Five More Ocean Carriers Join Digital Container Shipping Association

One month since it was created, the Digital Container Shipping Association (DCSA) has welcomed five more members with the aim of enabling digital standardization in the container shipping industry.

Shipping giants CMA CGM, Evergreen Line, Hyundai Merchant Marine (HMM), Yang Ming Marine Transport Corporation and ZIM Integrated Shipping Services have now become members of DCSA.

They are joining the association’s four founding members — A.P. Moller – Maersk, Hapag-Lloyd, Mediterranean Shipping Company (MSC) and Ocean Network Express (ONE).

It has been confirmed that CMA CGM would become a founding member of the association and hence, part of the supervisory board.

“Being a founding member will enable us to work together on setting the standards for digitalization of the entire industry,” Rajesh Krishnamurthy, Executive Vice President IT & Transformations, CMA CGM, stressed.

The four remaining container shipping companies are joining DCSA as members, subject to regulatory approval.

“In a more connected shipping supply chain, we are convinced that standardization is the prerequisite for all associated stakeholders to realizing effective digitalization and interoperability,” Kay Fang, Executive Vice President of International Customer Service of Evergreen Line, noted.

“Digitization is not only right but also the only path to follow for all of the stakeholders in the shipping industry,” Kyungin Jung, Senior Vice President, CIO of HMM, said.

According to Steven Tsao, CIO of Yang Ming, it is important to develop the relevant standards, processes and data flow for digital transformations as this is to improve the efficiency of the transportation process.

“We firmly believe that digital innovation will shape the future of the shipping industry…Standardization is the right way to improve the eco-system of all stakeholders,” Eyal Ben-Amram, Executive Vice President, CIO of ZIM, remarked.

With nine of the largest container shipping lines in the world, both from Asia and EMEA, DCSA now represents a substantial part of the industry. Specifically, members represent 70% of the market once regulatory approval is obtained.

“We are thrilled to have additional members joining the DCSA on our journey to drive standardization and interoperability in the industry, with CMA CGM joining as a founding member,” Thomas Bagge, CEO of DCSA, commented.

“It is critical for our success that the standards developed will be implemented, and the commitment and engagement of many container shipping lines is therefore crucial,” he pointed out.

DCSA gets Chief Operating Officer

As of July 1, 2019, Henning Schleyerbach takes on the role of the Chief Operating Officer (COO) of DCSA.

Schleyerbach comes from the position of Senior Director Customer Relationship Management at Hapag-Lloyd and will together with Bagge form the leadership team of DCSA, working on the development of standards for the industry.

“In Henning Schleyerbach we have won another strong industry profile, who as COO will drive DCSA’s operational activities,” Andre Simha, Chairman of DCSA supervisory board and Chief Information Officer of MSC, said.

“With Henning Schleyerbach and Thomas Bagge, DCSA has a strong leadership team in place which is supported by all founding members and represents container shipping at its best across all aspects,”Simha continued.

PIL enhanced Transpacific services

PIL enhanced Transpacific service by offering direct services from Vietnam to the U.S West Coast, with effect from end April 2019.

America China Service 5 (AC5) added Haiphong as first port of call with effect from 30th April 2019.

Full rotation of America China Service 5 (AC5): Haiphong - Nansha - Hong Kong - Yantian - Long Beach - Oakland - Yantian - Haiphong

PIL also launched a new string, America Cai Mep Service 2 (AC2)/ CJX, achieved through slot agreement on Ocean Alliance PSW3 service, with effect from 28th April 2019.Full rotation of America Cai Mep Service 2 (AC2)/ CJX: Cai Mep - Los Angeles - Oakland - Hong Kong - Cai Mep

AC2 and AC5 service allow PIL to tap into the fast growing Vietnam market and be amongst the first few carriers to provide the fastest direct service from both Ho Chi Minh and Haiphong to Pacific South West region, particularly Long Beach/Los Angeles and Oakland.

Yang Ming Forms Subsidiary in Indonesia

Taiwanese shipping company Yang Ming Marine Transport Corp. has decided to establish a new subsidiary in Indonesia.

Named PT Yang Ming Shipping Indonesia, the new arm will be formed with Yang Ming’s partners in Jakarta on May 16, 2019.

PT Yang Ming Shipping Indonesia will have branch offices at Surabaya, Panjang, and Palembang. The company has nominated Benson Chou as President Director for the first term.

Prompted by the rapid economic growth in Southeast Asia, global carriers begin to strengthen their regional services to meet the growing market demand. Among ASEAN countries, Indonesia has the largest economy, Yang Ming explained.

Given its strategic location and potential volume growth, Yang Ming has upgraded its Indonesian service network by deploying larger vessels and increasing service frequencies.

With the establishment of PT Yang Ming Shipping Indonesia, Yang Ming said it would have “a more comprehensive and intensive shipping network” by integrating business in surrounding areas and reinforcing the local operations for import, export and transship cargoes in Indonesia.

The shipping company has a total of six services in the country, three self-owned services CTI, TSE and SE5, and three joint services SS1, SSX, and TPI via exchange slots with partners. Yang Ming’s services cover four major ports in Indonesia – Jakarta, Surabaya, Semarang and Belawan.

The announcement on the new subsidiary comes a day after Yang Ming published a financial update for the first quarter of 2019 which shows that the company suffered a net loss of TWD 0.68 billion (USD 22.06 million), compared to a loss of TWD 1.95 billion posted in Q1 2018.

The consolidated revenues totaled TWD 35.08 billion (USD 1.14 billion) in Q1 2019, up 13.02% compared with TWD 31.03 billion (USD 1.07 billion) seen in the same quarter a year earlier.

In addition, volumes in the first quarter of this year also increased by 5% year over year, amounting to 1.29 million TEUs.

HMM Narrows Loss, Counts on Improved Rates and Volumes

South Korean shipping company Hyundai Merchant Marine (HMM) has managed to narrow its operating loss in the first quarter of 2019 on the back of increased revenues.

HMM reported an operating loss of KRW 105.7 billion (around USD 89 million), an improvement compared to an operating loss of KRW 170.1 billion from the first quarter of 2018.

The company’s operating income was affected by high bunker costs and the US-China trade war.

Revenues amounted to KRW 1315.9 billion for the first three months, an 18 percent increase compared to the same quarter a year before.

The increased revenues were explained by higher transport volumes and load factor.

Container handling volumes rose to 1.08 million TEU, an 11 percent increase compared to the 981,230 TEU handled in the same period last year.

HMM further said it expects the burden of high fuel costs on liners to increase due to the US sanctions against Iran, OPEC agreeing to cut oil production, and increased demand of low sulfur fuel oil in preparation for IMO 2020. Because of all this, the company has put its efforts into collecting the bunker surcharge to recover the higher fuel prices.

“HMM will maximize its efforts to strengthen profitability by successfully securing service contract with valued customers, rationalize its service network, attract high-value cargoes, and create competitive new service routes,” a company official commented.

“Given rising demand during peak season, both freight rate and container volumes are highly likely to increase in the second and third quarters.”

HMM added that it continues securing additional cargoes to fill up the newly ordered 20 eco-friendly mega-containerships slated to be sequentially delivered from the second quarter of 2020.

In addition, the company said it would look to improve its profitability by reducing the repositioning costs for empty containers and maximizing utilization of assets including terminal and vessels.

CMA CGM launches Reefer Pharma division

The new division will offer solutions for temperature-controlled transportation of pharmaceutical products.

CMA CGM said it has launched a Reefer Pharma division for the temperature-controlled transportation of pharmaceutical products.

The French container carrier said it will offer shipping solutions that guarantee optimal safety and are compliant with both the international quality standard and the European Commission recommendations.

CMA CGM, which has a fleet of 385,000 TEUs of refrigerated containers, said the new division will have experts available around the clock seven days a week. Shipments will be monitored CMA CGM’s head office in Marseille, as well as aboard its ships and from the company’s operational centers in Singapore and Miami.

Shippers yet to pay security on one-third of undamaged containers on the Yantian Express

General Average and Salvage security is yet to be posted on one third of the undamaged containers onboard the Yantian Express which suffered a cargo fire on 3 January.

As preparations are made for the vessel to sail to Halifax, Nova Scotia to from Freeport, Bahamas where fire damaged containers were unloaded, Ocean Network Express (ONE) – an alliance partner in the operation of the Hapag-Lloyd ship – said around General Average and Salvage security was yet to be paid on one-third of the containers.

“In order to assist progress of vessel operational proceedings and salvage company approval, we again encourage all cargo interests to immediately provide the requested General Average and Salvage security in order to allow the containers to be delivered,” ONE said in a customer advisory.

Repairs to the vessel which offloaded damaged cargoes in Freeport, Bahamas are nearing completion and its sailing date is now dependent on final Class approval and the fitting of hatch covers.

The Yantian Express is expected to depart Freeport during the first half of May bound for Halifax, Nova Scotia, its original destination when the fire broke out on the vessel.

“Exact date will be confirmed once forward schedule and terminal arrangements have been finally concluded,” ONE said.

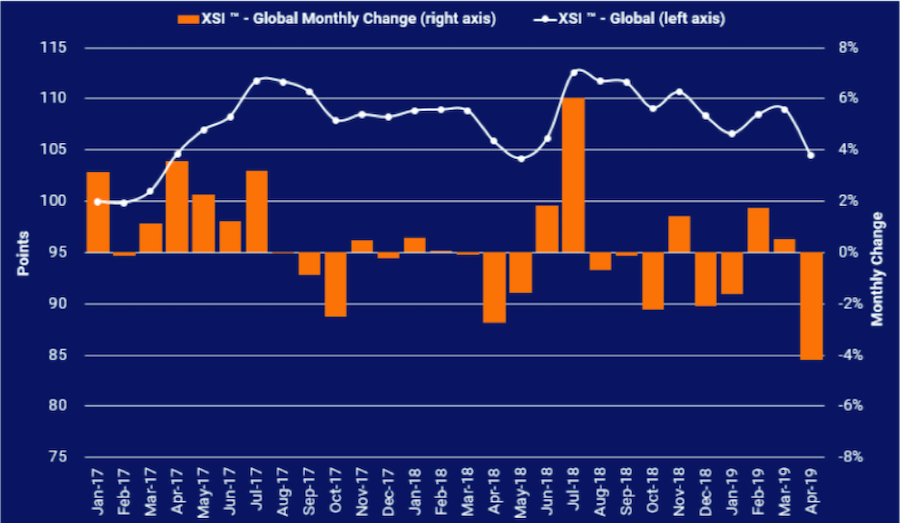

Container freight rates slump 4.2% in April

Container freight rates fell 4.2% in April to their lowest level since June last according XSI Public Indices published by Xeneta.

The indices based on crowd-sourced data covering 160,000 port-to-port pairings fell back sharply last month having reported container rate rises of 2.5% in February and 0.5% in March.

The indices stand at 104.45 points at the end of April, the lowest level since June last year.

The rate falls were across the board with European imports fell by 4.8%, while exports declined by 1.9%; for Asia the import benchmark dropped by 2.1% while exports slumped 3.6%; and for the US the export benchmark fell by 2%, while the import index dropped by 3.4%.

“The reasons for the decline are complex, but certainly overcapacity on the European trades (with Ocean Alliance increasing activity and new slots for a standalone HMM service) and continued fall out from the US-China trade war (where shippers initially front loaded cargoes to avoid additional cost) have added to longer term structural issues and political/economic uncertainty,” commented Xeneta ceo Patrik Berglund.

“In short, suppliers have benefited from a market in flux due to trade wars, IMO, socio-economical factors, like Brexit, and now the situation is turning. As always, uncertain waters may lie ahead for the contract market.”

Berglund said the outlook remains uncertain, “Geopolitics remain stubbornly unpredictable, with on-going uncertainty over US-China relations, while no one – not even the people at the very top – appear to have a clear view of what is happening regarding Brexit and its consequences.”

Maersk orders five 2,200 TEU feederships at Jiangnan Shipyard

The world’s largest container shipping company AP Moller – Maersk has signed a contract five 2,200 teu feederships with Chinese shipbuilding company CSSC Jiangnan Shipyard.

The feeders vessels will be172 metres in length and 32.2 metres beam.

All the five vessels are ordered through a financial leasing arrangement with China’s ICBC Leasing and will be classified by CCS. The ships will be deployed for Asia market after the delivery in the first half of 2021.

Jiangnan Shipyard currently has 13 feeder vessels in its orderbook.

PSA and ONE inaugurate jv Magenta Singapore Terminal

Terminal operator PSA Singapore and Ocean Network Express (ONE) inaugurated their joint venture terminal dubbed the Magenta Singapore Terminal in the Lion City earlier this week.

The four berth, 4m teu annual capacity facility at PSA’s Pasir Panjang Terminal in Singapore was announced in December last year. The joint venture terminal has been named the Magenta Singapore Terminal after ONE’s distinctive branding, the inauguration featured the 14,000 teu container vessel ONE Stork

The latest joint venture terminal by PSA represents an important step in locking in the Japanese container line joint venture ONE to using Singapore as its transhipment hub in Southeast Asia.

Other lines with joint venture terminals in Singapore include Pacific International Lines, MSC and CMA CGM and in November last year Cosco Shipping Ports and PSA joint venture Cosco-PSA Terminal announced it would be increasing annual capacity from 3m to 5m teu.

OOCL to launch two new Asia-Latin America services

Orient Overseas Container Line (OOCL) will introduce two new Asia to South America East Coast and the Caribbean direct services beginning in June 2019.

“With our focus to expand our business network in the Latin America market and to meet the growing demand for quality services in this region, OOCL is pleased to announce two new services, namely the Transpacific Latin Atlantic 2 (TLA2) and Transpacific Latin Caribbean 1 (TLC1), beginning in June 2019,” OOCL stated.

The carrier expects the new routes to offer competitive services with direct calls to strategic ports such as Santos, Navegantes, Manzanillo, Cartagena, Kingston, and Caucedo.

The port rotation for TLC1, effective with containership Cosco Beijing departing Singapore on 30 May, is Singapore, Hong Kong, Kaohsiung, Ningbo, Shanghai, Qingdao, Busan, Manzanillo (Mexico), Balbao, Manzanillo (Panama), Cartagena, Kingston, Caucedo and back to Singapore.

The TLC1 will first begin its services between Asia and Mexico, Panama and Colombia from June, while services to Jamaica and Dominican Republic will commence within the following two months.

The port rotation for TLA2, effective with Cosco New York departing Qingdao on 27 June, is Qingdao, Shanghai, Ningbo, Shekou, Singapore, Sepetiba, Santos, Paranagua, Itapoa, Navegantes, Itajai, Santos, Singapore, Hong Kong and back to Qingdao.

Source: World Maritime News, American Shipper, PIL's Website, Seatrade Maritime

.png)

.jpg)