Vinalines Set on Joining Global Shipping Alliances

The Vietnam National Shipping Lines Corporation (Vinalines) has set sights on joining the global shipping alliances.

In order to meet this goal, the company plans to focus its efforts on three major fields, those being the development of its port management, shipping, and maritime services, the Vietnam News Agency reported.

Transshipment and boosting cooperation with foreign shipping firms on its deep-water ports would be at the core of the company’s strategy of bolstering its competitiveness and ensuring further growth.

As informed by VNA, the company also aims to modernize its fleet and replace up to 15 old ships, invest in its infrastructure and new berths at the Lạch Huyện Port in Hải Phòng City to receive ships of up to 8,000 TEUs.

Based on the company’s investment plan, Vinalines aims to have a fleet of 80 vessels, with the average age of 10-12 years.

Under the plan, the company’s fleet structure would be comprised of 17 percent of container vessels, 26 percent of tanker vessels and 57 percent of bulker vessels.

Vinalines wants to invest in vessels that range between 80,000 DWT and 180,000 DWT to bolster its coal and iron ore transportation business. When it comes to the container sector, Vinalines’ objective is to keep its position as a leader in container and feeder transport on the domestic market. The firm is also interested in finding partners to build up Intra-Asia container service.

For 2020, the company is targeting to handle about 30 percent of the cargo through Vietnam.

Despite tough market conditions driven largely by geopolitical tensions, Vinalines reported better results for 2019 when compared to a year earlier.

According to Trần Tuấn Hải, head of communications for the company, cited by VNA, the company’s consolidated revenue was estimated at more than VND 12 trillion (USD 518 million), 6 percent above the 2018 figure.

Furthermore, some 106 million tonnes of goods were shipped via its port network last year, 12.9 percent more than in 2018.

The state-owned company is yet to complete its equitization process, the implementation of which saw some bumps on the road last year.

Vinalines secured approval for its equitization plan back in 2018 under which it intends to sell a part of the existing state capital and issue more shares to raise its charter capital.

After equitization, the parent company will have a chartered capital of VND 14.04 billion (USD 614,250), including a state capital of VND 11.9 billion.

Hapag-Lloyd launches remote reefer supply chain monitoring tool

Hapag-Lloyd is adding near real-time monitoring of its reefer containers to their product portfolio: “Hapag-Lloyd LIVE”.

The monitoring tool will increase the transparency of the cold chain by offering customers a number of data sets about the condition and location of their reefer containers. The product will initially be launched to a selected group of customers and will gradually be made available as the reefer fleet of some 100,000 containers is being outfitted with the monitoring devices, Hapag Lloyd said.

“‘Hapag-Lloyd LIVE’ significantly increases the reliability of the global supply chain and the accountability of all parties involved. We are committed to the highest level of transparency by making data available unfiltered and untampered,” said Juan Carlos Duk, managing director global commercial development.

The new solution is a step to further digitalise the supply chain of refrigerated cargo. Customers who use “Hapag-Lloyd LIVE” in the future will benefit from customizable graphic temperature limits, a convenient map mode, and easily downloadable data sets as part of the ‘basic product’.

The data will be conveniently accessible via the customer experience dashboard “Hapag-Lloyd Navigator” which was just launched in December 2019. With Hapag-Lloyd LIVE as a new feature, customers are now able to see all relevant shipment related information at one glance. At roll out, the following data will be made available: Actual temperature set point; Supply & Return Air temperatures; GPS location information; Container Track & Trace Events.

The remote container monitoring devices will be developed by leading supply chain visibility solutions provider Globe Tracker. The transmitters send data whenever the vessel is within mobile network reach – up to every 15 minutes when connected to a power source, otherwise every four hours. The entire reefer fleet will gradually be equipped with the devices, starting with a focus on Europe and South America

Australia Detains Yang Ming Boxship for Pollution Debt

Australian authorities have arrested a Panamax containership owned by Taiwan’s Yang Ming Marine Transport Corp. for a pollution debt that could reach as high as AUD 20 million (USD 13.4 million).

On February 9, the Federal Court Admiralty Marshall arrested the Liberia-flagged YM Eternity at Port Botany after the Australian Maritime Safety Authority (AMSA) petitioned the court to recover the outstanding debt.

The 4,250 TEU YM Eternity is a sister ship of the YM Efficiency, which lost 81 shipping containers off the coast of Newcastle and Port Stephens in June 2018.

According to AMSA, Yang Ming has refused to pay for the clean-up of the remaining pollution including the containers and their contents which have been located on the seafloor off the coast of Newcastle. 60 containers have been identified, five containers have been recovered while a further 16 are still missing.

In December 2019, AMSA signed an AUD 15 million contract with Ardent Oceania to begin the clean-up operation for those 60 containers. To begin in March 2020, work is expected to be completed within a month.

AMSA Chief Executive Officer Mick Kinley pointed out that the arrest of YM Eternity shows that AMSA “will not allow international shipping companies to pollute our waters without consequence”.

“If you pollute our waters and refuse to pay the price of cleaning up that pollution, we will hold you accountable. Our ocean won’t pay the price of Yang Ming’s pollution – Yang Ming will,” Kinley said.

The anticipated cost to locate and clean-up the remaining missing 16 containers is up to a further AUD 5 million, bringing Yang Ming’s debt to AUD 20 million.

The YM Eternity was also detained by AMSA in July 2019 in Sydney for the same systemic failure to safely stow and secure cargo that led to the YM Efficiency container spill.

COSCO, OOCL, ONE and Yang Ming to Set Up New Transatlantic Service

Asian shipping giants COSCO Shipping Lines, Orient Overseas Container Line (OOCL), Ocean Network Express (ONE) and Yang Ming are to launch a new weekly Transatlantic service, the new East Mediterranean – America service (EMA).

As informed, the first voyage is scheduled for April 2020, subject to FMC filing.

To be jointly operated by the four lines, the service will deploy six Panamax vessels.

The port rotation for the weekly service is Mersin – Haifa – Alexandria – Istanbul – Piraeus – Genoa – Algeciras – New York – Norfolk – Savannah – Algeciras – Mersin.

“EMA … will offer competitive transit times and provide more service frequencies in the market,” the companies said.

“By including Genoa and Algeciras port calls, the four lines will also engage in Genoa and Algeciras west bound service and provide diverse intra Mediterranean services through multi-stage utilization of the service.”

Evergreen Line Defends Shipbreaking Practices

Evergreen Line once again emphasizes that its ship demolition and recycling policy requires the shipbreaking yard selected by all buyers of its decommissioned vessels must be not only ISO certified (ISO 9000, 14001, 18001 or 30000), but also implement class approved standards of the 2009 Hong Kong Convention (HKC). The Convention comprises the control and regulation of vessel’s entire service life from design, construction, operation to recycling. It aims to enhance safety in the ship recycling industry, maintain environmental protection standards, reinforce regulation of ship design, construction, operation and demolition and, in particular, raise the environmental protection standards of ship recycling facilities. Despite the Convention as yet not being officially in force, Evergreen insists on the adoption of such stringent standards in order to ensure the decommissioned vessels being scrapped in a safe and eco-friendly manner.

It is also noteworthy that Evergreen recently strengthened its contracts by adding a liquidated damage clause into the memorandum of agreement (MOA), which makes it carry heavier weight and deterrent effect for any buyer who is non-compliant. Notwithstanding that, if it is found that recycling of any of the company’s vessels does not fully comply with the stated standards, Evergreen will take all necessary actions to safeguard its values of its green recycling policy.

A case in point is the scrapping of Ever Unison. Evergreen currently planning to launch arbitration proceedings against the buyer for breaching the obligation, under the terms of the MOA, to scrap at a HKC green shipyard. Evergreen is also considering to seek an injunction from the High Court to prevent vessel being demolished at its current location.

Commentary: Will coronavirus impact trade flows long-term?

According to MarineTraffic AIS data, the median time at anchorage at Chinese ports in the first week of February is 1.4 days. “The data now shows a sharp decline in port traffic at Wuhan in the first six weeks of 2020 when compared to the same period last year,” explained Georgios Hatzimanolis of MarineTraffic. “In the last seven days, the port saw just five arrivals and seven departures (all vessel types), compared to 72 arrivals and 47 departures in the same week last year. Chinese New Year always sees a slowdown but looking at the year-on-year data this drop is considerable.”

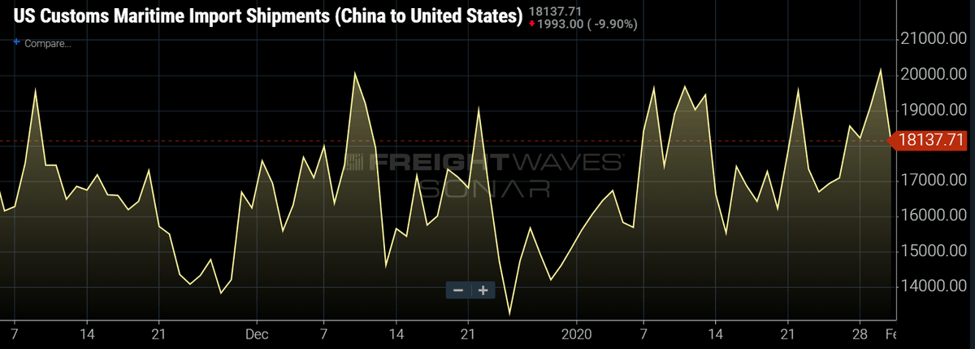

In times of uncertainty and fear, there is one flame of truth that is often overlooked. That is the flow of trade. The movement of containers, cargo and energy along the vast ocean highways is the ultimate indicator of trade truth, and the best diagnostic tool of a country’s economic health. The flow of trade is now showing how special pathogens like the coronavirus will impact both the maritime and intermodal sectors.

The flow of trade is simple supply and demand. Less trade moving means less volumes being transported. That translates into money. The reported slowing of turnaround times at the Chinese ports coupled with the increase in blank or void sailings as a result of the coronavirus, point to a decrease in the flow of trade. Ocean containers from Wuhan, China to the United States represent $15 million in merchandise weekly. A total of 37,000 containers valued at $3.5 billion is traded weekly between the U.S. and China.

To put this possible impact into perspective, we need to know historically how much trade flows into the U.S. ports after the Chinese New Year (CNY). Collectively, the Port of Long Beach and Port of Los Angeles receive the largest amount of exports from China. “Typically, we see volumes drop 5% from one month to the next during the holiday break,” explained Noel Hacegaba, deputy executive director at the Port of Long Beach. “We normally see a recovery in cargo volumes in the weeks that follow. If the coronavirus keeps factories in China closed, the recovery in cargo could be delayed.”

The delay compounds the existing problem that U.S. ports have – a continued decrease in Chinese exports because of the trade war. Phase One may have been signed, but given the magnitude of the coronavirus, the “natural disaster” clause in that deal could be enacted. In order for this to happen China would have to “consult” with the United States. If agreed to, China would have some wiggle room in reaching its import targets. Also do not forget the $350 billion in tariffs that are still levied on Chinese products entering the United States. The clause and tariffs would have an impact on intermodal volumes.

Before the trade war, the Port of Los Angeles and Port of Long Beach traditionally saw a bump in volumes ahead of the Chinese New Year. This year there was no pre-holiday bump. That translated into less cargo moved through the intermodal system.

Any post-holiday “bump” this year however will be delayed but is anticipated to be larger. “If U.S. consumer demand for Chinese goods remains the same, cargo volumes will simply be deferred,” said Hacegaba. “However, some goods whose value is time-sensitive – such as seasonal goods – could be impacted.”

Port of Long Beach and Port of Los Angeles: volume post-Chinese New Year (month-to-month % change) – Source: Port of Long Beach, IHS Markit

2017 (CNY = 01/28/2017): 15.15%

2018 (CNY = 02/16/2018): 14.62%

2019 (CNY = 02/05/2019): 13.36%

Hacegaba continued, “We estimate that for each additional week that factories remain closed beyond the traditional holiday break, we could see our cargo volumes decline by 1% of our annual throughput. To put that in perspective, 1% of our 2019 China cargo volumes is approximately 76,000 twenty-foot equivalent units (TEU). In the worst-case scenario that all cargo from China suddenly stops, we are talking about an economic impact of $1 billion per day. This would represent the worst-case scenario because it assumes that all services calling on our Port from China would be suspended.”

Deleting 1% of 2019 cargo volumes from the Port of Los Angeles equates to 93,000 TEU. In 2019, total Chinese goods arriving at the Port of Los Angeles were valued at $300 billion.

Hacegaba cautioned while the port’s management do not expect the worst-case scenario to play out, they continue to monitor developments and remain in close contact with their customers and supply chain partners.

U.S. ports can plan for anticipated volumes of Chinese exports based on the incoming port calls. So far, carriers Hapag Lloyd, CMA CGM and Maersk have announced blank sailings because of the hit in demand as a result of the coronavirus. This decrease in demand can easily be tracked by the Freightos Baltic Index.

So, when will the U.S. ports and intermodal system begin to see the trickle-down impact? Port of Long Beach Director Mario Cordero said his estimate is the later part of February and early March. “Before the coronavirus we were hoping to see some normal balance post-Lunar New Year,” explained Cordero. “Now we won’t. The coronavirus will have an impact on all facets of the supply chain. Everyone depends on point of origin. This virus has closed manufacturing plants, and this will create a domino effect.”

At the Port of Long Beach, 25% of all containers move by on-dock rail. The containers leave the port on a train. Any slow-down in cargo would affect all modes of transportation across the entire supply chain.

“The overall impact of the coronavirus could be catastrophic on the heels of last year’s more modest year due to the trade war with China,” cautioned Weston LaBar, CEO of the Harbor Trucking Association. “U.S. exports out of the Port of Los Angeles have been down for 14 consecutive months because of the trade war. West Coast ports have also seen fewer Chinese imports. The coronavirus now just adds to the uncertainty of volumes.”

The closing of the manufacturing plants in mainland China is also impacting some manufacturing plants in neighboring countries that are tied to China.

“Thread, labels and boxes are items that are ordered on an ‘as needed basis’,” explained Rick Helfenbein, former CEO of the American Apparel & Footwear Association and now an independent consultant. “Apparel makers may have the raw materials to make their items, but they might run out of the products needed to put their items together or ship them. You also have managers from China not able to travel to plants outside of their country. This is more than a Chinese manufacturing problem.”

This can add to the further slowing down of product movement.

“Almost on cue, the coronavirus is dampening a fragile positive outlook,” explained Jeff Tucker, CEO of Tucker Company Worldwide. “If the virus, or any other significant headwinds hit trucking for much longer, I believe we will see a culling of the nation’s fleet. Carriers and drivers will be forced to leave the industry. Market forces don’t spare anyone, and don’t care how large your top line is. Everyone is at some risk when the market decides it will turn down.”

Tucker cautioned those companies and owner-operators with heavy spot market exposure would be impacted first.

Cordero warned while the ports and intermodal system have been dealing with trade uncertainty for years, the coronavirus has brought unpredictability to a whole new level. “This now escalates the uncertainty to chaos when it comes to the supply chain.”

Container lines hit with $300m - $350m weekly revenue loss from coronavirus

Container lines are taking an estimated revenue hit of $300m - $350m as they blank sailings due to the impact coronavirus in China according to analysts Sea-Intelligence.

In its weekly newsletter SeaIntel highlighted that with the extended closure of Chinese factories extremely low levels of exports were forcing the mass cancellation of sailings.

According to the analyst in a “very short period of time” lines had blanked an additional 31 sailings on the transpacific and Asia – Europe trades due to the coronavirus, on top of existing cancelled voyages over the lull of Chinese New Year.

On the transpacific some 21 sailings had been blanked equating to 198,500 teu of capacity, these came in addition to 61 voyages cancelled over Chinese New Year.

On the Asia – Europe trade, where larger vessels are deployed, 10 additional sailings were blanked taking out some 151,000 teu of capacity. Lines had already blanked 51 sailings over the holiday period on the Asia – North Europe/Med trade.

In real terms for container lines this will equate to a substantial hit on revenues. “In very round numbers, we are experiencing a shortfall of some 300,000 - 350,000 teu per week in the market. Again, in very round numbers, if this is at average rate levels of around $1,000 per teu it equals a revenue shortfall for the carriers of $300-350m per week,” SeaIntel said.

For shippers using backhaul trades the result could be the shortage of capacity in the weeks to come and also therefore increased rates.

“The rapid mass-cancellation of additional sailings have a high likelihood of causing capacity shortages for back-haul shippers 3-6 weeks into the future, depending on geography. Back-haul shippers should therefore now prepare not only contingency plans for potential capacity issues, but also for significant price spikes,” the report said.

Sand: When China Sneezes, We All Catch the Flu

The outbreak of the novel coronavirus has dented market sentiment and spooked markets around the globe, according to BIMCO’s Chief Shipping Analyst, Peter Sand.

The ongoing outbreak that originated from Wuhan, Hubei in China, a major transportation and logistics hub, has seen stringent quarantine measures implemented across China and its neighboring countries.

Travel activities have been reduced and factory closures have been extended with expected production losses in the first quarter of 2020.

“When China sneezes, we all catch the flu. This especially holds true for the commercial shipping markets, which remain heavily reliant upon China, both on the import and export side,” Sand added.

The virus spread coincides with the Chinese Lunar New Year (CNY), which marks the traditional low season for shipping markets. Even though it still may be too early to predict the exact effect of the outbreak, an extended shutdown of China is expected to temporarily cripple the shipping markets and hit hard on freight rates.

Based on the latest update from the World Health Organization (WHO), globally 37, 558 infection cases have been confirmed around the globe, with 37, 251 confirmed in China.

Out of these, 6,188 severe cases have been diagnosed and the death toll has risen to 812, with only one death recorded outside China, i.e., in the Philippines.

“The virus illustrates just how dependent the world has become upon China with many supply chains deeply embedded into the country. Anecdotal evidence suggests that South Korean car manufacturers have started to reduce output due to supply shortage of Chinese goods,” Sand explained.

Container shipping

When it comes to container shipping, consumer spending, associated with CNY celebrations, has certainly taken a substantial hit, which is not likely to be made up for. The same goes for the consumption of oil which took a tumble amid the lockdown of large parts of the transport system.

“Advanced economies’ imports of manufactured goods from China remains the main driver of container shipping with seven out of the ten largest container ports located in China. Wide-spread factory shutdowns result in a slowdown of manufacturing and industrial production. The intra-Asian container shipping market, the largest in the world, will be the first trades to feel the fallout from the coronavirus if intra-Asian supply chains are disrupted. Secondly, the long-haul trades to North America and Europe will be affected,” Sand said.

“Extended blanking of sailing (meaning cancellations, ed.) by global liner companies have been the first measure taken to ease the pressure of low demand. But if goods are not produced at all, the short-term alternatives do not exist. Medium-term alternatives will rise fast though, meaning alternative producers of the goods, just as we have seen as an effect of the ongoing trade war between the US and China.”

Dry Bulk

Chinese imports of dry bulk commodities are the main driver for the dry bulk market and with a slowdown of industrial production in the short-term, the outlook for Q1-2020 is not shaping up particularly well.

Freight rates will stay low, until Chinese merchants get back into the market for the usual commodities, such as grain, coal and iron ore, Sand pointed out.

The traditional dry bulk low season is usually in Q1, and the market tends to rebound post-CNY. Yet, with the coronavirus not under control yet, the slump will inevitably be more protracted, he continued.

The Capesize index fell into negative territory on January 31, 2020 and has continued its descent to reach -133 index points on February 4, 2020. If large parts of China remain under quarantine, it is likely that earnings will continue to drop across the dry bulk segments.

An oil tanker market turned on its head

Speaking of the tanker market, Sand said that the market has been turned on its head in a single month, where VLCC earnings from the Middle East Gulf to China dropped from USD 103,274 per day on January 3, 2020 to USD 18,351 per day on February 3, 2020.

The key reason behind the slump aside to the virus outbreak is the lifting of US sanctions for a lot of Chinese-owned oil tankers.

“The outbreak has sent the oil prices on a rapid decline over the past month too and rumor has it that the Organization Of the Petroleum Exporting Countries (OPEC) is scheduling an emergency meeting in February to discuss production cuts in an effort to establish a floor under the dipping prices,” Sand added.

Commenting on the shipyards, BIMCO expects to see an effect as well, especially with regard to retrofits of scrubbers, ballast water treatments systems etc.

While the situation remains fluid, general expectations are for the outbreak to be contained and subside towards the summer months, with the global economy returning to gradual growth in the second half of 2020. If this outbreak turns out to be like similar ones in recent history, it will likely cause a temporary blip in economic growth in China and the rest of the world, Keppel Capital said in a commentary on the situation.

“As the virus continues to spread, the short-term consequences are clear: demand and freight rates are dropping,” Sand added.

“With past epidemics, the markets have rebounded sharply in a matter of months, so the question is essentially about how long China will stay locked down in a quarantine?”

Update: 66 More Coronavirus Cases Identified on Diamond Princess

An additional 66 cases of Coronavirus have been confirmed on board the cruise ship Diamond Princess currently harbored in Yokohama, Japan while under quarantine.

The infected passengers are from Australia (four), Canada (one), England (one), Japan (45), Philippines (three), Ukraine (one) and USA (eleven), Princess Cruises, owner of the vessel said in an update.

Following confirmation of a case of 2019-nCoV on February 5, all crew and passengers are being quarantined for a 14-day period on board the vessel, asked to stay in their cabins and to wear a mask when leaving their cabin.

To remind, last week 10 people tested positive for coronavirus onboard the cruise ship, after a health screening conducted by the Japanese Ministry of Health.

According to the World Health Organization (WHO), the crew and passengers are closely followed-up and are medically examined and tested for 2019-nCoV when displaying any signs or symptoms suggestive of 2019-nCoV disease.

The quarantine period is scheduled to come to an end on 19 February.

WHO added that all individuals testing positive were disembarked and admitted for medical care in infectious disease hospitals in the Yokohama area.

“Close contacts of the infected passengers are asked to remain in quarantine for 14 days from the last contact with a confirmed case. Thus, the quarantine period will be extended beyond the February 19 as appropriate only for close contacts of newly confirmed cases,” the organization said.

Epidemiological and environmental investigations are ongoing, WHO added.

“We are following guidance from the Japan Ministry of Health on plans for disembarkation protocols to provide medical care for these new cases,” the company said.

“Since it is early in the quarantine period of 14-days, it was not unexpected that additional cases would be reported involving individuals who were exposed prior to the start of the quarantine.”

The company added that the Japan Ministry of Health has been the lead public health authority defining the testing protocols for all guests and crew on Diamond Princess, adding that questions on the timeline, test results, and reporting protocols should be directed to them.

Cruise Lines International Association (CLIA) has stepped up its safety protocols as a response to recent developments concerning the 2019-novel coronavirus outbreak and its impact on the global cruise industry.

CLIA Members are to deny boarding to all persons who have traveled from, visited or transited via airports in China, including Hong Kong and Macau, within 14 days before embarkation.

CLIA Members are to deny boarding to all persons who, within 14 days before embarkation, have had close contact with, or helped care for, anyone suspected or diagnosed as having Coronavirus, or who is currently subject to health monitoring for possible exposure to Novel Coronavirus.

CLIA Members are to conduct preboarding screening necessary to effectuate these prevention measures. Enhanced screening and initial medical support are to be provided, as needed, to any persons exhibiting symptoms of suspected Novel Coronavirus.

“In coordination with cruise lines, medical experts and regulators around the world, CLIA and its member lines will continue to closely monitor for new developments related to the coronavirus and will modify these policies as necessary with the utmost consideration for the health and safety of passengers and crew,” CLIA said.

(Source: World Maritime News, American Shipper, Seatrade Maritime, ONE's Website)

.png)

.jpg)