Hapag-Lloyd Cheers 80 Pct Higher Operating Profit in 2019

German container shipping heavyweight Hapag-Lloyd recorded an over 80 pct increase in earnings before interest and taxes (EBIT) for the 2019 financial year amid improved freight rates and cost management efforts.

The company’s EBIT stood at EUR 811 million (USD 876 million) against an EBIT of EUR 444 million secured in 2018.

Earnings before interest, taxes, depreciation, and amortization (EBITDA) rose to EUR 1,986 million from EUR 1,139 million posted a year earlier.

Hapag-Lloyd’s revenues for the year were up by 9 percent, reaching EUR 12.6 billion.

The company attributed the increase to an improved average freight rate of 1,072 USD/TEU for the year as a whole, which rose by 2.6 percent year-on-year (2018: 1,044 USD/TEU) as the company placed a stronger focus on more profitable trade lanes and active revenue management.

In addition, the company said that a 1.4 percent year-on-year increase in transport volumes, to more than 12 million TEU (2018: 11.9 million TEU), and a stronger US dollar exchange rate against the euro also made a positive contribution to revenues.

Lower expenses for the handling and inland transport of containers, as well as a slightly lower average bunker consumption price of USD 416 per tonne (2018: USD 421 per tonne), had a positive effect on transport expenses, which increased to a total of EUR 9.7 billion (2018: EUR 9.6 billion), also impacted by a stronger US dollar.

Maersk Posts Higher Earnings in 2019, Expects Weak Start of 2020 amid Coronavirus Outbreak

Despite weak market conditions and slow container growth of 1.4 percent, Danish shipping heavyweight A.P. Moller – Maersk managed to improve earnings and free cash flow in 2019.

The company’s earnings before interest, tax, depreciation, and amortization (EBITDA) were up by 14 percent to USD 5.7bn compared to 2018 and the EBITDA margin increased to 14.7 percent.

Revenue decreased slightly to USD 38.9bn in 2019 from USD 39.3bn.

Free cash flow was USD 6.8bn, compared to USD 5.1bn last year and CAPEX declined by USD 1.2bn to USD 2bn in 2019.

“Despite weaker market conditions A. P. Moller – Maersk was able to improve profitability and cash flow. Our cash return was healthy, and we continued the reduction of net interest-bearing debt, leading to a further deleveraging of USD 3.3bn over the year. It gives us a solid starting point for 2020 to further expand our end-to-end offering within container logistics while at the same time managing the market challenges that are obviously out there,” CEO of A.P. Møller – Mærsk A/S, Søren Skou, said.

“While we still need to improve returns, we delivered solid progress in our financial performance in 2019 while progressing the business transformation, in spite of weak trade growth, ongoing trade tensions and geopolitical uncertainty in many markets.”

In Ocean, EBITDA in 2019 increased 15 percent to USD 4.4bn, with revenue at USD 28.4bn amid a small decrease in volumes to 13.3m FFE. Unit cost at fixed bunker decreased by 1.7 percent, mainly due to improvements in capacity management and foreign exchange rate developments.

EBITDA in Logistics & Services saw a 24 percent increase to USD 238 million, while revenue decreased slightly to USD 6bn from USD 6.1bn, driven by a decrease in sea and air freight forwarding activity, which was only partly offset by an increase in warehousing and distribution.

Terminals & Towage reported an increase in EBITDA of 11 percent to USD 1.1bn with a revenue increase of 3.2 percent to USD 3.9bn.

In gateway terminals, EBITDA increased by 17 percent to USD 902m, amid a ramp-up of the new terminal in Moin, Costa Rica, higher volumes, higher storage income and reduction in SG&A.

Maersk said that synergies harvested from the Hamburg Süd acquisition and the integration of transport and logistics reached USD 1.2bn, which is above the expected target.

The long-term target on return on invested capital after tax (ROIC) grew to 3.1 percent in 2019, compared to 0.2 percent the year before.

Q4 took a tumble

In the fourth quarter of 2019, A.P. Møller – Mærsk A/S’ share loss hit USD 72 million, compared to the prior year’s profit of USD 32 million.

Loss from continuing operations in Q4, 2019 reached USD 61 million, compared to a loss of USD 72 million a year ago.

The underlying profit from continuing operations was USD 29 million, down from USD 65 million in 2018.

Revenue fell to USD 9.67 billion from USD 10.24 billion in 2018.

Outlook for 2020

For 2020, Maersk expects an EBITDA of around USD 5.5bn, before restructuring and integration costs. The organic volume growth in Ocean is expected to be in line with or slightly lower than the estimated average market growth of 13 percent for 2020.

“The outlook and guidance for 2020 is subject to significant uncertainties and impacted by the current outbreak of the Coronavirus in China, which has significantly lowered visibility on what to expect in 2020. As factories in China are closed for longer than usual in connection with the Chinese New Year and as a result of the Coronavirus, we expect a weak start to the year,” Maersk said.

“The guidance for 2020 is also subject to uncertainties related to the implementation of IMO 2020 and the impact on bunker fuel prices and freight rates combined with the weaker macroeconomic conditions and other external factors.”

The accumulated guidance on CAPEX for 2020-21 is still USD 34bn. A high cash conversion (cash flow from operations compared to EBITDA) is expected for both years.

Vinalines to divest capital from 13 firms this year

State-owned Vietnam National Shipping Lines (Vinalines) plans to divest capital from 13 member companies this year, Vietnamese media have reported.

The corporation will reduce its ownership in six businesses and divest completely from seven others.

With this divestment plan, the liquidation of vessels and impact of its shrunken market share in temporary import for re-export services, the firm forecasts its consolidated revenue this year will decrease by 14.5% from 2019 to over VND10.31trn ($444.26m).

Since 2013, when Vinalines began restructuring, the firm has divested capital from many companies, cutting the number of its subsidiaries from 73 to 35.

Notably, it has divested all capital invested in enterprises operating in other sectors like banking, securities, insurance and real estate to focus on its main business sectors of seaports, sea transportation and maritime services.

Divestments from poorly-performing subsidiaries have helped slash the group’s debt from more than VND67.5trn (before restructuring began) to over VND17trn, the corporation noted.

Vinalines has joint ventures in a number of port operations, in Haiphong, Cai Mep and HaLong. The company has reported losses during the Corona Virus epidemic as they must skip Chinese ports to lower the risk of infection while many of their shipping partners and customers were in China.

According to Vinalines' website, during the epidemic, many of its companies lost up to 70% of the volume compared to the same period last year.

Coronavirus Comes at the Worst Time for Shipping

The outbreak of the coronavirus, originating from Wuhan, China, comes at one of the worst time for the shipping industry, which is currently struggling with the additional fuel costs from IMO 2020 and the switch to low-sulfur fuels, according to BIMCO.

“Demand is destroyed in China due to the coronavirus. Demand stemming from consumer spending, power generation and industrial production is lost every day that large parts of China remain quarantined. That demand will not necessarily rebound once the virus is contained,” Peter Sand, BIMCO Chief Shipping Analyst, said.

Even though there is a veil of uncertainty hampering the ability to predict the outlook for the shipping industry, BIMCO’s Chief Shipping Analyst analyzed three scenarios:

• In BIMCO’s Scenario 1, it is assumed that the virus in large parts will be contained by the end of February and that the Chinese workers will return to work during early March, prompting a subsequent pick-up in manufacturing, industrial production and refinery throughput, as well as shipping demand.

• In Scenario 2, it is assumed that in the medium-term large-scale quarantines will continue until mid-March, but hereafter economic activity picks up and reaches a state of normalisation by April-May.

• Scenario 3 is the worst-case scenario, where the spread continues until an indeterminate point in time. However, with the massive uncertainties related to this scenario, it remains outside the scope of this analysis to make long-term projections. As such, BIMCO’s analysis primarily focuses on the short to medium-term implications.

Shipyards in China, many of which would otherwise be busy with IMO 2020 scrubber retrofitting, have remained closed and declared force majeure in many cases. An estimated 150 vessels are currently under retrofit at Chinese yards, according to Clarksons.

“The lockdown of newbuilding yards may prove to be the only silver lining to the outbreak as inflow of more ships are temporarily stopped,” BIMCO said.

Container shipping is inextricably tied to China with the main trade lanes, China-Europe and China-North America, linking China’s manufacturing capabilities with the rest of the world.

Now, the entire logistics chain is being disrupted.

First, many of the producers of containerized goods have halted production or are producing at lower levels.

Second, the Chinese hinterland transportation of containers, in the shape of trucking, is in massive labour shortages.

Faced with the lower container volumes, container carriers have started large-scale blanking of sailings. On the Asia-North Europe trade lane, 40 sailings have been blanked in the eight-week period after Chinese New Year, compared with the 15 sailings blanked last year, according to Alphaliner.

The blanked sailings have partially safeguarded the freight rates from the coronavirus with the composite SCFI index, dropping a modest 93 index points from 981.19 on January 23 to 887.72 index points on February 14 2020.

However, BIMCO believes the blanked sailings will only fend off the downward pressure for so long.

The intra-Asian market is expected to be the first to feel the blow with fewer semi-finished goods, such as parts used in car manufacturing, being transported to manufacturers in nearby countries like South Korea and Japan.

Should the regional manufacturers slow production due to supply shortages, the long-haul trades will soon hereafter start to feel the pressure, the association said.

“Currently we are seeing carriers trying to mitigate the low container volumes in Chinese ports by blanking sailings. If the situation continues, we could start to see global supply outages in retail stores. Manufacturing in Europe and North America could also start to decline, as some supply chains are reliant upon the Chinese semi-finished goods,” Sand added.

In which ways does it impact liner shipping?

In the Scenario 1, the impact on the long-haul trades will remain largely unaffected, according to BIMCO, given the capacity management measures already exercised. February traditionally brings with its declining freight rates and in this scenario, the month will unfold largely within the scope of usual seasonality. Yet, volumes will remain lower this time around, especially on the Intra-Asian trades, which could bring a minor disruptive interference to global supply chains.

In Scenario 2, more dark clouds will start to gather. A temporarily obstructed active labour force, caused by a continued wide-spread quarantine, will extend disruptions to manufacturing, hinterland transportation and port operations. Given the lower container volumes, the disruption could extend into a global supply shortage of retail and manufactured goods.

In this case, manufacturers in Asia and the rest of the world, reliant upon semi-finished goods imported from China, will have to temporarily cut production, creating a dent in manufacturing activity on a global scale. If that happens, container ship freight rates and time-charter rates will come under massive downward pressure, BIMCO predict.

“However, in this scope of influence, the effects will only be transitory, and we are likely to see a gradual rebound back to normal market conditions after weathering the storm,” BIMCO adds.

Mounting pressure on the dry bulk market

Dry bulk shipping is set to be hit the hardest, given the sector’s heavy reliance upon Chinese import demand. China accounted for roughly 35% of all seaborne dry bulk imports in 2019.

The extended Lunar New Year shutdown has already materialised in the freight rates. Dry bulk earnings were already heavily battered by seasonality, the implementation of IMO 2020 regulation, but the coronavirus also dealt an additional and significant blow.

The Baltic Exchange Capesize Index (BCI) plummeted into negative territory at the end of January, with the average earnings sitting at USD 2,735 per day on February 20, 2020.

Similarly, the smaller segments have followed down the Capesize path and stayed in unprofitable territory in recent months.

Traditionally, the dry bulk market enjoys a sharp pickup after the Chinese celebrations of the Lunar New Year are concluded. With only little improvement in freight rates this week, the coronavirus has postponed the rebound.

If assuming, in Scenario 1, that China manages to contain the virus by end of February, and that industrial production picks up through March, the impact of the virus on the dry bulk market will remain relatively short-lived.

Steel-production, the driver of iron ore imports, will take a blow, but normalise to baseline in the following months. Nonetheless, fixtures of iron ore imports to China, have already taken a hit with only 38 cargoes fixed for China in February – a stark contrast to the 62 spot cargoes fixed in the same period last year, BIMCO’s data shows.

Given the lower level of iron ore spot cargoes, and the long-running trend of Chinese steel production favouring Electric Arc furnaces which used scrap metal and not iron ore, BIMCO expects Chinese iron ore imports to decline year-on-year for 2020 as a whole.

Chinese imports of coal, the second largest dry bulk commodity, will similarly take a coronavirus-induced blow. The extended holidays and slower industrial production will reduce demand for coal-powered energy, which essentially destroys demand permanently.

China remains the world’s largest producer of coal, and with the pressure to reach annual GDP targets, the government may prioritize domestic production over coal imports. Growth of coal imports is hereby likely to be low in 2020.

In Scenario 2, where the virus spread continues until mid-March, dry bulk shipping will remain in a depressed earnings environment for the remainder of Q1. Construction projects and industrial projects will remain slow up until mid-March, before ascending on a gradual rebound.

In this situation, improvements for dry bulk earnings in Q1 will come in the shape of declining bunker prices and not by demand pick-up, BIMCO said.

Commentary: Coronavirus will significantly impact US container imports in March

The magnitude of declines over the next few months from the virus as well as lingering tariffs will have broad flow-through effects on the U.S. economy.

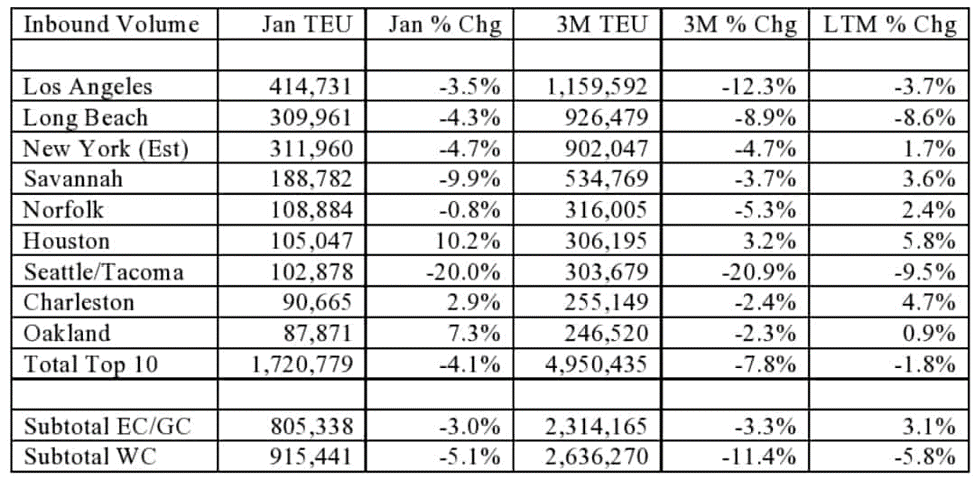

Container imports into the 10 largest U.S. ports dropped 4.1% in January, a reprieve from December’s 12.5% decline and November’s 6.5% decline. These recent downturns are driven by China tariffs.

Vagaries related to the Chinese New Year holiday make single-month comparisons in these early months less meaningful. However, broader actual measures point to a consistent downward trend. The six-month trailing numbers are down for the fifth straight month — to a 4.6% decline — and the 12-month trailing numbers are down for the ninth straight month, to a 1.8% decline.

With tariffs still in place, I had anticipated that the actual downward trend would continue as my forecast called for the first nine months of 2020 circling around a 10% actual decline, similar to the fourth-quarter experience.

The reprieve in January will be short-lived, but not just because of tariffs. A new negative catalyst in the form of the coronavirus originating in Wuhan, China, is now impacting supply chains. After the virus first became a news story in mid-January, the World Health Organization declared it a global health emergency on Jan. 30.

The spread of the coronavirus and its ramifications have grown exponentially. U.S. inbound loads weren’t affected in January and the impact in February will be moderate. But the coronavirus impact on March will be significant.

The coronavirus impact first resulted in at least a one-week holiday extension that kept factories throughout China closed. Reports point to extensive quarantines and reduced activity, even after the holiday ended. For instance, one report claimed only 50% of stevedores are now on duty in Shanghai, the world’s largest container port. Earlier this week, a 23,000 twenty-foot equivalent unit (TEU) ship reportedly departed China en route to North Europe with only 2,000 TEUs in loaded containers. Industry sources have cited numerous canceled sailings despite what is normally a busy post-holiday period.

The magnitude of declines we’ll see over the next few months will have broad flow-through effects on many aspects of the U.S. economy. The coronavirus could make some of those declines unprecedented, but they should be temporary when that situation abates. It would, however, be a mistake to ascribe the entire container volume declines to the coronavirus as most of the China tariffs remain in place.

In January, East and Gulf Coast port volume declined 3% versus a 6.1% decrease in December, while West Coast ports decreased 5.1% versus a 17.2% decrease in December. In addition to the tariff effect, the structural shift away from the West Coast due to the mid-2016 expansion of the Panama Canal allowing more economical mostly water service will continue.

East and Gulf Coast ports constituted 46.8% of January’s top 10 port volumes, compared to 43.3% in 2015, the last full year before the expanded Panama Canal went into operation. The canal expansion energized a transition that has been unfolding for a while — in 1995, East and Gulf Coast ports were 37.3% of the top 10 ports’ volume. Note that when all smaller ports are included, the coastal split is about 50-50. The population dispersion in the continental United States has 75.7% of people closer to the East and Gulf coasts than the West Coast.

Ports with the strongest January performance were Houston, up 10.2%; Oakland, California, up 7.3%; and Charleston, South Carolina, up 2.9%. The weakest performance in January came at Seattle/Tacoma, down 20%; Savannah, Georgia, down 9.9%; and Long Beach, California, down 4.3%.

The table below shows all of the 10 ports ranked by imported container volume in January. Volume for the three months ending Jan. 31 is shown with year-over-year percentage changes for that period as well as the last 12 months. January data for New York is estimated at the percentage change at the other East Coast ports as its data isn’t expected for weeks. Seattle/Tacoma volume is combined and not separately disclosed, but historical data confirms that each is among the top 10 ports.

The top 10 U.S. ports are ranked by imported container volume in January. (Courtesy: John McCown)

For the three months ending Jan. 31, East and Gulf Coast ports declined 3.3% compared to an 11.4% decline at West Coast ports. That spread is narrower than the last 12 months, when East and Gulf Coast ports grew 3.1% and West Coast ports declined 5.8%. The best performers over the last three months were Houston, up 3.2%, and Charleston, down 2.4%, with the worst performers Seattle/Tacoma, down 20.9%, and Long Beach, down 8.6%.

Container exports are less relevant and typically backhaul lanes of less valuable cargo. In January, total export volume was 52% of import volume. While outbound loads grew 2.9% in January, all of that was driven by a 35% surge in Houston’s presumably petrochemical-related loads. Houston now is the only port where exports exceed imports (a 113% ratio in January). At the other end of that imbalance spectrum is Long Beach, with a 35% ratio in January.

The macro story in 2020 will be driven by the continuing effect of the China tariffs, which now will be exacerbated by the impact of the coronavirus. The latter will make achievement by China of some of its recent commitments more challenging, and that itself could rekindle trade tensions that were put on hold with the recent Phase One truce. Our tariff initiatives have put a crowbar into the spokes of what was basically a free trade world, and we have yet to feel the full ramifications of this.

Unfortunately, if and when the tariffs go away, it is unlikely we will see a bounce back to pre-tariff trade levels for the United States. When obstructed, trade flows change and new networks and patterns are developed. They won’t automatically snap back when the obstruction goes away. One reason for this is that even after they go away, some companies will remember the unprecedented whipsaw implementation of those prior tariffs and want to hedge their supply chain vulnerability.

The injection of uncertainty in terms of what may happen in the future may be the most pernicious long-term effect to the United States of the ill-conceived tariff initiative.

Shipping Industry Faces $370 Million Hit from Panama Canal ‘Freshwater’ Charge

A new “freshwater” charge that came in this month to help the Panama Canal cope with climate change will cost the shipping industry up to $370 million a year, marking another blow for maritime companies already hit by fallout from the coronavirus.

The Panama Canal, one of world’s busiest shipping routes, which handled nearly 14,000 transits last year, said last month it would introduce a charge from Feb. 15 of $10,000 for any vessel more than 125 feet long.

The canal, which relies on water from nearby Gatun Lake, has been hit by drought which affects water levels in the chokepoint. The Panama Canal authority also said it would bring in a variable surcharge based on the level of Gatun Lake to ensure the canal has enough water.

The authority said the charges were a consequence of a lack of rainfall and said this was a short-term measure needed to tackle the impact of climate change.

The International Chamber of Shipping (ICS), which represents more than 80% of the global merchant fleet, said on Thursday it was surprised by the charge after working with the canal authority on a separate increase in tolls which is due to come into effect in April.

“The industry is currently facing increased price pressures globally, as demand has been hit hard by the coronavirus and markets are adjusting to the new regulations on sulphur levels,” ICS secretary general Guy Platten said, referring to new rules requiring ships to use cleaner fuel.

The coronavirus epidemic has upended supply chains and already disrupted shipping across the world leading to commercial losses for certain types of shipping, including container lines.

The industry is also having to pay billions of dollars in extra fuel costs due to the tough new sulphur emissions rules that started in January.

Platten said the global shipping sector was already operating “on the slimmest of margins”.

“ICS calculates that at current water levels the ‘freshwater charge’ alone could cost global shipping $230 million. In a worst-case scenario this could be as high as $370 million per year,” he said.

“Cost hikes in this range, without sufficient warning, places undue pressure on the industry at a sensitive time when we are being asked to invest in a low emissions future,” Platten said. He urged the canal authority “to rethink the hasty introduction”.

Canal officials were not immediately available for comment.

A study last month estimated at least $1 trillion of investment in new fuel technology is needed to enable the shipping industry to meet U.N. targets for cuts in carbon emissions by 2050. (Additional reporting by Elida Moreno in Panama City and Diego Ore in Mexico City. Editing by Jane Merriman)

Coronavirus Claims the Lives of Two Diamond Princess Passengers

Two passengers from the cruise ship Diamond Princess, who were infected with coronavirus, have passed away, the Japanese Health Ministry informed on Thursday, February 20.

Both persons, a man, and a woman were in their 80s, according to the ministry.

“Our hearts go out to the families, friends and all who are impacted by these losses. All of us at Princess Cruises, as well as the crew of the Diamond Princess, offer our sincere condolences,” Princess Cruises said in a statement to World Maritime News.

The news comes after the 14-day quarantine of the cruise ship in Yokohama, Japan, officially ended, allowing the passengers to disembark.

As being reported earlier, some 2,666 guests and 1,045 crew on board the cruise ship were told to stay in their cabins since February 5 in order to prevent the spread of the fatal virus. About half of these people were of Japanese nationality.

Approximately six hundred guests onboard Diamond Princess were the first to be cleared by the Japanese Ministry of Health and released to disembark the ship on Wednesday. The U.S., Canada, the U.K., and Australia dispatched chartered aircraft to evacuate their citizens.

Several hundred other guests were expected to be cleared on Thursday by health officials.

The ministry’s data shows that a total of 634 people out of 3,063 people from the cruise ship tested positive for the virus.

(Source: World Maritime News, American Shipper, Seatrade Maritime, Shipping Lines' Website)

.png)

.jpg)