Cosco Shipping Holdings profits from expanded container business

Expanded Cosco Shipping Holdings remained in the black in 2018 with a RMB1.23bn ($183.4m) profit and both its container lines, Cosco Shipping Lines and Orient Overseas International Ltd (OOIL), were profitable and reported significant improvement.

In 2018, the container shipping business of the company handled a volume of 21.79m teu, representing a year-on-year increase of 29%; of which Cosco Shipping Lines handled 18.37m teu, representing a year-on-year increase of 8.7% and OOIL handled 3.4m teu from July to December.

Cosco Shipping Holdings acquired OOIL in July 2018 and further expanded its fleet and service capacity.

The company has continued to expand in the intermodal arena and in 2018, it opened several new self-operating China-European container liner trains in cooperation with China Railway Corporation. The company provided services in a total of 112 foreign trade rail lines departing from China and 152 domestic rail lines, covering 20,000 to-door-service points.

Last year, the China-European Sea-rail Express based in Piraeus Port in Greece recorded a freight volume of 50,000 teu, representing a year-on-year increase of 27%.

In terms of port operation business, a majority of terminals controlled and invested by the company’s port arm, Cosco Shipping Ports, are located along the Belt and Road with a total of 283 berths in operation, including 192 container berths with an annual handling capacity of 106m teu. The container terminals of Cosco Shipping Ports recorded a total throughput of 120m teu last year, representing a year-on-year increase of 21%.

Cosco Shipping Holding, the listed arm of China Cosco Shipping Group, is engaged in container shipping and terminal operations. As of the end of 2018, the company operated a fleet of 477 container vessels with total shipping capacity of 2.76m teu and had an orderbook with a capacity of nearly 180,000 teu.

OOIL, JD Logistics to Jointly Invest in Eshipping

Orient Overseas International Line (OOIL) has signed a deal with COSCO SHIPPING Logistics and JD Logistics to jointly invest in online logistics platform Eshipping.

The agreement, reached on March 29, would see JD Logistics, OOIL’s subsidiary Gold Talent and Cosco Shipping Logistics form a joint venture for the acquisition of COSCO’s online logistics platform, established in July 2014.

Gold Talent and Cosco Shipping Logistics would subsequently transfer their share in Eshipping into the joint venture, while JD Logistics would provide a capital injection and logistics assets.

The parties plan to establish the JV in Shanghai with an initial registered capital of CNY 255 million (USD 37.9 million). It is subject to approvals by relevant authorities in China.

Once the transaction is finalized, JD Logistics and its affiliate JV ESOP would hold a 56% stake in the JV, while Gold Talent and Cosco Shipping Logistics would have 22% and 18%, respectively.

CMA CGM merges Containerships, MacAndrews

CMA CGM's Containerships and MacAndrews brands will move forward under the Containerships brand as of April 1.

By joining the forces of the two intra-European multimodal transport firms, the CMA CGM Group says it will unlock synergies and develop an Intra-European leading brand that combines unique maritime and inland solutions.

Acquired by the CMA CGM Group in 2018, Containerships is a specialist in intra-Europe for logistics services related to containerized cargo. Containerships offers logistics solutions for all modes of transportation (ships, trucks, trains and barges) and is present in the Baltic markets, Russia, Northern Europe, North Africa and Turkey.

Containerships took delivery last December of the Containerships Nord, the first vessel powered with LNG to join the Group’s fleet. Also equipped with a fleet of LNG-powered trucks, Containerships is therefore able to offer LNG at each step of the transportation process. This capacity will be further boosted in the coming months with the delivery of new 1,400-TEU LNG-powered container ships, and from 2020 with the integration in the CMA CGM fleet of nine 22,000 TEU vessels propelled by LNG.

MacAndrews, which joined the CMA CGM Group in 2002 and which merged with OPDR in 2018, also offers a complete range of rail, road and maritime transport services and is a specialist of container transport on Intra-European routes. It mainly connects North and Central Europe with the Iberian Peninsula, the Canary Islands and Morocco.

HMM opts for scrubbers on its twelve 23,000 teu giant boxships

Twelve largest containerships at 23,000 teu ordered by Hyundai Merchant Marine (HMM) will be fitted with scrubbers, ahead of their expected deliveries in the second quarter of 2020.

he installation of the exhaust gas cleaning system will allow the giant boxships to continue burning the 3.5% high sulphur bunker fuel beyond 1 January 2020, when the IMO 2020 regulation will be enforced to limit fuel sulphur content to 0.5%.

Among the twelve 23,000 teu containerships, seven will be built at Daewoo Shipbuilding & Marine Engineering (DSME) and five at Samsung Heavy Industries (SHI).

On Wednesday, Finland-based Valmet announced that it won the deal to supply seven scrubbers to the newbuilds at DSME. The scrubber system deliveries will start this year, and the value of the order was not disclosed.

Valmet said its scrubber system deliveries will include tailor-made hybrid systems for main engine and generator engines. The exhaust gas is washed with seawater in open-loop mode and recirculated water and alkali in closed loop mode.

In addition to installing scrubbers on the twelve 23,000 teu boxships, HMM will install scrubbers on another eight 15,000 teu containerships to be built at Hyundai Heavy Industries (HHI).

The Korean shipowner also plans to retrofit scrubbers on 19 containerships currently in operation by the first half of 2020. Furthermore, HHM’s five VLCCs starting delivery from January 2019 are also retrofitted with scrubbers.

This brings the number of scrubber fitted HMM ships to 44, out of more than 100 ships in its fleet.

Last week, HMM signed a memorandum of understanding to establish a fund for its scrubber installation. The KRW153.3bn ($134.9m) fund will consist of HMM’s investment of KRW46bn and the remaining KRW107.3bn will come from Korea Ocean Business Corp’s guaranteed loan of KRW62.3bn and KRW45bn invested by Hyundai Corporation, SKTI, Hyundai Global Service, DSEC and Panasia.

Outlook on those largest trading partners of Vietnam in 2019.

The IMF forecasted that US economic growth (as Vietnam’s largest export market) in 2019 could fall to 2.5% and even lower by 2020. However, according to the report: Vietnam Economic Annual Review 2018 from Vietnam National Economics University, this growth rate would be still considered higher than the potential output of the US economy.

The report also said that Chinese economy was expected to grow slower for next several years, could be at 6.3% in 2019 and 6.4% by 2020. In fact, Chinese government had been taking initiatives in their monetary policies, however, the impacts from China-US trade war and their tightening on financial and banking regulations would certainly have some negative impacts on China – a large export market of Vietnam.

In Asia, Japan was reported by IMF to grow at 1.1% in 2019. This increase reflects a confidence on Japan’s fiscal policies implemented throughout 2018, even a consumption tax increasing plan would take place by October 2019.

In Southeast Asia, the ASEAN-5 group was expected to grow at 5.1% in 2019 and 5.2% by 2020. This increase is only slightly reduced compared to the previous period which mainly reflects risks from exchange rates as well as unusual changes from international investment flows.

In European region, it was about 1.6% in 2019 and 1.7% by 2020, lower than the previous period. Those major economies of European Union such as Germany, Italy and France could face certain difficulties, mainly from weak growth of domestic demand and their political instability.

World trade growth in 2019 was forecast by the IMF at 4%, down by 0.2% compared to 2018, mainly due to the impact of trade wars between big countries such as US-China trade war which could be likely to keep continuing for next several years, this could push many countries tend to multi-lateralize their economic and trade links in order to avoid reliance on some major markets.

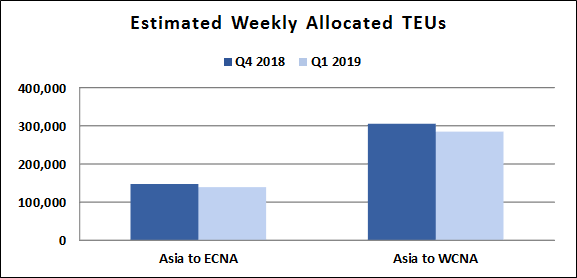

Asia-to-North America trades see capacity sink in Q1

While weekly allocated capacity on Asia to North America trades took a sharp downturn between Q4 2018 and Q1 2019, prominent North Europe outbound trades saw a modest increase.

The container shipping industry in the first quarter of 2019 faced challenges as the trade war between the United States and China began hindering transpacific capacity and European economic growth continued to stagnate.

Trade between the most prominent economic zones in the world can be measured on a quarterly basis using the Bluewater Reporting World Liner Supply (WLS) Report.

On the Asia-to-East Coast North America trade, weekly allocated TEUs fell 5.61 percent between Q4 2018 and Q1 2019, from 147,509 TEUs to 139,229 TEUs, while weekly allocated TEUs on the Asia-to-West Coast North America trade declined 6.81 percent between Q4 2018 and Q1 2019, from 305,474 TEUs to 284,674 TEUs, as illustrated in the chart below.

The Asia-to-North America trade is heavily influenced by the two largest economies in the world, the U.S. and China. The Q4 2018 WLS Report assumed there would be a reduction in capacity if tariffs enacted by the U.S. and Chinese governments started to reduce demand for consumption. This reduction in demand is clearly shown in Q1 2019 as tariffs have made foreign goods more expensive. Furthermore, this reduction in demand has caused a decrease in capacity and shows that the tariffs are beginning to have their intended consequences.

The significant reduction in capacity suggests that unless the U.S. and China come to a trade agreement, both economies will suffer, and externalities will be produced worldwide.

However, an agreement currently is being debated. Myron Brilliant, head of international affairs at the U.S. Chamber of Commerce, explained during a Tuesday press briefing that U.S.-China trade talks have progressed to a point where the two countries will most likely reach a deal, with about 90 percent of talks completed, yet the final 10 percent is the hardest part to get through.

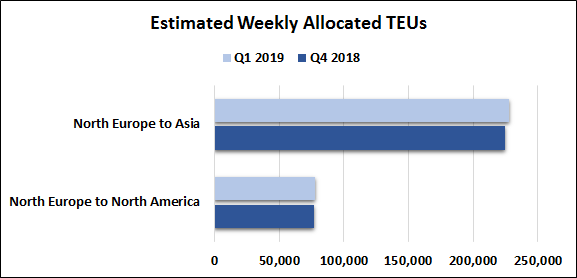

While trade from Asia and North America plummeted between Q4 2018 and Q1 2019, the prominent outbound North Europe trades saw modest growth over this time frame. As mentioned in the previous WLS analysis, the European Union is facing adversity with the economies of Germany, Britain and France all experiencing sub-optimal growth.

Estimated weekly allocated TEUs from North Europe to Asia grew 1.15 percent between Q4 2018 and Q1 2019, from 224,885 TEUs to 227,470 TEUs, while estimated weekly allocated TEUs from North Europe to North America grew 0.83 percent, from 77,097 TEUs to 77,738 TEUs, as illustrated in the chart below.

The relative stability for European exports to North America and Asia suggests that manufacturing has stopped retracting and could be benefiting from the trade war between the United States and China. The growth in exports to Asia and North America could be replacing capacity that would typically be exported from China and the U.S.

If this hypothesis is correct and the trade war continues during Q2 2019, growth in exports from Europe to Asia and North America should continue to increase. Inversely, if the trade war comes to an end, exports from Europe to Asia and North America should decline as the U.S. and China retake their market share.

The results for Q1 2019 illustrate that while the trade war began as political posturing, it is starting to have negative impacts on the largest economies in the world. If the trade war continues, the U.S. and China will face domestic consequences and will risk inducing a global recession.

VCN - World Bank: Reducing the investment rate for road infrastructure by 2-3% will not cause much impact on transport efficiency. But if investment increases for water transport by 2-3%, there will be a transformative impact on waterways.

The imbalance between types of transport is due to different investment levels for transport types compared to road investments. According to statistics of the Ministry of Transport, in the period of 2011-2015, the total investment for roads accounted for 89.93% of the 5 types of transport, this is a shortcoming in investment of the Transportation in Vietnam today. The inconsistency in scale, especially on the implementation process between investment projects to build the technical infrastructure system is greatly affecting the operational capacity and efficiency of the entire transport infrastructure system.

According to the transport sector, in terms of the volume of goods transported, although road transport is high cost, it accounts for 77.2% of the market share. Mass transport with low cost like inland waterways and seaways account for only 17.14% and 5.22%; respectively. Rail transport accounts for only 0.42% and air transport accounts for only 0.02%.

According to the report on sustainable development of inland waterway transport in Vietnam by the World Bank (WB), increasing investment and effective management of infrastructure networks plays a key role in maintaining a competitive advantage of inland waterway transport. In particular, the investment in improving and maintaining inland waterway infrastructure network plays a decisive role in helping Vietnam directly connect with seaports to serve export needs. This will also boost the trend of container shipping by new industries.

WB Country Director for Vietnam Ousmane Dione said that over the past decades, Vietnam has achieved significant achievements in transport infrastructure development. The Vietnam road network has expanded to nearly 400,000km, with most of the commune centers connected together, despite any weather conditions. However, the inland waterway network plays a key role and transports a huge volume of goods, accounting for nearly 20% of the total cargo volume in tons per kilometer (in 2016) and currently is largely lacking in investment. According to the WB's review, in the period of 2011-2015, the inland waterway sector accounted for 2-3% of the annual investment budget for the transport sector, but in the period 2016-2020, this dropped to only 1.2% of the estimated budget.

This level of investment is not adequate for the expansion of transportation and maintenance capacity. After decades of development, the length of inland waterway network capable of receiving barges of over 300 tons accounted for only 30% of the 7,000 km of the entire route. This rate is very low compared to other successful commercial inland waterway transport systems in the world. This fact shows that investment is vital in this infrastructure system. “Allocate the public human resources in a strategic way, and mobilize the participation of the private sector in funding and service provision”, said Ousmane Dione.

Restrictions on infrastructure conditions, especially waterway corridors, hinder Vietnam's inland waterway industry. Specifically, only 29% of the national waterways (about 2,033km) are capable of operating barges of at least 300 DWT due to the depth of the canal, vessel size and low bridge clearance. In particular, many ports have outdated facilities with a low level of mechanization, while connecting with other modes of transport is weak.

The World Bank said, reducing the proportion of investment in road infrastructure by 2-3% will not cause much impact on transport efficiency. But if investment increases for water transport by 2-3%, there will be a transformative impact on waterways, while only making a small change in the speed of road network development. However, the World Bank team recommended that the Ministry of Transport should carefully consider investing in ports because it would disperse scarce investment capital that could have been invested in the waterways sector. The transport sector should encourage investment from the private sector into the port system, while the state budget focuses on investing in the development of transport infrastructure.

Mr. Hoang Hong Giang, Director of Vietnam Inland Waterways Department, said that WB5 and WB6 projects on development of waterway infrastructure in the South and North, after being implemented, helped to increase cargo transport volume by 20% on the waterways. The question now is to to provide solutions to better exploit the system of waterway infrastructure which has been upgraded and improved, especially in key waterway areas.

In order to reduce logistics costs and enhance transport efficiency, Ms. Yin Yin Lam, WB's transport expert, suggested that Vietnam needs to invest in infrastructure and promote the use of transportation using "container transport by barges" to increase the use of inland waterway transport. To further promote the development of coastal transport on the North - South route and integrate logistics centers and urban centers in domestic container port planning.

Vietnam: Already reduced 4,379 backlogged containers at seaport

According to statistics of Customs sector, as of 22/3/2019, the number of backlogged containers which were declared on E-manifest as scrap, was 17,216 (a reduction of 4,379 containers compared to the previous month). Currently, the number of backlogged containers (stored over 90 days) was 9,463 containers (decreased by 5 containers compared to last month).

After the issuance of documents about solving difficulties (Resolution No. 09 / NQ-CP dated 3/2/2019, Document No. 1036/VPCP-TH dated 1/2/2019 and Document No. 406/TCHQ-GSQL dated 17/1/2019), backlogged goods are currently tending to decrease, due to backlogged goods which implemented customs declaration registration for processing import procedure by receivers.

Currently, the General Department of Vietnam Customs is developing a specific plan to handle in accordance with the directives of the Prime Minister in Document No. 2227/VPCP-KTTH dated 21/3/ 2019 of the Government Office.The Ministry of Finance chaired and coordinated with the Ministry of Natural Resources and Environment to establish an interdisciplinary working group in order to handle the backlogged shipments of imported scrap at ports across the country.

It is known that in the work of specialized inspection, implementing the scheme "Solutions to improve the effectiveness and efficiency of specialized inspection activities for import and export goods" under the Decision 2026/QD-TTg of the Prime Minister and Resolution 02/NQ-CP; Decision No. 1254/QD-TTg of the Prime Minister, the General Department of Vietnam Customs is continuing to urge the ministries and sectors to complete the report on the results of work in 2018 and the direction of implementing tasks in 2019; develop detailed plans for implementation and report to the Ministry for approval. Prepare detailed data and information (List of pre-clearance and post-clearance specialized inspection goods, standard regulations and management policies for export and import goods subject to specialized inspection) in order to work with ministries and branches.

Source: World Maritime News, American Shipper, Seatrade Maritime, Vietnam Customs News

.png)

.jpg)