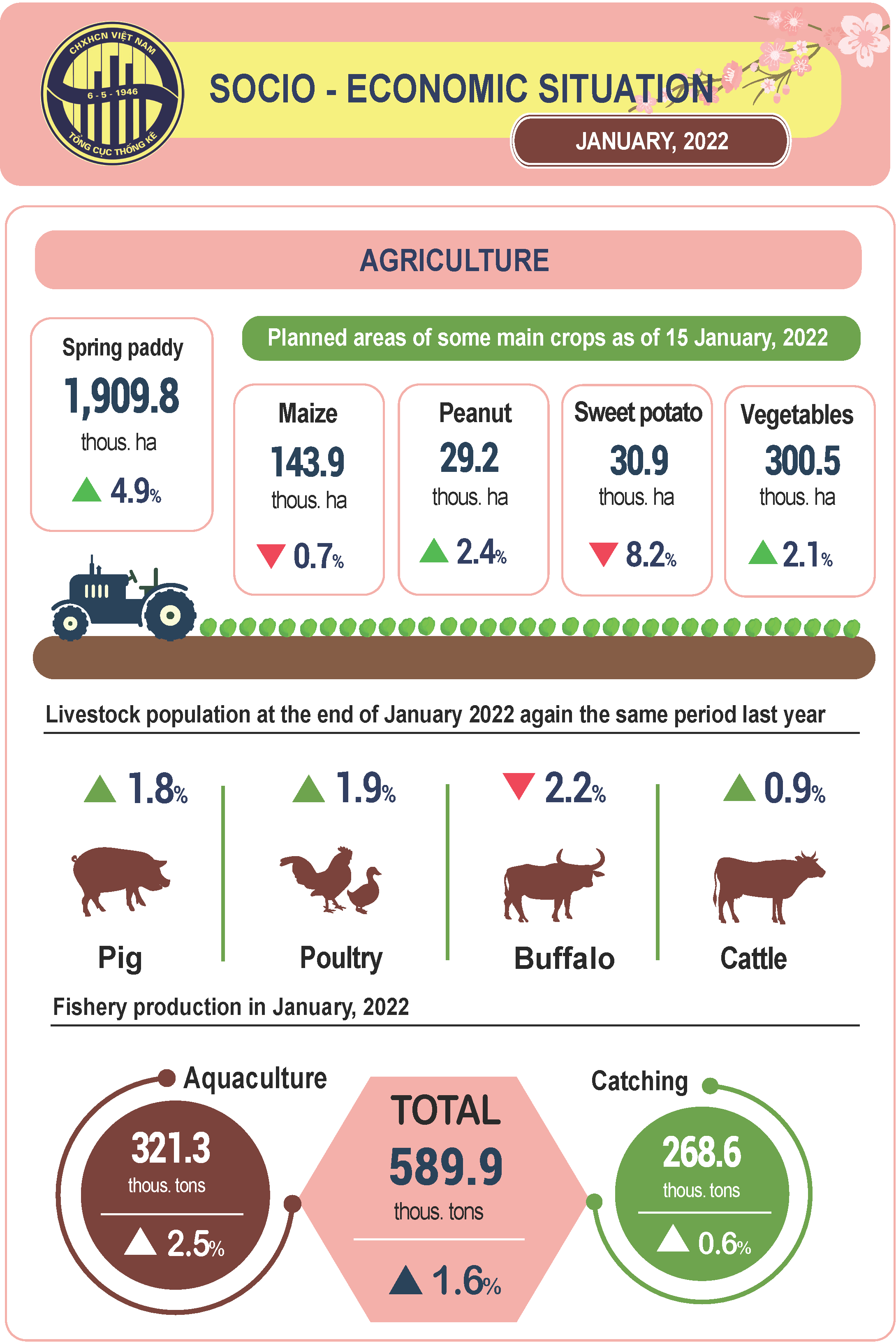

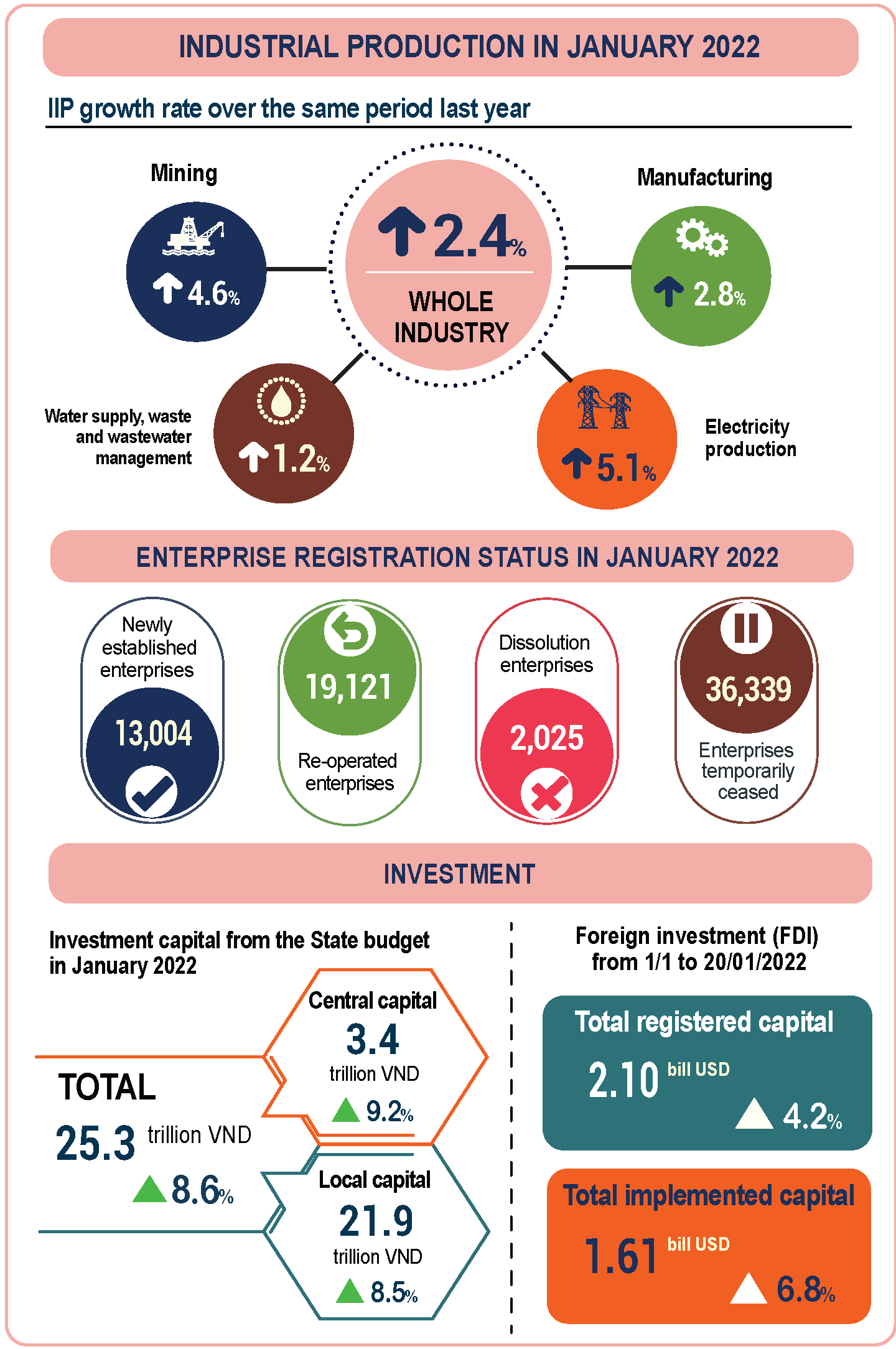

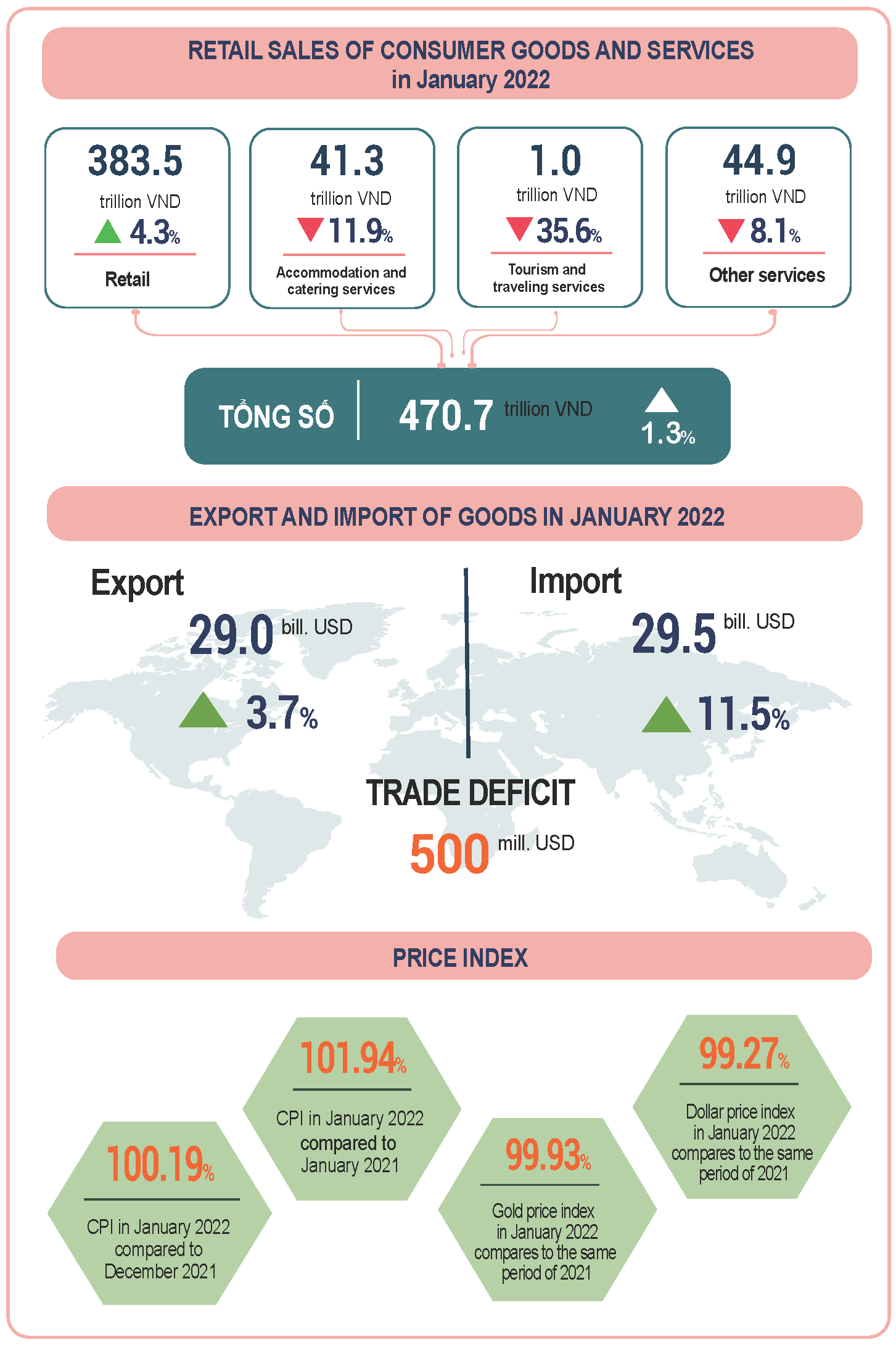

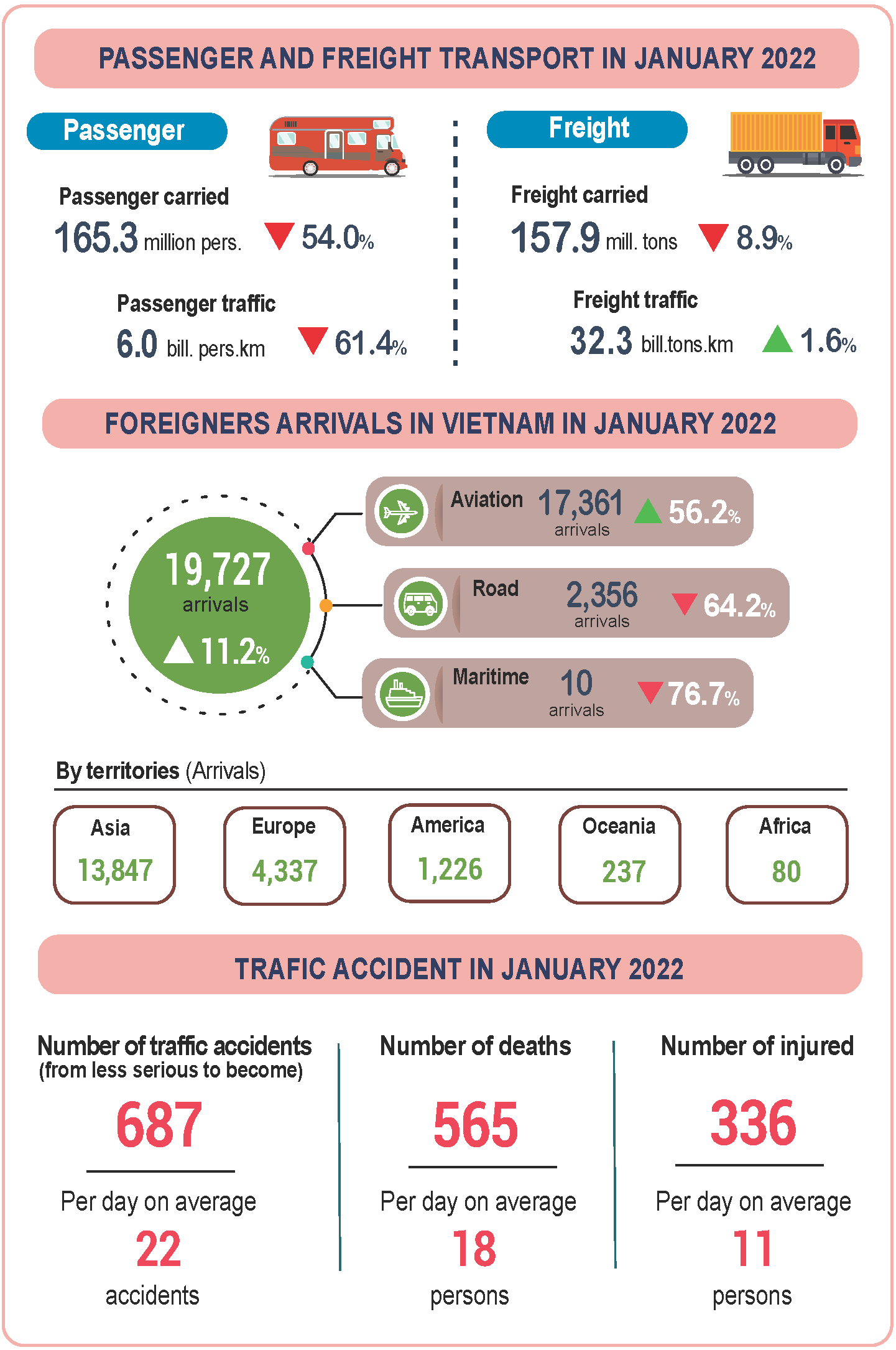

Infographic Vietnam’s social-economic situation in January of 2022

(Source: Vietnam General Statistics Office)

Hapag-Lloyd’s profit rises sevenfold in 2021

Preliminary figures from container shipping line Hapag-Lloyd show pre-interest and tax profit of $11.1 billion for the whole of 2021, up sevenfold from $1.5 billion in 2020.

Hapag-Lloyd’s mother vessel at TCIT

Preliminary data for the fourth quarter from container shipping line Hapag-Lloyd showed EBIT (Earnings Before Interest and Taxes) of $11.1 billion for the whole of 2021, a sevenfold increase from 1.5 billion USD in 2020. Meanwhile, EBITDA (Earning Before Interest, Taxes, Depreciation and Amortization) has been increased 4 times over the same period from 3.1 billion USD in 2020 to 12.8 billion USD in 2021.

Profits increased strongly despite shipping volume remaining stable at 11.9 million TEUs in 2021 compared to 11.8 million in 2020. However, freight rates have increased by nearly 80% from 2020 to in 2021, from 1,115 USD/TEU to 2,003 USD/TEU. This helped increasing revenue to $26.4 billion in 2021 from $14.6 billion in 2020.

“The main drivers of these positive business developments have been significantly improved freight rates resulting from very strong demand for goods exported from Asia. At the same time, the major disruptions in global supply chains have led to a significant increase in transport expenses,” Hapag Lloyd said in a press release.

The margins of the major container lines have benefited from supply chain disruptions as congestion and delays at ports have reduced vessel capacity and disturbed the flow of empty container equipment, resulting in freight rates increased.

Hapag-Lloyd will release its 2021 Annual Report including audited figures and outlook for 2022 on March 10, 2022.

(Source: Seatrade Maritime News)

Global supply chain bottlenecks due to lack of containers still remain

According to the economic survey released by the Finance Minister of India for the period 2021-22, global supply chain congestion due to lack of containers will remain for the foreseeable future.

Indian Finance Minister Niramala Sitharaman presented the Pre-Budget Pre-Budget Economic Survey for 2021-22 in Parliament to give an insight into the economic state of the country.

According to the survey, India's Gross Domestic Product growth is forecast to pick up between 8% and 8.5%, based on the assumption that "there will be no more debilitating pandemic related economic disruption, a normal monsoon, significant withdrawal of global liquidity, average global oil prices in the range of US$70-US$75, and global supply chain disruptions easing over time."

Supply chain bottlenecks due to lack of containers in ocean freight and rising freight costs will remain for some time, the survey said.

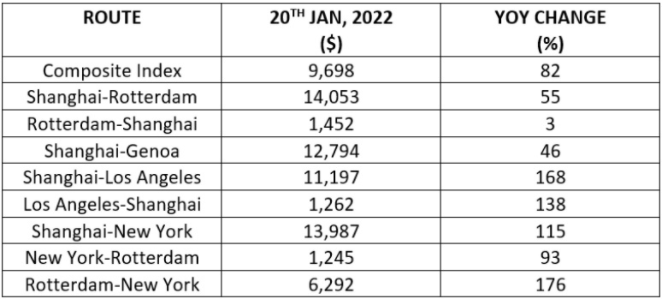

Additionally, the survey highlighted the container shortage as reflected in the Drewry container freight index, at $9,698.33 per 40-foot container as of January 20, 2022.

This is $6,656 higher than the five-year average and 82% higher than a year earlier. The prolonged period of higher rates shows that the disruption in the international container shipping market is far from over and will continue to impact commercial ocean freight.

Freight rates for major international sea routes tend to increase in the same period.

Container freight rates tend to increase in the same period (Source: Drewry 2022)

Ocean freight rates have increased from 300% to 350%, due to lack of containers and lack of space on container ships.

The survey also highlights that since 2019, the production of new containers has also slowed while there is an increase in the transfer of old containers during the same period. Overall growth in container manufacturing has fallen from 11% in 2019 to 5% in 2021.

"Unless the production is ramped up significantly across the globe, the shipping bottlenecks will remain a persistent problem," the survey noted.

(According to ContainerNews)

Capacity of non-alliance carriers increased sharply on trans-Pacific services

According to a report by Sea-Intelligence, services by non-alliance shipping lines on transpacific routes have increased sharply in recent months.

Analysis of 13-week rolling average of capacity on Asia-North American West Coast routes over the past decade, disequilibrium between capacity of alliance carriers and capacity of non-alliance carriers has been seen very clearly since the outbreak of the pandemic.

After a period of stabilization with around 80% of the alliance's capacity share between 2012 and 2020, the alliance's capacity has sharply increased to nearly 90% in response to the pandemic. "Clearly, the immediate impact of the pandemic was that non-alliance services were much more likely to be blanked than alliance services," said Alan Murphy, CEO, Sea-Intelligence.

However, since the initial reduction of capacity to 10% on the Asia-West Coast North America service, the capacity of non-alliance carriers has increased again, accounting for 35% of capacity. For the Asia-East Coast North America services, alliances have dominated since 2019, but capacity by non-alliance carriers has also captured 10% market share since mid-2020.

“The development on Asia-Europe is starkly different than on Asia-North America. The market on this trade is nearly fully serviced by alliances," said Murphy. "The recent market disruption has done little to change this situation. A few non-alliance services have been seen; however, the number of such sailings and the small size of the vessels being used, means that this has an overall insignificant effect on the total capacity in the market.”

The difference between the two routes indicates lower barriers to entry in the Asia-North America route, he added.

(Source: Phataa)

.png)

.jpg)

.jpg)