YANTIAN PORT IS BACK TO NORMAL, BUT CONTAINER BACKLOG WILL TAKE WEEKS TO CLEAR.

Yantian International Container Terminal (YICT) said it would return to normal operations on June 24, after weeks of disruption due to the Covid-19 outbreak among people coming to work at the port.

Yantian International Container Terminal (YICT), China

Yantian International Container Terminal (YICT) operations fell to about 20% of capacity as the virus spread through the port workforce, causing delays and congestion at ports across the Pearl River Delta, as desperate carriers looked for alternative facilities to maintain the flow of cargo.

Hutchison Ports, which operates YICT, yesterday announced it has "taken proactive measures to stabilize the resumption of normal port operations".

Hutchison Ports added: “Currently, Covid-19 has been effectively under control in the port area, and the operation capacity of the terminals have steadily recovered.”

The company added that as of midnight local time, all ports (including the West Port area) will essentially return to normal operations and the number of trailers carrying cargo queues at the gate will increase to 9,000 vehicles a day, while receiving empty containers and imported containers will continue to operate at normal levels.

Arrangements to be able to receive export cargo containers will return to normal levels within seven days of the vessel's expected arrival date (ETA).

Hutchison added that “Yantian will continue to strictly implement epidemic prevention, control measures and promote production in a safe and orderly manner.”

However, the container backlog at the port could take several weeks to clear as more cargo needs to be exported to meet demand in both the US and Europe.

(Source: The Loadstar)

HAPAG-LLOYD APPLIES PEAK SEASON SURCHARGE FROM EAST ASIA TO USA AND CANADA.

Hapag-Lloyd shipping line informs customers that it will implement the Peak Season Surcharge effective from July 18, 2021.

A mother vessel of Hapad-Lloyd at TCIT berth

Hapag-Lloyd will apply Peak Season Surcharge (PSS) to all dry, reefer, open top (*) and flat rack (**) containers from East Asia to the US and Canada.

The quantum of the PSS surcharge from East Asia to North America (USA and Canada) are as follows:

- 1000 USD for all 20' container types

- 2000 USD for all kinds of 40' container types

East Asia region is defined as the countries/counties of Japan, Korea, China/Taiwan, China/Hong Kong, China (PRC), China/Macau, Vietnam, Laos, Cambodia, Thailand, Myanmar, Malaysia, Singapore, Brunei, Indonesia, Philippines and the Pacific coastal provinces of Russia.

(*) Open Top Container is a type of container without a roof, the top is covered with a tarpaulin.

(**) Flat rack container is a special type of container, used to transport super-heavy goods. There are two main types of flat rack containers: 20-foot and 40-foot.

(According to Hapad-Lloyd)

ONE IMPOSES CONGESTION SURCHARGE FOR REFRIGERATED CARGO SHIPPED TO YANTIAN PORT.

ONE (Ocean Network Express) applies a port congestion surcharge of USD 1,000/container for refrigerated cargo transported to Yantian port.

2 mother vessel of ONE at TCIT berth

Shipping lines have been facing increasing congestion, low productivity and growing export backlogs in southern China that have forced them to temporarily bypass Yantian port due to extended shipping time. time when entering port. For shipping line ONE (Ocean Network Express), the carrier has imposed an additional surcharge of USD 1,000 for refrigerated cargo transported to Yantian.

ONE and Maersk are skipping the port of Yantian in an effort to maintain schedules, as congestion and delays in Europe, the US and Asia are increasing.

Shipping lines are reducing the time to unload containers for export cargo in some ports to three days before the ship's scheduled arrival time (instead of seven days before) and Maersk is predicting the situation will deteriorate. going, as some ports are operating at only about 30% of normal capacity.

Faced with this situation, ONE informed its customers: "Considering the above reasons, ONE may need to adjust its initial shipping plan for refrigerated shipments to Yantian port. lead to an extension of refrigerated storage at the transshipment port or unloading of refrigerated containers at an alternative port without prior notice.

In an effort to not complicate operations and to keep operations as safe as possible in these situations, ONE will encourage customers to consider changing destinations to other alternative ports, especially for time-sensitive goods such as fresh and frozen goods."

At the same time, "ONE has decided to apply a congestion surcharge (CGD) of USD 1,000 per container to cover the costs incurred in connection with the arrangement of shipments and the charges incurred for running electricity, supervision fees, etc. If the shipper requests to change the port of destination (COD), the goods are requested to be unloaded at alternative ports other than Yantian, the CGD and COD fees may be waived.

This measure is effective immediately for all refrigerated shipments to Yantian from June 10, 2021 onwards until further notice."

Meanwhile, the Hong Kong-based South China Morning Post reports that “most of the port operators in Shenzhen and Guangzhou, including Yantian, Shekou and Nansha, plan to maintain decontamination measures, disinfection and strict quarantine at least until next week.”

These measures will delay freight operations further and lead to even more rate increases. Freight rates are expected to hit record levels in the second half of the year.

(According to Phataa)

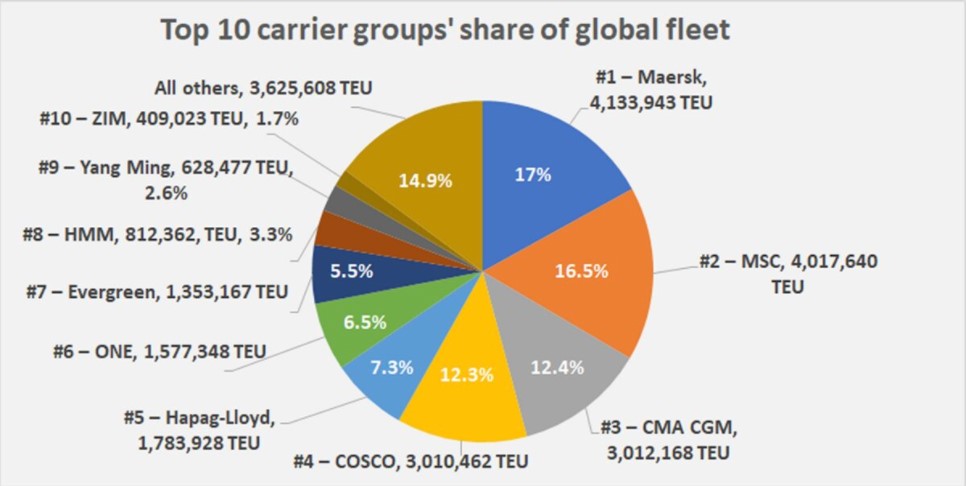

TOP 10 LARGEST CONTAINER SHIPPING LINES IN THE WORLD CONTROL 85% OF THE MARKET

When all the newly-ordered vessels are delivered, MSC will become the world's largest container shipping line and far ahead of other shipping lines.

The extreme consolidation within the container liner sector is the kind of thing owners of tankers and bulk carriers can only dream of. The latest data from Alphaliner highlights the extent of liner consolidation, how soon the rankings will change, and how newbuilding orders will render the carrier arena even more concentrated than it already is.

The top 10 carriers now operate 85% of global shipping capacity. Four groups — Maersk, MSC, CMA CGM and COSCO — control more than half of capacity (58%). The top seven, including Hapag-Lloyd, ONE and Evergreen, control 78%.

TEU = twenty-foot equivalent unit (Chart: American Shipper based on data from Alphaliner)

This base level of fleet concentration is then greatly enhanced by the existence of three vessel-sharing alliances on the mainline East-West trades — 2M, the Ocean Alliance and THE Alliance — which count nine of the top 10 liner groups as members.

(Source: Freightwaves)

COSCO AND OOCL OFFER NEW FAR EASE – MED – USEC LOOP

COSCO Shipping Lines and OOCL have started a new China – Vietnam – US East Coast service which also calls at Piraeus both ways.

The new service, which is branded “AWE6” by COSCO and ‘Vietnam China East Coast’ or ‘VCE’ service by OOCL, was launched without much fanfare, but the first sailing with the 9,469 teu COSCO HELLAS was officially welcomed last week at Cai Mep International Terminal (CMIT).

The ‘AWE6 / VCE’ is expect to turn in eleven weeks using 8,500 – 14,500 teu ships calling at Lianyungang, Qingdao, Shanghai, Ningbo, Yantian, Cai Mep, Singapore, Piraeus, Singapore, Lianyungang.

The Greek call allows the Chinese carriers to use the new loop for the carriage of Asia – Med and Med – USEC cargo as well.

The first sailings were offered with the 9,469 teu COSCO HELLAS, the 13,208 teu OOCL BANGKOK nad the 14,568 teu COSCO SHIPPING ALPS. The 8,501 teu COSCO MALAYSIA will join the ‘AWE6 / VCE’ fleet this week.

Finding the required ships to operate this new long distance loop could be challenging for COSCO and OOCL. Only a few ships have been nominated already for sailings in July and August.

These are currently deployed in the OCEAN Alliance Far East – USWC ‘AAC / VCS / SEA / CC4’, operated by COSCO and no replacement vessels for them have been announced yet. Of note, the OCEAN Alliance partners CMA CGM and Evergreen are not involved in the new ‘AWE6 / VCE’ service.

The China – Vietnam – USEC trade appears to be very strong as three new services have been launched in a short period of time.

The other new loops launched this month are the ‘TP-23 / ZSE’ service operated jointly by Maersk and Zim (with MSC taking slots) and the standalone ‘AA7’ service operated by Wan Hai Lines.

(Source: Alphaliner)

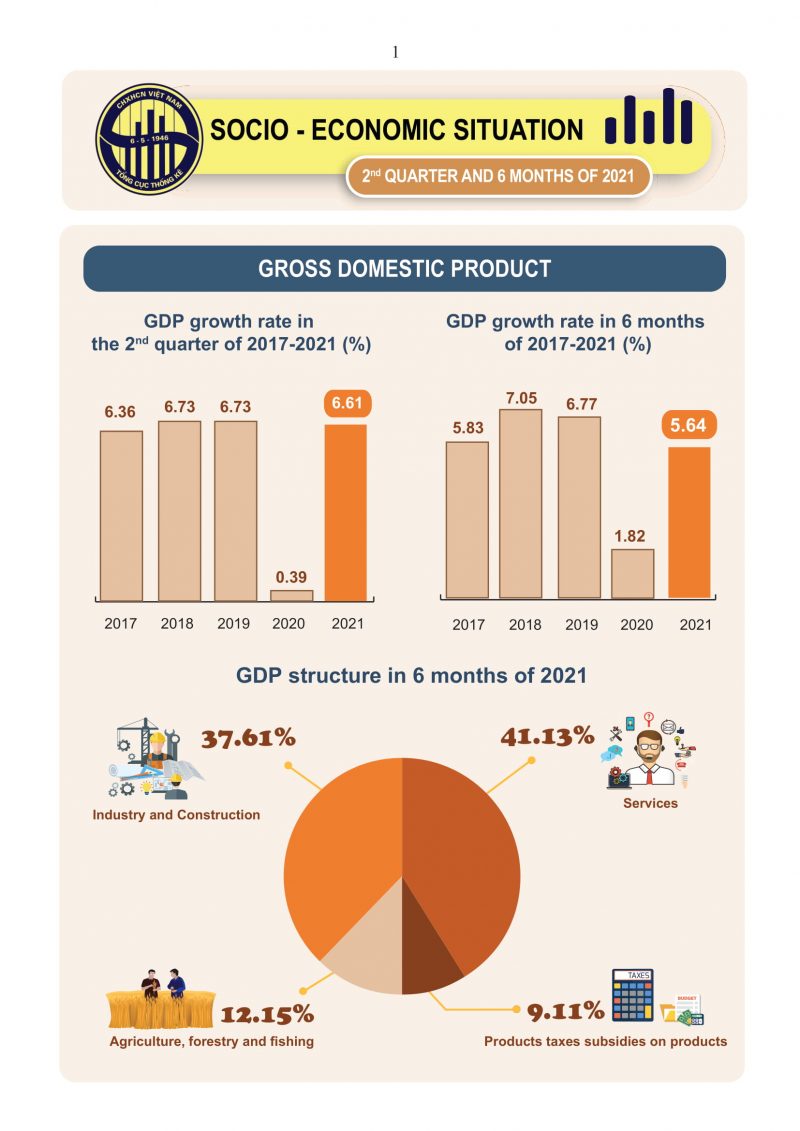

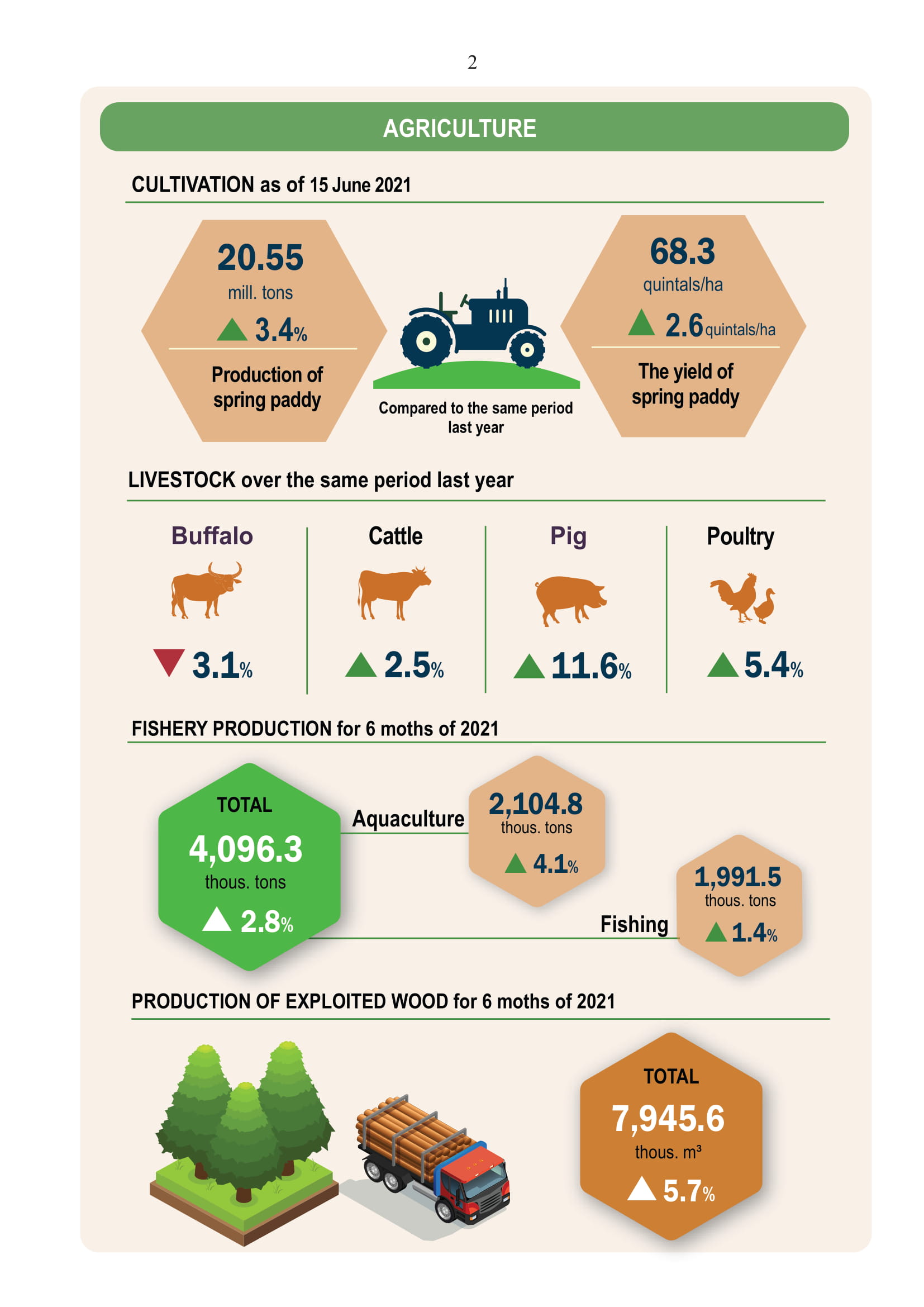

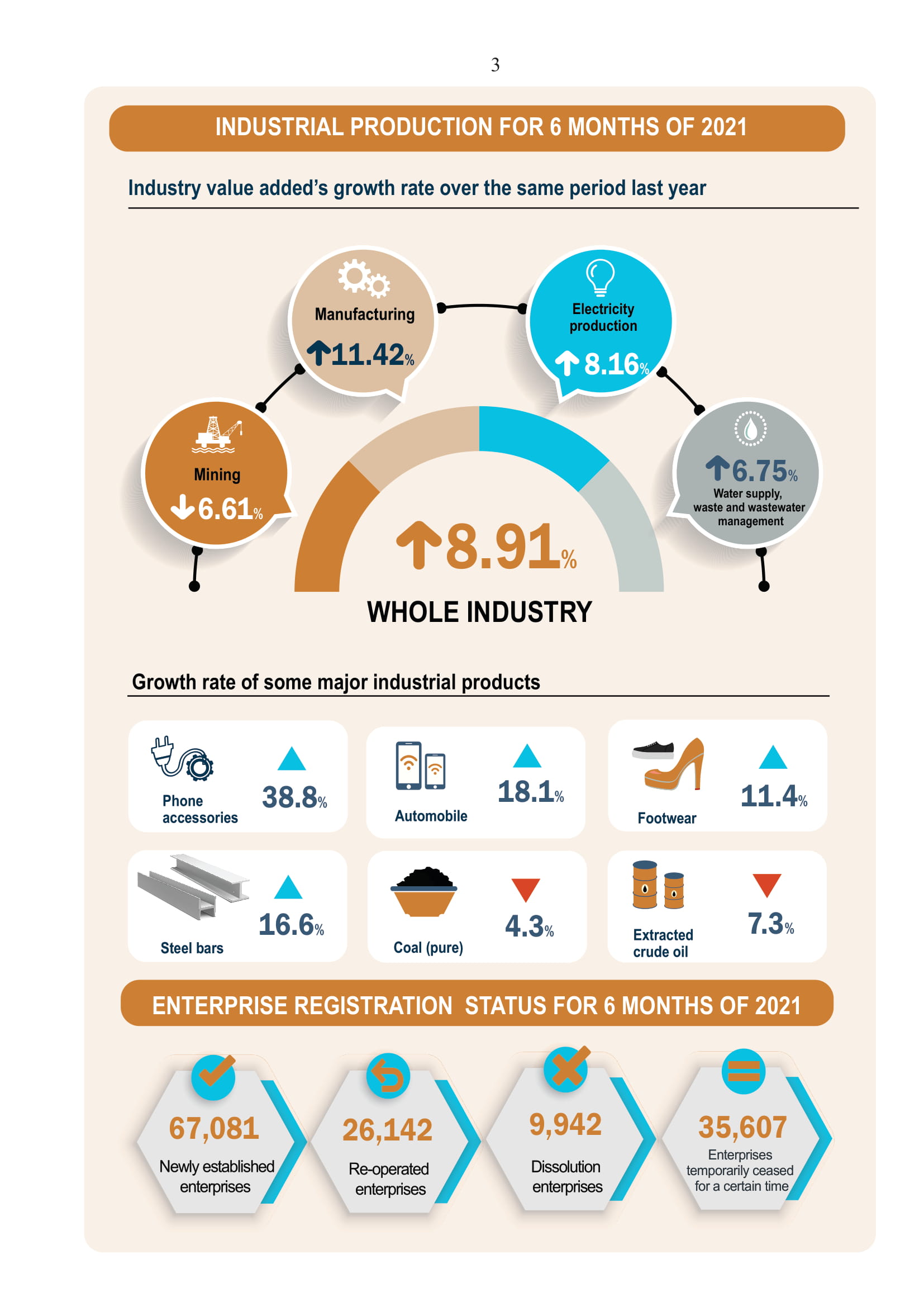

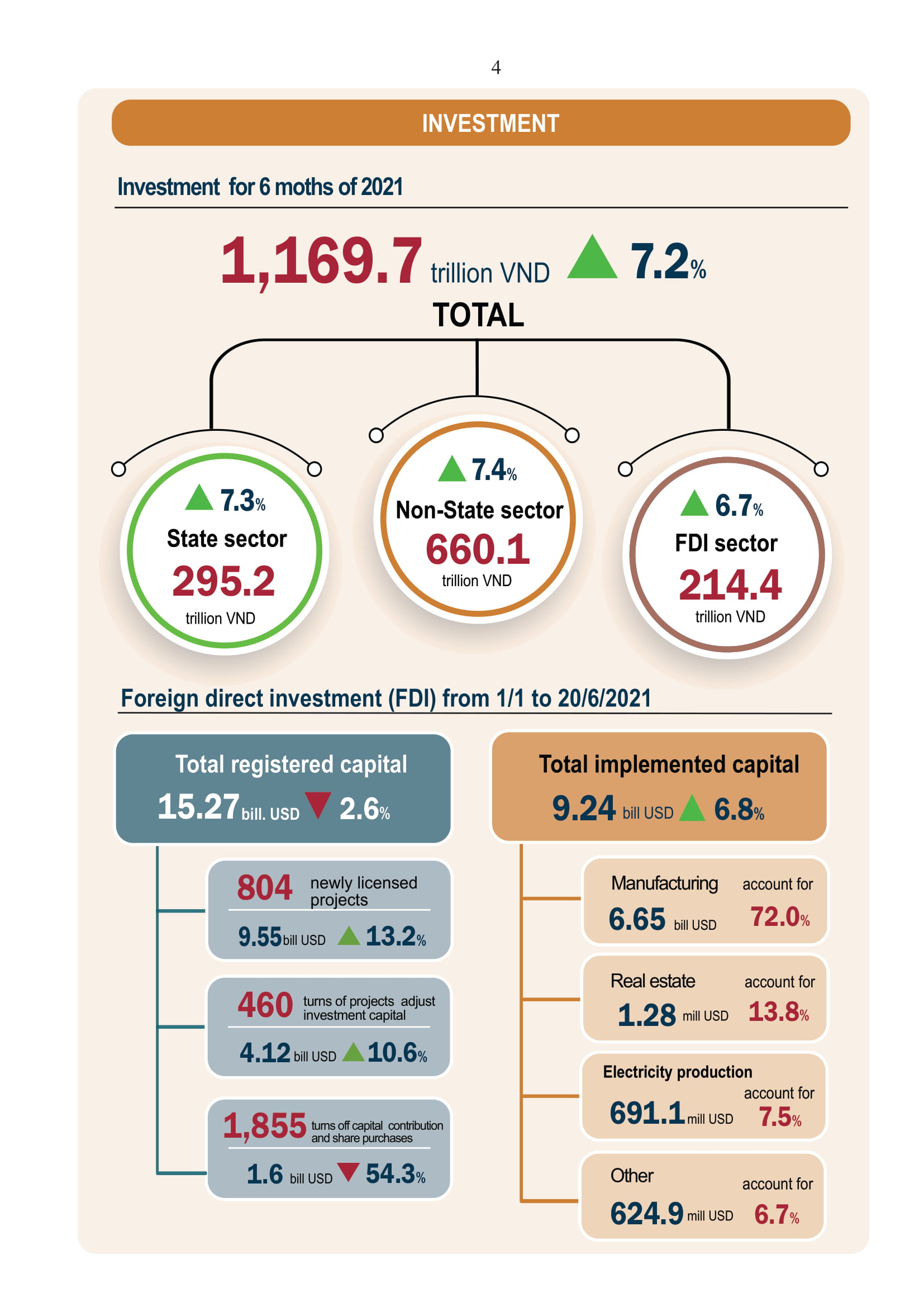

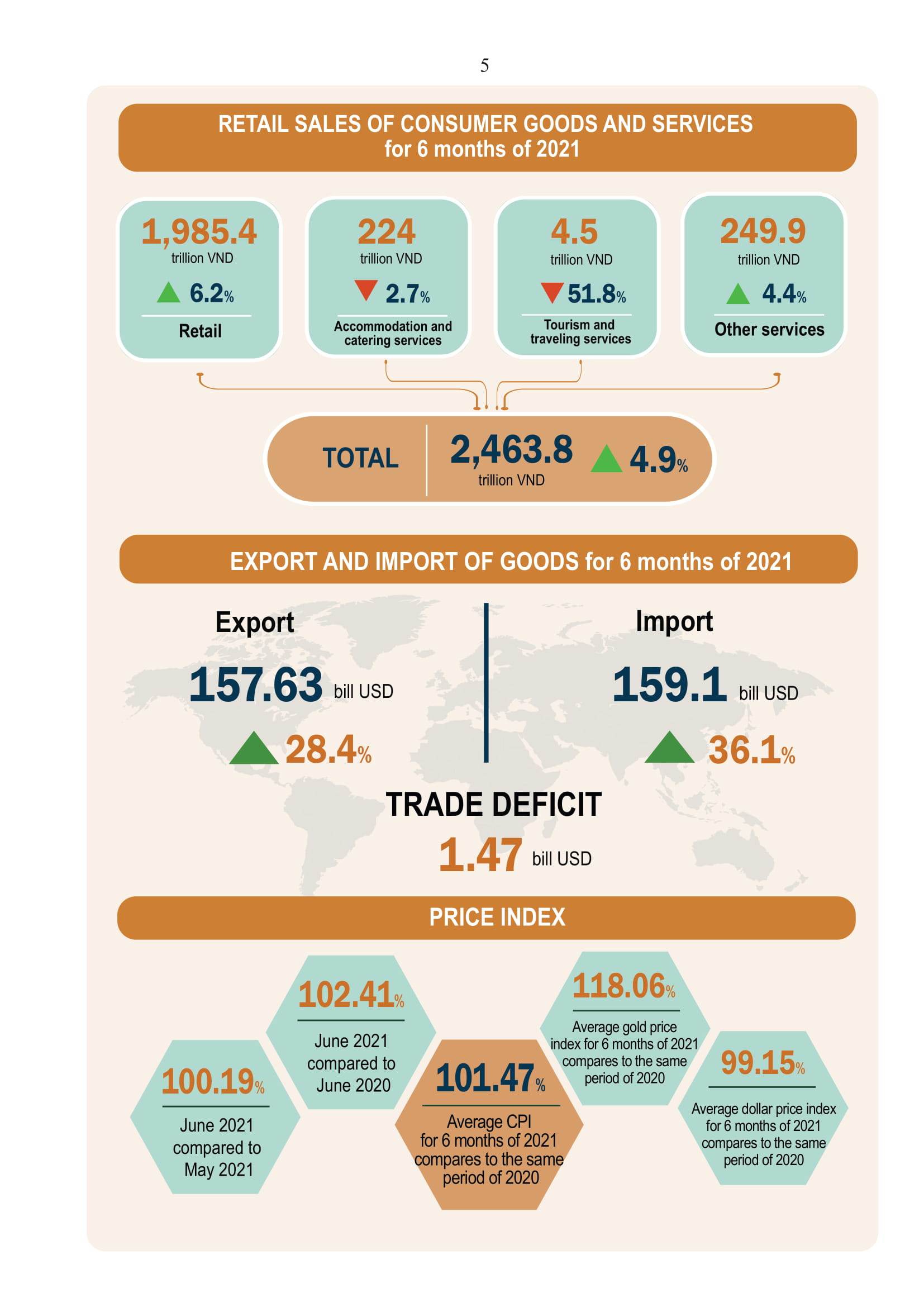

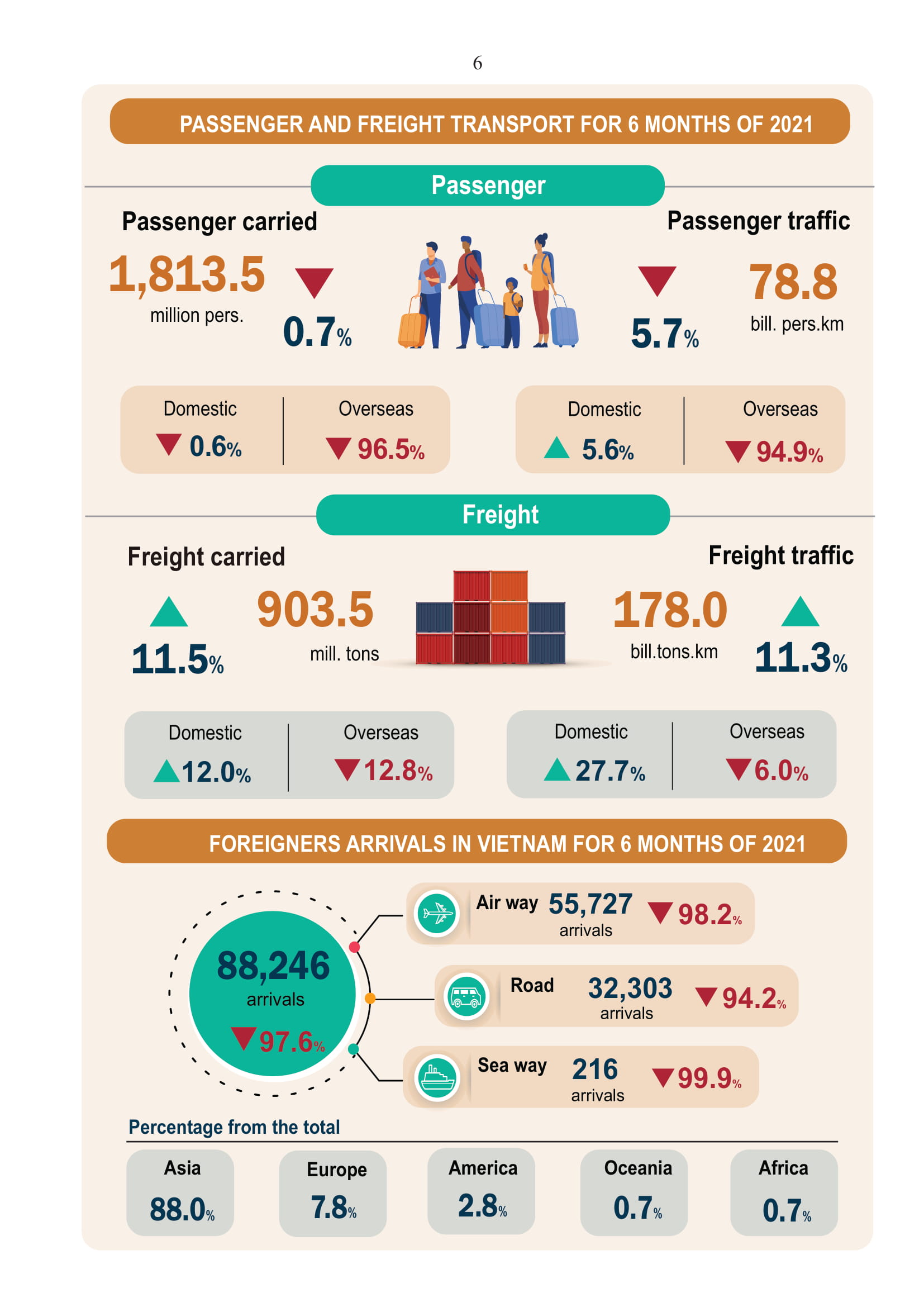

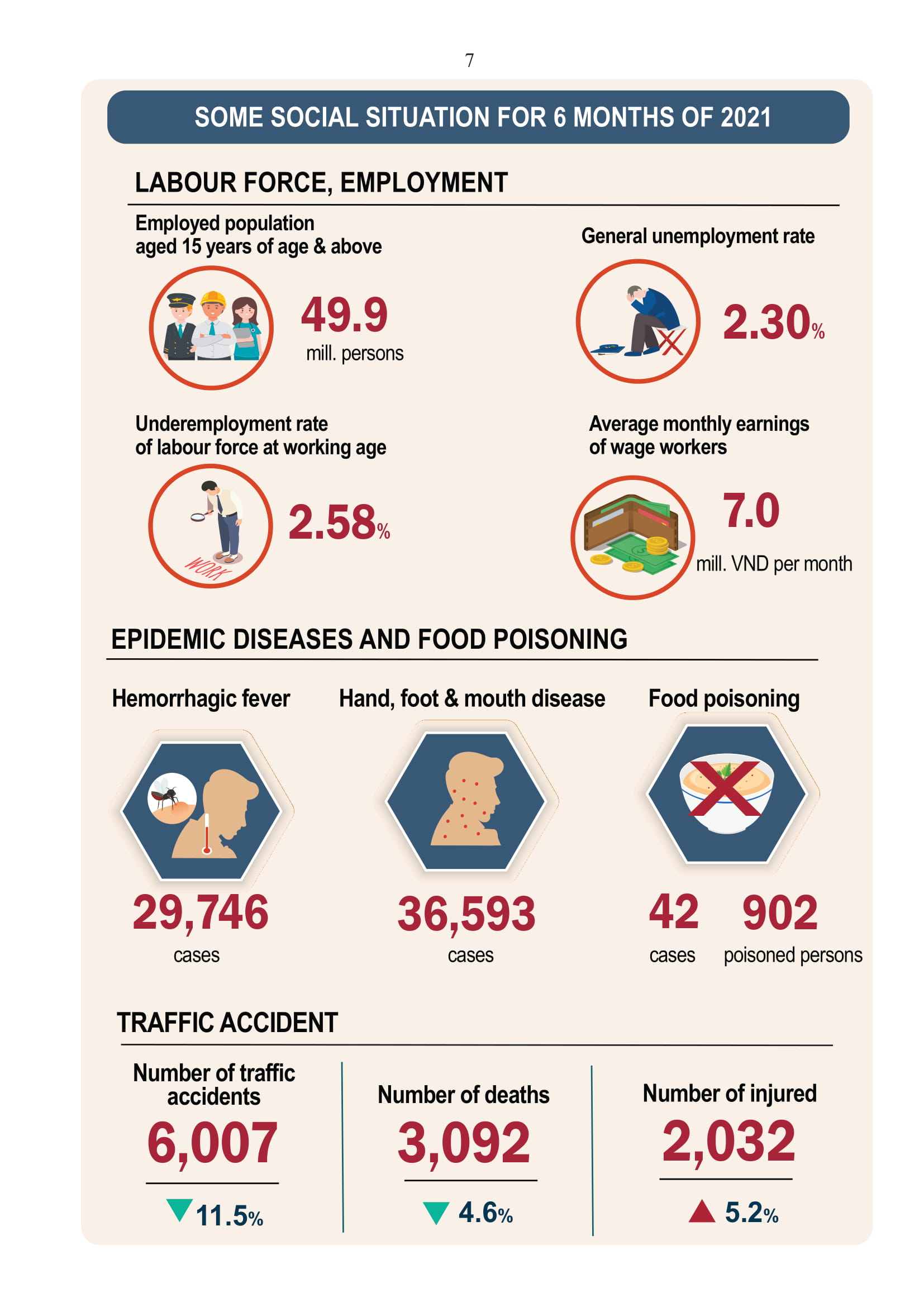

VIETNAM’S INFOGRAPHIC SOCIAL-ECONOMIC SITUATION IN THE SECOND QUARTER AND 6 MONTHS OF 2021

.png)

.jpg)

.jpg)