added.

For his part, Pierre Groning, head of the Brussels Office of German Chemical Industry Association, described the EVFTA as a deal with a country whose economy is complementary to the EU’s.

Vietnam is a big producer of many products and can meet the EU market’s demand. It is also able to import a number of EU products, including chemicals, he said, expressing his belief that his association’s chemical exports will increase strongly once the pact takes effect.

Bottom of Form

Striving to complete connection of 61 procedures with the National Single Window

VCN - The General Department of Customs - Standing Committee of the National Steering Committee on ASEAN Single Window (NSW) and National Single Window (ASW) and Trade Facilitation (Committee 1899) are striving to complete the connection of 61 procedures with the National Single Window in 2019.

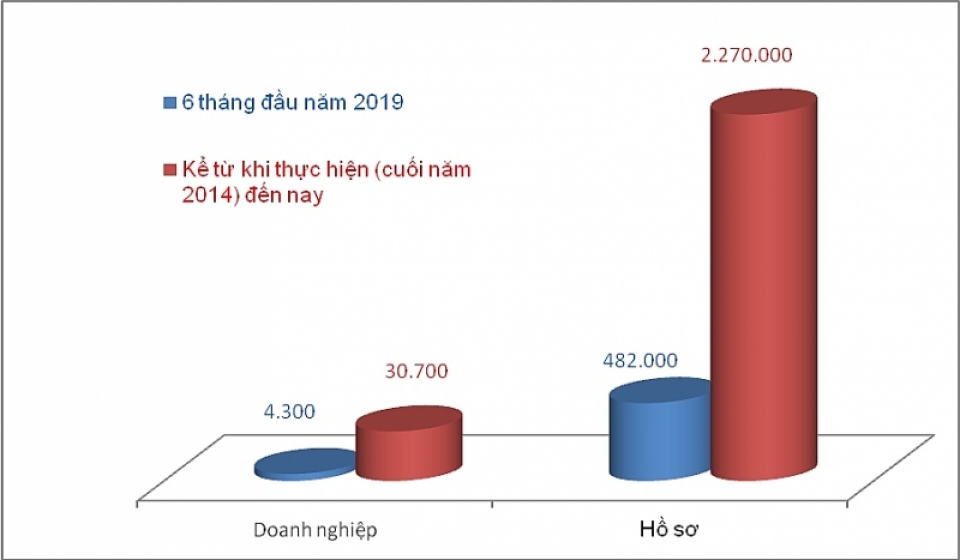

Results of implementation of the National Single Window.

According to the General Department of Customs, from now until the end of 2019, the General Department of Customs will strive to complete the implementation of 61 new administrative procedures on the NSW (including 18 procedures from 2018 and 43 procedures of 2019 according to the Decision No. 1254 / QD-TTg of the Prime Minister).

Preparing to exchange ASEAN Customs declarations and plant and animal quarantine certificates with ASEAN countries according to the ASEAN general plan; and preparing to exchange customs declarations and electronic C/O with Eurasian Economic Union and South Korea.

The General Department of Customs continues to perform its regulatory role in the implementation of the NSW, ASW and specialized inspections.

Focusing on directing, monitoring, supervising ministries and sectors in the implementation; advising the Committee 1899 in directing ministries and sectors to implement the NSW and ASW.

Another important issue is to further improve the legal basis for the NSW and ASW implementation; to develop independent monitoring, reporting and evaluation mechanisms, coordinate with the Vietnam Chamber of Commerce and Industry to develop a mechanism to supervise the implementation of tasks of ministries and sectors under the Government’s plans.

Regarding the results of the NSW implementation, there are 13 ministries and agencies connecting with NSW; 174 administrative procedures are updated to the NSW with total administrative records processed on the National Single Window of nearly 2.27 million sets of more than 30,700 enterprises.

In the first six months of 2019, the number of processed records were nearly 482,000 sets from more than 4,300 enterprises.

How do transit procedures via the ASEAN transit system work?

VCN –The Ministry of Finance is drafting a circular regulating the information index, sample declaration form when implementing procedure of transit goods via the ASEAN transit system. The draft would adjust the contents about information index of instructing transit goods declaration on ASEAN transit system; stipulating letter of guarantee and sample documents applying the priority mode for enterprises.

Specifically, the draft clearly states when implementing customs procedures for transit goods, declaration have to lodge a letter of guarantee of credit institutions to customs authorities to update the ASEAN Customs Transit System (ACTS system).

The letter issued by credit institutions must meet requirements and criteria including the name of credit institutions, address, phone, tax code, code of credit institutions granting by State Banks; name of taxpayers or individuals, organizations representative for taxpayers, address, phone, enterprises’ code; and the amount of money to be guaranteed.

For private guarantee, the money to be guaranteed would be equivalent to the amount of tax payment for one customs declaration. The ACTS system helps customs declarants calculate the amount of money privately guaranteed for each customs declaration on the basis of HS code and the highest tariff rate of country participating in the route of the transit goods.

For common guarantee, the money to be guaranteed would be equivalent to the amount of tax payment for a certain period of time. The ACTS system has a function of helping customs declarants calculate the amount of money that was guaranteed commonly on the basis of comparing transit activities arising in a certain of time.

The duration of validity of guarantee would be calculated from the effective date of the letter of guarantee until the end of the transit route or when the amount of tax, late payment, fine (if any) arises in the process of transit is fully paid to the State budget.

The credit institution that accepted the guarantee should be responsible for the duration of validity of the guarantee. The customs authority checking the contents of the letter of guarantee should ensure full compliance with criteria, requirement of the regulation and update the guarantee information through the ACTS system. In cases of valid guarantee information, the system would automatically grant the guarantee reference number (GRN) for customs declaration to declare on the transit customs declaration.

After the system grants a guarantee reference number (GRN), if the guarantee information changes, the customs declarants should inform the customs authority for updating and amending the information on the system. For a private guarantee, the update and modifying guarantee information could only be done before the customs authority approves the transit declaration. For common guarantees, the update and amendment of guarantee information would not affect tax obligations and fees (if any) of previous declarations using guarantee.

After 10 days from the date the customs authority has a notice of customs duty, but the taxpayer or credit institution fails to fulfill tax obligations, the taxpayers must pay full amount of tax together with the amount of late payment.

The calculation of the delayed payment amount is 0.03 percent per day.

UNCTAD: China Ranked as Best Connected to Other Countries by Sea

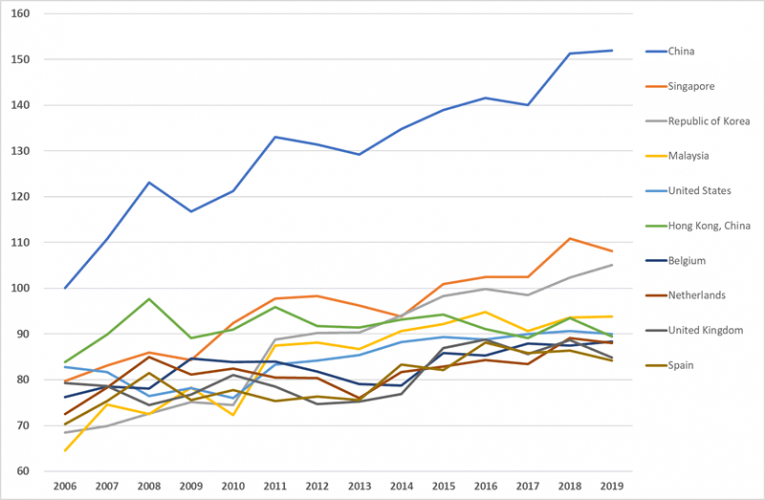

China has retained its lead as the country best connected to others by sea, according to the liner shipping connectivity index (LSCI) from United Nations Conference on Trade and Development (UNCTAD).

The index for 2019, that shows which countries improved or worsened their positions in maritime transport networks, pointed that China’s LSCI has increased by 51% since 2006.

“A country’s position in the global container shipping network – its connectivity – is an important determinant of its trade costs and competitiveness,” Jan Hoffmann, UNCTAD’s chief of trade logistics, said.

Five of the top 10 best connected economies in 2019 are in Asia, with Singapore, Korea, Hong Kong (China), and Malaysia rounding out the top-five list, each with a score of more than 100, according to the index’s metrics.

At the other end of the table, small islands developing states (SIDS) have hardly seen any improvement, meaning trade in shipped goods remains problematic in those countries, with knock-on economic effects.

Source: UNCTAD, based on data provided by MDS Transmodal

“We observe a ‘connectivity divide’ – a growing difference – between the best and worst connected countries,” Hoffmann added.

The LSCI, which is calculated from data on the world’s container ship deployment and released annually, covers 178 countries and shows maritime connectivity trends from 2006 to 2019.

Additionally, UNCTAD said that the 2019 shipping connectivity index has expanded country coverage and added a new component on countries that can be reached without transshipment.

“Counting on a direct regular shipping connection has empirically been shown to help reduce trade costs and increase trade volumes,” Hoffmann noted.

Research shows that the absence of a direct connection is associated with a 42% lower value of bilateral exports, according to UNCTAD.

Will IMO 2020 change US ports of call?

A fuel spike could push Asian containers to West Coast ports, but time and risk elements also must be considered.

The Panama Canal is designed as a shortcut. It’s the most impressive shortcut ever built in the history of mankind. For shippers sending U.S. liquefied natural gas and liquefied petroleum gas to Asia, it drastically reduces voyage time.

But when it comes to Asian containers being shipped to the U.S., the Panama Canal is not a shortcut. Between Shanghai and the Port of Prince Rupert in Canada (which connects via rail to Chicago), it’s 4,678 nautical miles. Between Shanghai and Los Angeles/Long Beach, it is 5,708 nautical miles. To Charleston, S.C., via the Panama Canal, it’s 10,170 nautical miles. To New York/New Jersey, it is 10,582 nautical miles.

In other words, it takes roughly twice as much travel at sea to get from Asia to the U.S. East Coast via the Panama Canal than to the West Coast. Starting on Jan. 1, this disparity is about to matter much more than it ever has before. On that date, the IMO 2020 rule goes into effect, mandating that sulfur content of marine fuel and emissions cannot exceed 0.5%.

Unless a ship has an exhaust scrubber installed, this will require operators to switch to ultra-low-sulfur fuel, including marine gas oil (MGO), which is expected to be much more expensive than the high-sulfur heavy fuel oil (HFO) used today.

Source: Seatrade Maritime, Sea News, World Maritime News, VN Customs News

.png)

.jpg)