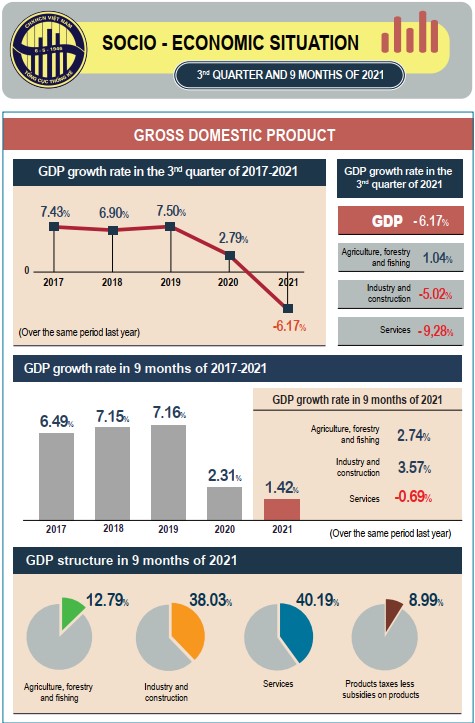

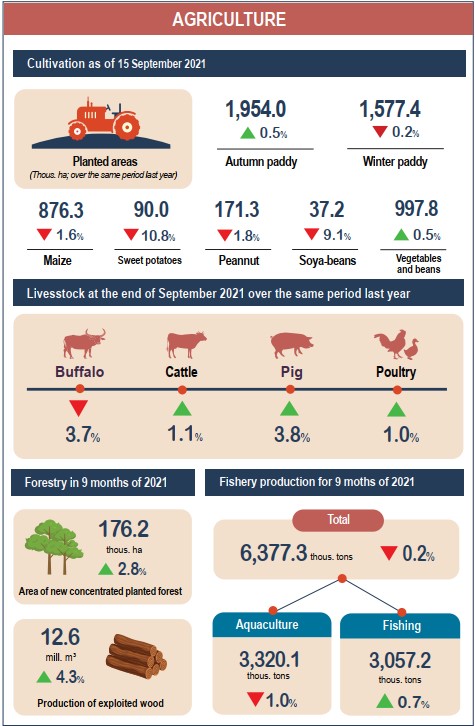

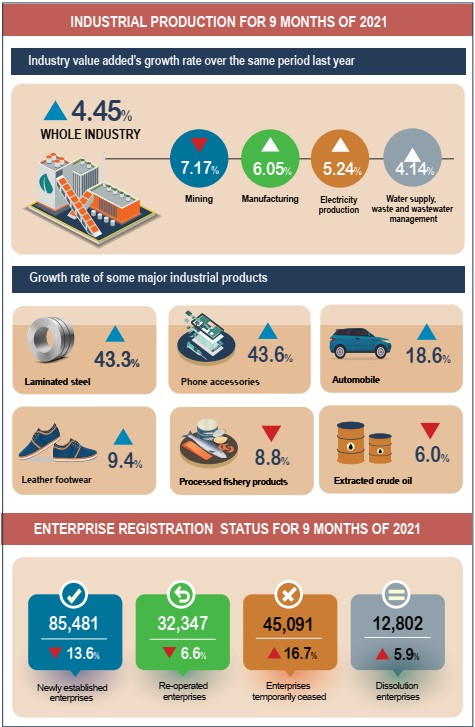

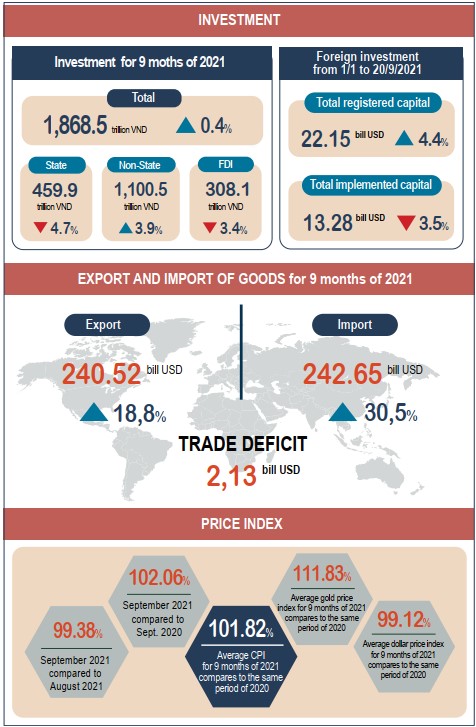

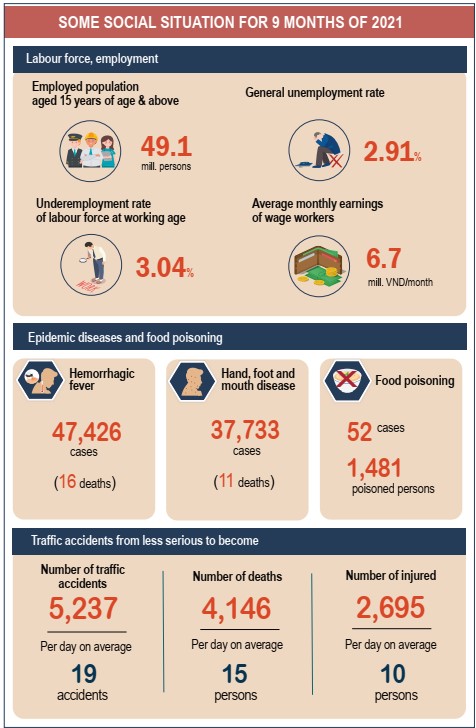

Infographic Social-Economic Situation 09/2021

Source: Vietnam General Statistics Office

Wan Hai Lines holds online ship naming ceremony for new vessels

Wan Hai Lines Ltd. held ship naming ceremonies for WAN HAI 289 and WAN HAI 290, according to the company's release. Due to the COVID-19 pandemic, a physical ceremony was replaced by an online one.

WAN HAI 289 and WAN HAI 290 are the 6th and 7th vessels in a series of 2,038 TEU containerships built by China Shipbuilding Trading Co., LTD., and Guangzhou Wenchong Shipyard Co., LTD.

Wan Hai Lines - a shipping line customer as well as a shareholder of TCIT.

The 2,038 TEU series is designed with LOA 175 m, deadweight capacity of 23,802 mt on 10.5 m draft and a maximum cruising speed of 20.66 nautical miles. The design of 2,038 TEU series takes energy efficiency and environmentally-friendly aspect into account. Moreover, all the ships delivered are certified with “Smart Ship” notations by international well-known classification societies. The newbuildings are part of Wan Hai Lines efforts to ensure their continuous pursuit of fleet upgrade in order to provide most quality service to customers.

WAN HAI 289 will be delivered on September 30th at Guangzhou Wenchong Shipyard. After delivery, she will join Wan Hai Lines’ Japan Kansai-Vietnam Service to provide efficient delivery service among the corridor.

Source: PortNews

Delays and congestion grow at ports in US and Asia

The number of containerships queued at the ports of Los Angeles and Long Beach (LA/LB) eased at the end of last week, however, congestion is growing at other US ports and Asia

The Marine Exchange of Southern California said that the number of vessels at an anchor or drift areas in San Pedro on Friday was 62, down from 70 at the start of the week. There 33 vessels at berth for cargo operations in the ports of LA/LB.

However, the number was expected to rise with in the three days following 25 September 19 containerships expected to arrive at anchorages/drift areas and just 12 moving into berth at port. “So the trend of container ships at anchor or in drift areas should also be up,” the Marine Exchange said on social media.

Meanwhile container line Maersk reported growing congestion at other US ports and in Asia – Pacific. In an Asia – Pacific market update the Danish line said the Port of Seattle was continuing to struggle with available yard capacity with waiting times of 11 – 12 days to berth, and port stays around seven days up from a typical three days.

On the US East Coast it said the Port of Savannah had become increasingly challenging. “There were around 30+ vessels at anchorage with wait times upwards of 7 days in mid-September,” Maersk said.

Meanwhile load ports in Asia – Pacific which have been hit by a combination of extreme weather in the form typhoons and Covid-related closures in recent months are seeing continued congestion. “Operational challenges remain in port operations and the situation is not expected to improve in the immediate future,” Maersk said.

Busan, Shanghai, Ningbo, and Yantian were all reported to have delays of more than three days.

Source: Seatrade-maritime

Shippers hope that more carriers will follow CMA-CGM and Hapag-Lloyd to freeze freight rates.

Increasing market share is a new concern of shipping lines; freight rate freezes are seen as a precursor to a pricing war; Lack of space and equipment remains a major concern for shippers.

The recent announcement of a rate freeze by CMA CGM and Hapag-Lloyd has given shippers hope that many other shipping lines will follow in the footsteps of this event and hope to reduce the possibility of soaring container freight rates in coming time.

Mother vessel of Hapag-Lloyd at TCIT berth.

“To me this is a quick jump on the bandwagon to address deteriorated customer relationships in a longer [term] perspective” said Bilal Khan, Pakistan Enterprise Business Lead of Hash Move digital logistics platform.

"With this new announcement they're are trying to shock the system in hopes of increasing their market share with all this new capacity that they will soon have on their hands," an Indonesia-based freight forwarder about CMA CGM. The company also added that this could be a harbinger of a "pricing war".

Another freight forwarder, based in India, believes that the major shipping lines may have lost some of their customers to small companies and carriers outside the three major alliances. "Now that all these companies are cash rich, one thing they will do is use it against each other--either by buying some companies or cutting their profit margins to challenge the others."

However, schedule reliability remains a top concern for shippers, alongside freight rates.

Peter Sundara, Vice President of Global Ocean Freight Management, LF Logistics, said: “Freezing sharp rate increases via premium and other surcharges is very much welcome but our main concern is how the carriers are going to prioritize releasing space and equipment when we continue to face huge vessel delays and port congestion.”

Sundara added that it is unlikely that the day-to-day challenges will disappear because of this announcement. "It also remains to be seen if the carriers will drive customers to use more of their online quotes which are charged at premium levels and what would likely be the impact of this for 2022."

CMA CGM and Hapag-Lloyd have announced the suspension of short-term rate increases, in the context of freight rates fluctuating at record highs on most shipping routes. While CMA CGM said it would not raise rates until February 1, 2022, Hapag-Lloyd said it would avoid a spike "for the time being."

The German carrier will also limit any sharp increases in warranties and other surcharges, a company spokesman told S&P Global Platts on September 13.

According to Platts data, the current general cargo rate (FAK) on the North Asia to North American West Coast route is at $9,000/FEU, compared to the price with a package of premium fee between $15,000-$22,000/FEU.

Source: Phaata

.png)

.jpg)

.jpg)